Manual > Track Refund Status > Post-Login

How can I track the status of refund on the GST Portal, after logging into the GST Portal?

To view status of your refund application after logging to the GST Portal, perform following steps:

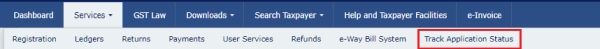

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal. Click the Services > Track Application Status option.

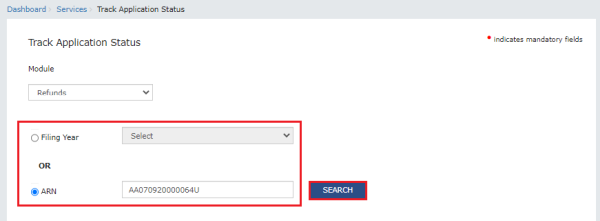

2. Track Application Status page is displayed. Select the Refund option from the Module drop-down list.

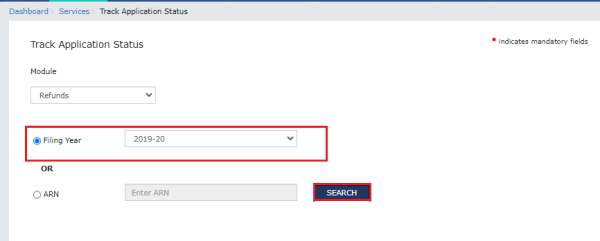

3.1 In case of Filing Year: You can track status of your application by selecting the Filing Year of the refund application.

3.2 In case of ARN: On submission of the refund application on the GST Portal, you will be given an Application Reference Number (ARN). You can track status of your application by tracking this ARN.

3.1.1. Select the Filing Year from the drop-down list and click the SEARCH button .

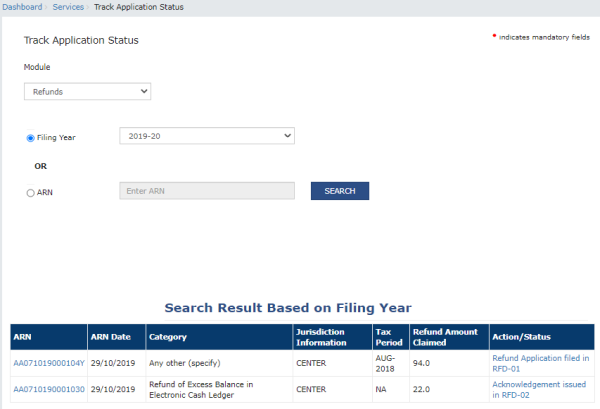

3.1.2. List of ARNs of refund application filed in that year are displayed.

Note:

- You can click the ARN hyperlink to download the Refund ARN receipt in PDF format.

- You can click the Action/Status hyperlink to view the Refund ARN details.

3.2.1. Enter the ARN of refund application and click the SEARCH button.

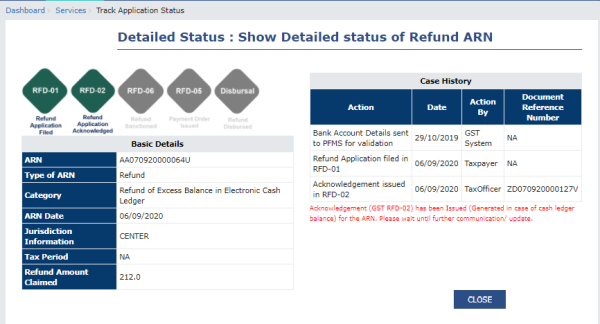

3.2.2. Detailed status of the Refund Application ARN is displayed.

Note:

- You can click the CLOSE button to go back to Track Application Status page.

- Stages are color coded according to the current status of the application. For Example: If current status of the application is at Stage 3 then all stages till stage 3 will be depicted in green color and further stages will be greyed out.

- Details of the present status of the application is shown below the case history in Red Texts as shown in the screenshot below.

- You can view additional details of Tax Period and Tax Amount Claimed when you view status of refund application after logging into the GST Portal.

To read the full article, Click here

CAclubindia

CAclubindia