Popular Articles

Substance over Form

Amol Gopal Kabra (CA,CS,DISA) 09 June 2014 at 12:05The concept of substance over form is very difficult to understand for the students in the initial stage. Owing to initial confusion many students either keep it in option or even if they study, dont understand it fully. I have made a short at

Penultimate Sales under CST Act 1956-Submission of H forms

Amit Bajaj 14 February 2011 at 11:50Tax by State Governments on sales or purchase of goods made during the cource of import or export of such goods is prohibited by article 286(1)(b) of the Constitution of India. Section 6(1) of CST Act also levies tax on interstate sales hence there

Additional Tax under section 140B

Neethi V. Kannanth 16 February 2022 at 09:00A new section 140B has been proposed in the Union Budget,2022. If an assessee opts for filing the return under newly proposed section 139(8A), an additional tax is required to be paid under Section 140B.

CA Results - Mount of Expectations and Tensions

N.Vimal Kumar Jain 06 January 2020 at 11:07In this article I have given some suggestions on how to overcome stress and fear before results. The suggestions given in this article are based on my personal experience. I have tried my level best to help you overcome fear you experience before result.

Reverse Charge Mechanism in service tax-more clarifications

Amit Bajaj 22 March 2012 at 15:46In the Budget-2012-13 under the new Reverse Charge Mechanism in certain services the recipient of the service has been made liable to pay tax instead of service provider. In three of services namely hiring of means of transport, construction and

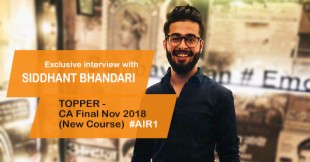

Interview: Siddhant Bhandari AIR-1, CA Final Nov 2018 (New Course) in an Exclusive talk with CAclubindia

CCI Team 25 January 2019 at 13:36CA Final Nov 2018 results have been released. And as the tradition goes, we are happy to bring to you the exclusive interview with the CA Final Nov 2018 topper..

Procedure for Amendments/Changes in the Registered Firm

CS MOHIT SALUJA 03 September 2012 at 12:21Procedure for Changes/ Amendments in the Constitution of Registered Partnership Firm The law relating to a partnership firm is contained in the Indian Partnership Act, 1932.Under Section 58 of the Act, a firm may be registered at any time (not mer

Clearing CA Exams - What Next?

CA Darshak Shah 23 July 2012 at 12:07Kudos to everyone who cleared the CA Final exams...Hope you are feeling awesome as you are shifting from Student to Member Section.. Coming to the point...The intention behind this article is to guide the students regarding further procedure

2 Months Strategy For CA Intermediate May 2020

Sandip Goyal 24 February 2020 at 10:29Know 2 Months Strategy For CA Intermediate Old as well as New for May 2020. Clearing CA is not everyone's cup of tea. However, with the proper strategy, it can be achieved. Here is the strategy for the last 2 months for CA Inter May 2020 exams.

Section 9 : Income deemed to accrue or arise in India

Saloni Gandhi 12 May 2018 at 13:11Section 9 of Income Tax Act , 1961The Indian Income-tax Act provides for levy of income-tax on the income of foreign companies and non-residents, but only to ..

Popular Articles

- Interest Computation Changes under GST (Effective from January 2026)

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Revised Return Due Date Extension

- Tax Deduction Rules for Employee Contributions From April 2026

- TDS and TCS: The New Shields and Arrows of the Taxpayer

- Tax Calculation Slabs For FY 2025-26 (AY 26-27)

- Comprehensive Guide to Statutory, Tax & Regulatory Compliances for Hotels

- Cheque Bounce Rules in India: What Changes in 2026 Mean for You

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia