Popular Articles

Business GST Registration Guide: A Practical Field Manual

LegalDev 07 February 2026 at 09:21Learn the messy reality of GST registration for businesses, from document pitfalls to Aadhaar authentication, ITC benefits, officer queries and post-registration compliance.

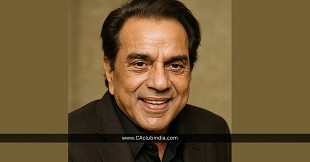

Darr Ke Aage Jeet Hai - Part VI: Dharmendra Ji - The Courage To Smile, The Strength To Stay Humble

Raj JaggiA heartfelt tribute to Dharmendra Ji, celebrating his humility, courage, humour, loyalty and poetic soul through an inspiring morning conversation that turned memories into life lessons for every generation.

Lata Mangeshkar & Majrooh Sultanpuri: The Timeless Melody of "Rahe Na Rahe Hum" - Part II

Raj JaggiDiscover the divine artistry of Lata Mangeshkar Ji - her humility, discipline, and soulful bond with Majrooh Sultanpuri Ji that turned music into prayer.

Rapid Yen Appreciation and Its Global Impact: A Shift in Japan's Monetary Policy

Affluence Advisory 08 August 2024 at 08:38Over the past few weeks, there have been significant changes in the value of the Japanese Yen, with several key events leading to a major shift

Case Study: Composition of Board of Directors of Insurance Company

FCS Deepak Pratap Singh 11 July 2024 at 08:33Preferential Life Insurance Ltd. was incorporated to conduct the insurance business. The Certificate of Registration was issued to the company on 1st June 2014.

Global Capability Centres: Shaping New Growth Story of India

Shailesh PrajapatiDiscover how Global Capability Centers (GCCs) in India have evolved from cost-saving units to strategic hubs driving innovation, R&D, digital transformation, and economic growth. Learn about their key functions, impact on employment, emerging destinations, and the opportunities and challenges they create for Indian MSMEs.

Whether a listed company reverses decision of dividend payment once taken in board meeting?

FCS Deepak Pratap Singh 30 July 2025 at 08:35A comprehensive analysis of dividend declaration under the Companies Act, 2013, including legal provisions, treatment of interim and final dividends, revocation rules, Board and shareholder roles, and SEBI compliance for listed companies.

Income Tax and GST on Social Media Income

venkanna settyComplete guide on tax and GST on social media income in India. Covers income tax, TDS, GST registration, foreign income, LUT and compliance tips.

ITAT Ahmedabad: No Section 14A Disallowance When Assessee Has Sufficient Own Funds

Vivek Jalan 04 November 2025 at 06:34ITAT Ahmedabad rules that disallowance under Section 14A read with Rule 8D is not justified when the assessee has sufficient own funds for investments.

Note on Offering of Co-Investment Opportunities through a Co-Investing Portfolio Managers (AIF)

Affluence Advisory 22 January 2025 at 08:46On 9th November 2021 Securities and Exchange Board of India("SEBI") has notified amendments to Securities and Exchange Board of India (Alternative Investment Funds) Regulations 2012 ("SEBI AIF REGS") and Securities and Exchange Board of India (Portfolio Managers) Regulations 2020

Popular Articles

- Interest Computation Changes under GST (Effective from January 2026)

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Revised Return Due Date Extension

- Tax Deduction Rules for Employee Contributions From April 2026

- TDS and TCS: The New Shields and Arrows of the Taxpayer

- Tax Calculation Slabs For FY 2025-26 (AY 26-27)

- Comprehensive Guide to Statutory, Tax & Regulatory Compliances for Hotels

- Cheque Bounce Rules in India: What Changes in 2026 Mean for You

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia