Articles by Prerna Saraogi

ICAI Protest : Right to rechecking of CA exam answer scripts - the complete story

Prerna Saraogi 24 September 2019 at 12:02The provisions of ICAI Act, clause 39(4) states that a student has the right to verification of marks subject to totalling and marking error. It specifically re..

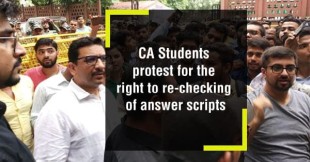

Protest by CA Students against Evaluation of answer scripts by ICAI

Prerna Saraogi 23 September 2019 at 17:14In the recent protests made by some renowned faculties of CA fraternity along with CA students, grievances have been brought forward regarding the evaluation of answer scripts.

All changes in new ITR Forms AY 2019-20 with snapshots

Prerna Saraogi 08 April 2019 at 17:57The all new Income Tax Return Forms for AY 2019-20 have been released. The ITR forms ITR-1 and ITR-4 have also been made available for e-filing.

Economists vs CAs: Here's the complete story

Prerna Saraogi 20 March 2019 at 13:03On 18th March 2019, 131 CAs voiced against the contention made by 108 economists through an open letter. This news got the attention of the media and hashtag #C..

Don't pay any tax if your annual income is up to Rs. 5 lacs

Prerna Saraogi 05 February 2019 at 10:58The recent announcement in the Interim Budget on 1st February, made by the honorable Finance Minister there was an increase in the tax rebate to Rs. 500,000.

32nd GST council meet changes - Expectation Vs Reality

Prerna Saraogi 10 January 2019 at 17:08The 32nd GST Council Meeting was held today at New Delhi. As always, there were give speculations and expectations in the industry from the FM Arun Jaitley that..

Easy calculation of long term capital gain tax on sale of shares for FY 2018-19

Prerna Saraogi 08 January 2019 at 16:45Income from the gain on sale of shares was exempt until FY 2017-18. From the current FY 2018-19 the same has become taxable w.e.f 1st April 2018. Therefore, in ..

Popular Articles

- Interest Computation Changes under GST (Effective from January 2026)

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Revised Return Due Date Extension

- Tax Deduction Rules for Employee Contributions From April 2026

- TDS and TCS: The New Shields and Arrows of the Taxpayer

- Tax Calculation Slabs For FY 2025-26 (AY 26-27)

- Comprehensive Guide to Statutory, Tax & Regulatory Compliances for Hotels

- Cheque Bounce Rules in India: What Changes in 2026 Mean for You

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia