CAclubindia Articles

Things to be checked before Balance Sheet Finalization

Varsha Nayyar 24 September 2021 at 09:45Balance Sheet finalization is the most important work that needs to be done for Statutory Audit. Discussing all the important points that need to be taken care of before finalization of the balance sheet.

Clearing CA Exams / Overcoming failure (Unpopular Opinion)

Abhishek Panegal 24 September 2021 at 09:44The simple point is to look outside the box of "CA". There is an entire world out there, where we have people from what diverse backgrounds are pursuing their dreams!

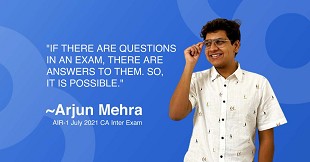

Arjun Mehra - AIR 1 July 2021 CA Inter Exams on his Exam Preparation, Importance of Mental Health and Reaction to the SCs PIL

CCI Team 23 September 2021 at 19:57In our conversation with Arjun, he emphasises the importance of dedication and intrinsic motivation during the preparation of CA exams, or any exams for that matter. He talks about the things that helped him the most to stay consistent and keep going. Moreover, he beautifully highlighted the importance of Mental Health over everyone else.

Impact of AGM extension on various other forms

CS Divesh Goyal 23 September 2021 at 19:56In this series of editorial, the author shall discuss the Quick bites on Annual Filing for the F. Y. 2020-21

Extension of AGM for 2020-21

CS Divesh Goyal 23 September 2021 at 19:56In this series of editorial, the author shall discuss the Quick bites on 'Extension of AGM for the FY 2020-21'.

Due date of AGM extended by 2 months

CS Tanveer Singh Saluja 23 September 2021 at 15:02Finally, the update for which we all were waiting is here. The Ministry has released an Office Memorandum on 23rd September, 2021 regarding the extension of due..

Key Action points to be considered before filing GSTR-1 & GSTR-3B of September 2021

Bimal Jain 23 September 2021 at 11:43Finally, after facing every step of hurdle during past financial year, the final goal of every taxpayer is to assess their business records and analyze and correct the mistakes made during the past financial year either through GSTR-1 and GSTR-3B of September, 2021, following the end of financial year, being 2020- 21

Clarification On Doubts Related To Scope Of Intermediary under GST

Vivek Jalan 23 September 2021 at 09:32ANALYSIS OF CIRCULAR NO. 159/15/2021- GST: CLARIFICATION ON DOUBTS RELATED TO SCOPE OF "INTERMEDIARY"-REG.

Explanation of Condition V of Section 2(6) of IGST Act, 2017

CA Amit Harkhani 23 September 2021 at 09:31As per the Section 2(6) of IGST Act, 2017 "export of services" means the supply of any service

All About ITC under GST | An analysis

Neethi V. Kannanth 23 September 2021 at 09:24Input credit means at the time of paying tax on output, one can reduce the tax payable by taking the credit for tax paid on inputs. If you are a manufacturer, supplier, agent, e-commerce operator, aggregator or any of the persons mentioned, registered under GST, you are eligible to claim Input Tax Credit.

Popular Articles

- No More Forced ITC Order: New Rules from Jan 2026

- Income Tax Return Filing Due Date For AY 26-27: Full Details With New Updates

- Cash Deposit Limit In Current Account in 2026

- Budget 2026-27: Expected Benefits for Salaried Persons in FY 2026-27

- GST Twist From Feb 2026: Pay Tax On MRP Not Sale Price

- Revised Return Due Date Extension

- Holiday or Trading Day on 1st Feb 2026: Will the Stock Market Really Be Open on Sunday?

- Simplified GST Changes in Budget 2026: Finance Bill 2026 CGST and IGST Amendments

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia