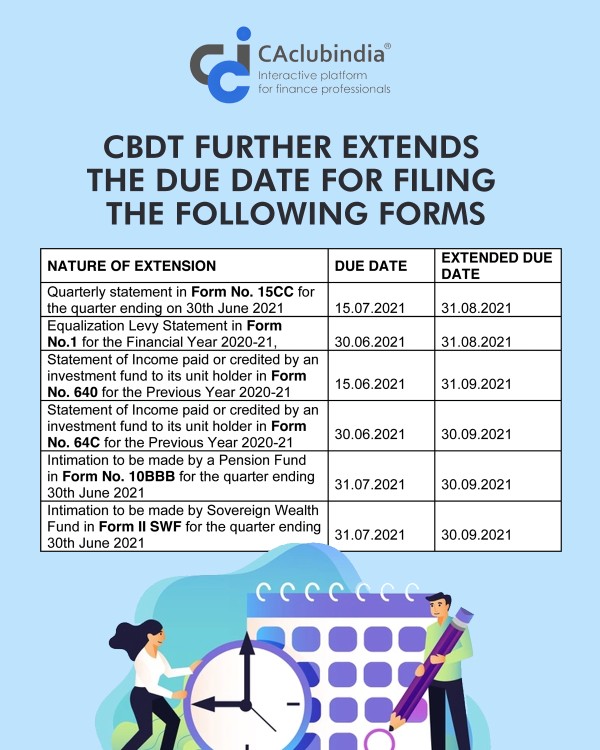

The Board of Direct Taxes (Income Tax Department) vide circular No. 15/2021 dated 03.08.2021, in exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as 'the Act') has issued circular w.r.t. Extension of timelines for electronic filing of various Forms under the Income-tax Act, 1961 to provide relief to taxpayers in view of the severe pandemic and spike in COVID-19 cases and also announces tax exemption:

Extension Table

|

Sl. |

Nature of Extension |

Provisions of IT Act 1961 |

Due Date |

Extended Due Date |

|

1 |

The Quarterly statement in Form No. 15CC to be furnished by authorized dealer in respect of remittances made for the quarter ending on 30th June, 2021 |

Rule 37BB of the Rules |

15.07.2021 |

31.08.2021 |

|

2 |

The Equalization Levy Statement in Form No.1 for the Financial Year 2020- 21, |

30.06.2021 |

31.08.2021 |

|

|

3 |

The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 640 for the Previous Year 2020-21 |

Rule 12CB of the Rules |

15.06.2021 |

31.09.2021 |

|

4 |

The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 64C for the Previous Year 2020-21 |

Rule 12CB of the Rules |

30.06.2021 |

30.09.2021 |

|

5 |

Intimation to be made by a Pension Fund in respect of each investment made by it in India in Form No. 10BBB for the quarter ending on 30th June,2021 |

Rule 2DB of the Rules |

31.07.2021 |

30.09.2021 |

|

6 |

Intimation to be made by Sovereign Wealth Fund in respect of investments made by it in India in Form II SWF for the quarter ending on 30th June, 2021 |

31.07.2021 |

30.09.2021 |

Clarifications by CBDT

It is also clarified that the above said forms, e-filed, after the expiry of time limits provided as per Circular No.12 of 2021 dated 25.06.2021 or as per the relevant provisions, till date, will stand regularized accordingly.

Official Notification: CBDT further extends the due dates for electronic filing of certain forms

Disclaimer: Every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event the author shall be liable for any direct, indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information.

CAclubindia

CAclubindia