Recently, the government (CBDT) notified the Income Tax Return Forms (ITR) for the financial year 2019-20 (A/Y 2020-21).

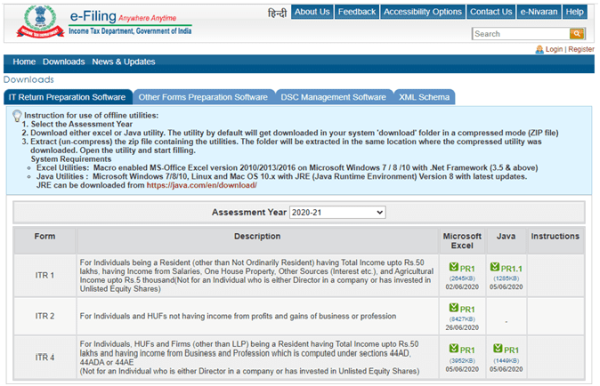

Today i.e. on the 26th of June, 2020, the department has made the Income Tax Return Preparation Software (also known as the income tax return utility) for ITR-2 available on its e-Filing portal for filing the income tax returns. (https://www.incometaxindiaefiling.gov.in/downloads/incomeTaxReturnUtilities ).

As of now the tax return preparation utility is available only for Microsoft Excel (though not working perfectly for now) and not for JAVA (expected soon).

Earlier, by the 5th of June, 2020, the department made the income tax return preparation software/utility for ITR-1 and ITR-4 available for e-filing on its portal.

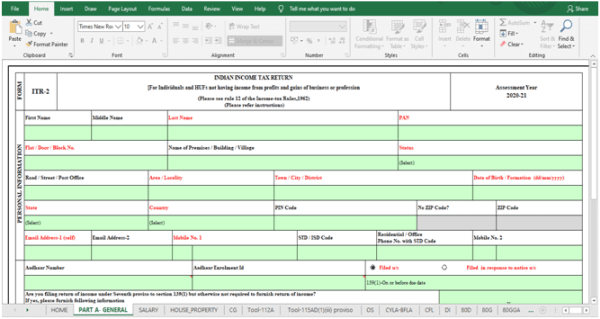

Starting today, individuals and HUFs will be able to file their ITR-2 pertaining to financial year 2019-20.

We have thoroughly analyzed ITR-2 and in this article, we are highlighting the three key insertions made in the ITR-2 form that is now made available for e-Filing.

#KEY ADDITION NO. 1:

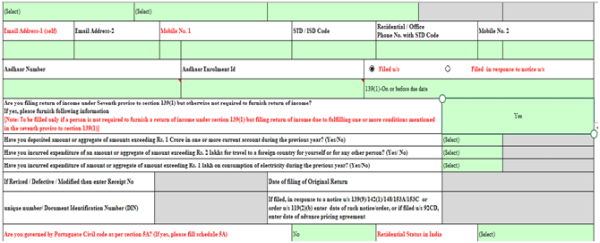

Disclosure with regard to Cash Deposits, Expenditure on Foreign Travel and Expenditure on Consumption of Electricity:

The Final Budget, 2019 added a seventh proviso in section 139(1) w.e.f. 1st April, 2020 which states as under:

A person who is not required to furnish a return under 139(1) and who during the previous year (i.e. F/Y 2019-20) —

(i) has deposited an amount or aggregate of the amounts exceeding Rs. 1 crores in one or more current accounts maintained with a banking company or a co-operative bank; or

(ii) has incurred expenditure of an amount or aggregate of the amounts exceeding Rs. 2 lakh for himself or any other person for travel to a foreign country; or

(iii) has incurred expenditure of an amount or aggregate of the amounts exceeding Rs. 1 lakh towards consumption of electricity; or

(iv) fulfils such other conditions as may be prescribed,

shall furnish a return of his income on or before the due date in such form and verified in such manner and setting forth such other particulars, as may be prescribed.

To give effect to the above, a new section in ITR-2 has been added as displayed below:

If you are required to file your ITR-2 because of the seventh proviso mentioned above, then you will have to select YES and fill the amount in the relevant section applicable to you.

IMP. NOTE: If you are required to file your ITR under Section 139(1) (i.e. except under the seventh proviso) then no information is required in this section. You can simply select NO and move ahead.

#KEY ADDITION NO. 2:

SCHEDULE DI

Keeping in view the challenges faced by taxpayers in meeting the compliance requirements under lockdown conditions, the Finance Minister had announced several relief measures relating to statutory and regulatory compliance matters across all the sectors in view of COVID-19 outbreak on 24.03.2020 vide a press release. To give effect to the announcements so made, the government brought an Ordinance (named “The Taxation And Other Laws (Relaxation Of Certain Provisions) Ordinance, 2020”) on 31.03.2020 which provided for extension of various time limits under the Taxation and other Acts.

In order to provide further relief to the taxpayers for making various compliances, the Government has issued a Notification on 24th June, 2020 which has further extended various time limits under the Taxation and other laws.

The Notification has further made an EXTENSION in the date for making investment/payment/deposit for claiming deduction under Chapter VIA-B: The date for making investment/payment/deposit for claiming deduction under Chapter VIA-B which includes Section 80C (LIC, PPF, NSC, etc.), 80D (Mediclaim, etc.), 80G (Donations), etc. has been further extended to 31st July, 2020 ( from the earlier extended date 30th June, 2020).

Therefore, the investment/payment/deposit made up to 31st July, 2020 shall be eligible for claiming deduction under Chapter VIA-B.

The Notification has further made an EXTENSION in the date for making investment/construction/purchase for claiming roll over benefit/deduction in respect of Capital Gains under section 54 to 54GB: The date for making investment/construction/purchase for claiming roll over benefit/deduction in respect of Capital Gains under sections 54 to 54GB of the Income Tax Act, 1961 has also been further extended to 30th September, 2020 (from the earlier extended date 30th June, 2020).

Therefore, the investment/ construction/ purchase made up to 30th September, 2020 shall be eligible for claiming deduction from Capital Gains.

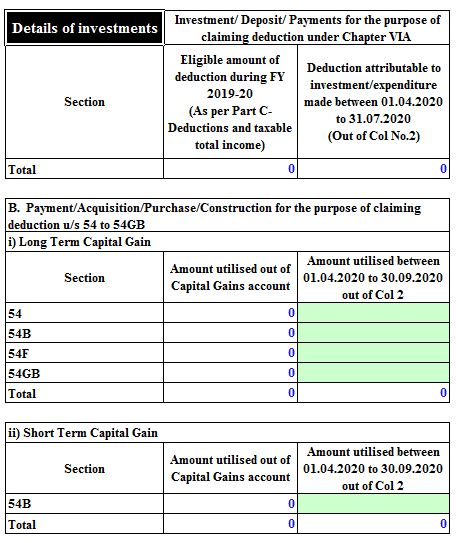

The new return form has a special schedule named “DI” where the taxpayers, in order to avail deductions for the financial year 2019-20, have to report the investments/payments/deposits/construction/purchase so made from the period starting 1 st April, 2020 to 30 th September, 2020 (as applicable).

From the total eligible amount of investments/payments/deposits/construction/purchase so made for the financial year 2019-20, the taxpayers shall have to separately disclose investments/deposits/payments/construction/purchase made during the extended period (01.04.20 to 30.09.20) , as applicable, in order to claim the deduction for the same for this financial year under chapter VIA-B [i.e. under section 80C (PPF, Life insurance premium, 5 year FD, NSC, etc.); 80D (medical insurance premia, medical expenses, preventive health check-up, etc.); 80G (Donations), etc.] and under section 54 to 54GB .

The snapshot of the schedule is displayed below:

IMP. NOTE: If you have made the relevant investments/ deposits/ payments/ construction/ purchase on or before 31 st March, 2020 for claiming deductions under chapter VIA-B or under section 54 to 54GB (as applicable) for the financial year 2019-20 and you have also made deposits/investments/payments/construction/purchase during the period starting from 1st April, 2020 to 30 th September, 2020 (as applicable) for the financial year 2020-21, then no disclosure is required to be made in this schedule.

#KEY ADDITION NO. 3:

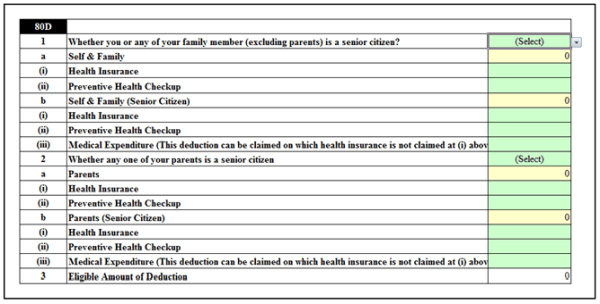

SCHEDULE 80D

A new schedule 80D has been added in the ITR-2 this time for claiming deduction under Section 80D of the Income Tax Act i.e. for medical insurance premium, expenditure, preventive health check-up etc.

The bifurcated amounts under each sub head shall required to be reported this time.

CONCLUSION:

All other sections in the ITR-2 are more or less the same as were before.

The extended last date for filing the ITR-2 for the financial year 2019-20 is 30th November, 2020.

1. We advise all the taxpayers to file their ITRs only after 31st July, 2020 (being the extended last date for making investments/payments/deposits in order to claim deductions under chapter VIA-B i.e. 80C, 80D, 80G, etc .) so that they do not miss out on claiming any deduction in a hurry to file for their ITRs.

2. We advise all the taxpayers to file their ITRs only after 30th September, 2020 (being the extended last date for making investments/construction/purchase in order to claim roll over benefit/deductions under section 54 to 54GB ) so that they do not miss out on claiming any benefit/deduction in a hurry to file for their ITRs.

File your income tax returns in time to avoid last minute rush, late fees, interest, penalties and other statutory fines.

The author can also be reached at connect@ujlegal.com

CAclubindia

CAclubindia