What's cooking with this precious metal?

GOLD IS SHINING, so let us know why.

Gold operates under the fundamental price dynamics of supply and demand, similar to other capital markets. However, the couple of underlying factors influencing these dynamics are often more distinctive and can be both rational and irrational.

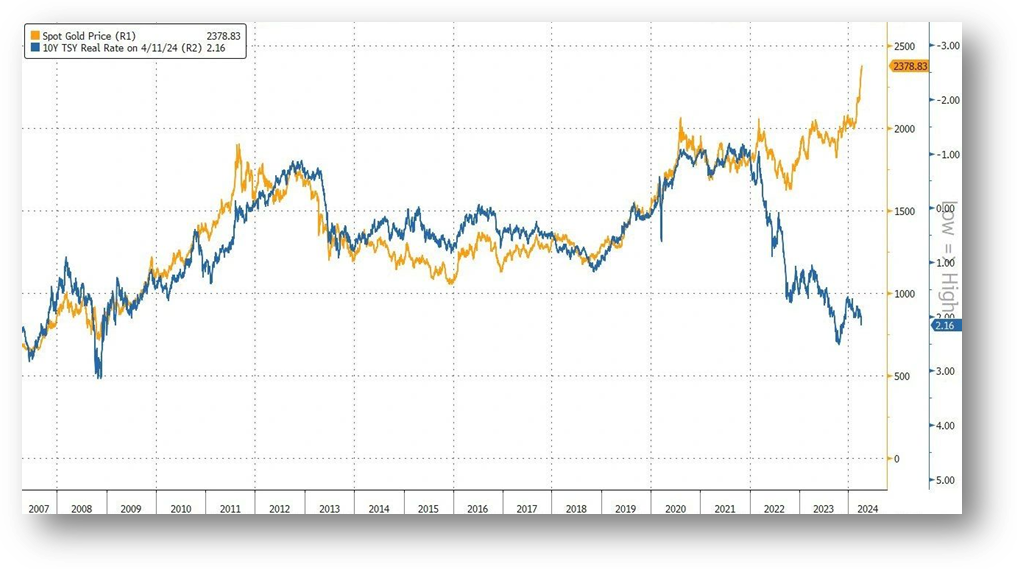

A major downside of gold is its absence of yield. The primary chart in this article illustrates this by comparing gold prices to the yield on government bonds. The strong correlation between the two is clear. The reasoning is straightforward: since gold does not generate any yield, it becomes less appealing when yields on other investments are high, leading to a drop in investor demand and, consequently, the price of gold.

This chart, spanning 17 years When real rates increase, gold prices tend to decrease as investors shift towards higher-yielding alternative but, but......Currently, we are witnessing the opposite trend.

Wait... why is that?

Despite the interest rates being at high. Well, the divergence was very much visible in the year 2022 exactly since the Russia-Ukraine war. The Russian assets in $ confiscated, and the major global south stopped buying the US treasuries, Chinese specially in 2013.

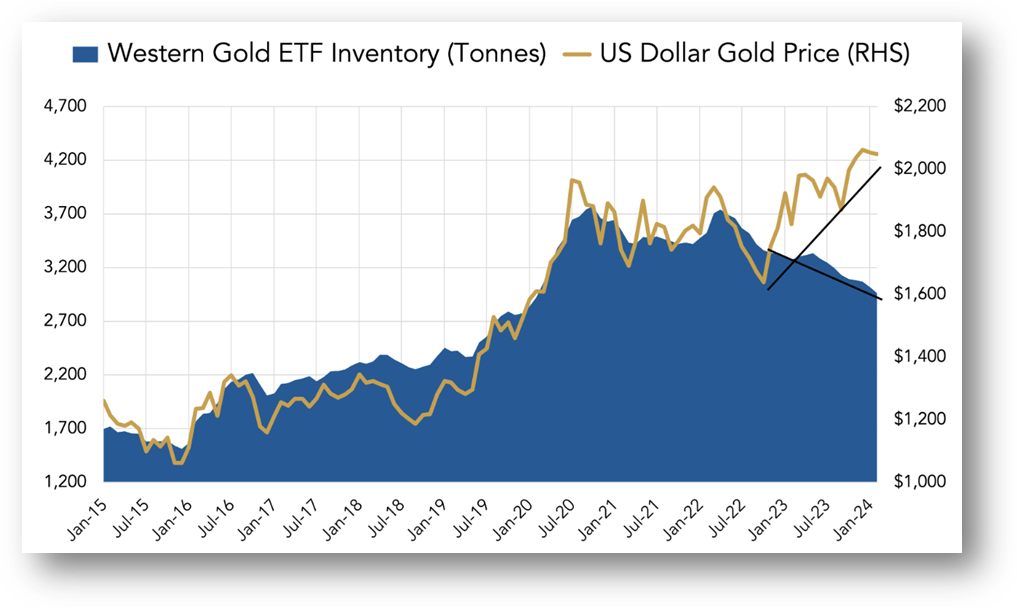

Okay wait, let us make it simple. Since a long time probably decades until now gold price moved in tandem with the west (US) buying and vice versa. That means when the west bought from the London (Major central market for bullion), gold price moved up and when the west sold it went down. The prices where more of less control by west.

However, the current situation is different—the West has been selling gold, as shown in the graph below.

Source: World Gold Council

So, coming back to the question who is driving the price when the west (which once used to control the prices) is selling. Well can you make a guess.

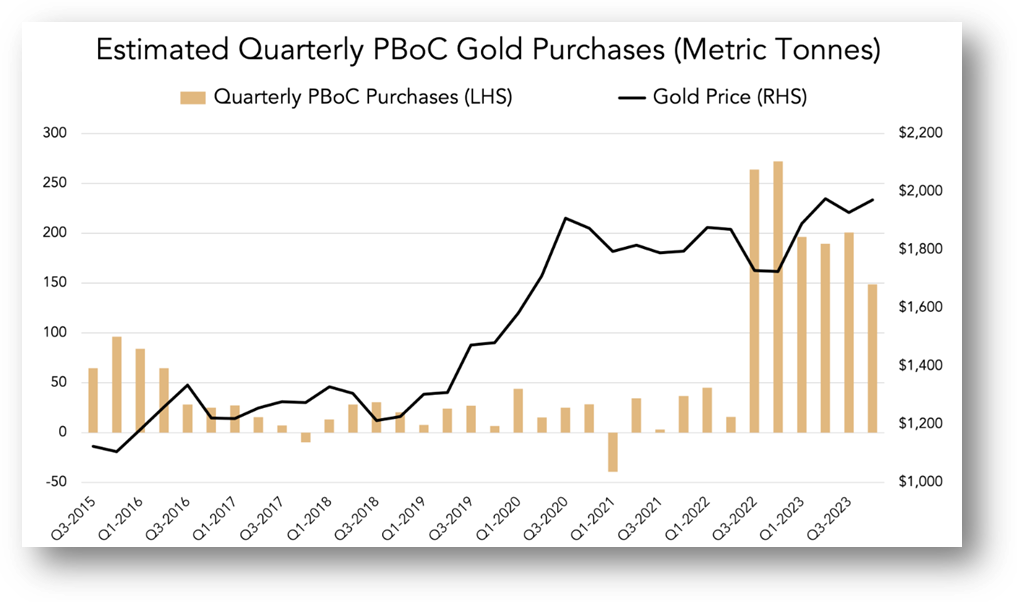

Yes, your right, it’s the Chinese. As you might expect, China has the major hand behind the recent surge in gold buying. The question arises: why is China purchasing such large amounts of gold?

Be it and we know that the Chinese hides more than they reveal, right. But the data does not lie right? The charts below illustrate that since the People's Bank of China (PBoC) began purchasing significant quantities of gold in the latter half of 2022, the price has been on an upward trend. This is happening even though the West has been a net seller of gold during the same period. In the past, the West would typically buy gold when prices were rising. However, this time the West has been offloading gold, as seen through outflows from ETFs and net exports from major gold markets in London and Switzerland. During this period, gold prices increased from $1,736 per ounce in July 2022 to $2,384 in April 2024

Also, the Chinese are routing in gold through Hong Kong. But why route It such way. You know hawala transaction, ahh not really are the Chinese adopting that but buying through the administrative region is because this approach could allow them to monetize gold in Hong Kong before repatriating it off the radar to mainland China.

With their major asset's classes, equities and real-estate bubble deflating, the option left is gold and not only the central bank which hides more than they disclose and the official number of gold purchases are always an assumption but also the retail (their citizen) going berserk buying gold, left right and centre.

One interesting data, since 2022, total net exports of gold from the UK have been approximately equal to the UK's net exports to Eastern countries. This suggests that the majority of the UK's gold exports are heading towards Eastern markets, possibly indicating a shift in the global gold market dynamics. And east is none other than........yes India, China, Japan, Hong Kong.

We have examined the factors behind the rise in gold prices and identified the key players driving this rally. However, the increase in gold prices seems to have occurred for reasons beyond the traditional ones such as acting as a hedge, offering inflation protection, or responding to geopolitical events. Let's explore this further - but hold on a moment.

The sudden divergence in gold market dynamics and the East's significant increase in gold buying could be attributed to various economic, geopolitical, and strategic reasons. In the next article, we will delve into the potential motivations behind the East's gold-buying spree and its implications for the world economy.

CAclubindia

CAclubindia