We have seen various ways to save Income Tax since ages, but what about this GST, how GST can be saved, How inflow of cash in the firm can be increased, how can I increase my assets and decrease liabilities towards GST department.

So to solve this confusion, I would like to present some of the techniques/measures/ways to save your GST:-

1. Do more and more Inter State purchases and avoid Intra State purchases (if possible).

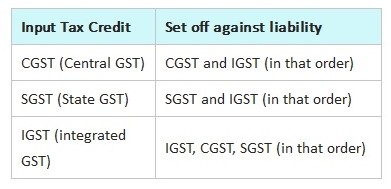

By doing more and more Inter State purchases, you will pay IGST on your purchases, which have an ultimate advantage that, IGST ITC can be set off with CGST Liability as well as SGST Liability after you set off your IGST Liability.

But if you do Intra State purchases, then you have a disadvantage that SGST ITC can be set off against SGST Liability and IGST Liability only and CGST ITC can be set off against CGST Liability and IGST Liability only.

Therefore, if you want to save GST Liability then prefer more and more Inter State purchases in place of Intra State purchases.

If you are a manufacturing concern, then if feasible try to set up your manufacturing plant/house in one state(s) or Union Territory(s) and make your sales depot at a different state(s) or Union Territory(s).

2. Accept your sales consideration as deposit without settlement of your receivables from customers '(Most trending these days)'.

a. According to the definition of consideration as per section 2 (31) of CGST Act, 2017, Consideration in relation to the supply of goods or services includes :-

- Any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

- The monetary value of any act or forbearance, whether or not voluntary, in respect of, in response to, or for the inducement of, the supply of goods or services, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

b. PROVIDED that a deposit, given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies the deposit as consideration for the said supply;

c. Every Indirect Tax in India whether in past or in present, follows the principle of Expense Policy to levy Indirect Tax on the supplier of goods, services or both.

d. Previously department has made efforts to levy Indirect Tax on Investment Policies also, but their efforts are very limited on it. This is because due to Constitutional propaganda, to follow other provisions of the act which are present for the time being in force.

e. Since now, there are no rules have been framed by GST Council to tax notional interest on deposits taken by the supplier of goods or services or both, as it was present in Rule 6 of Excise Valuation Rules, 2000 and Rules prevalent in various State VAT Laws regime.

f. Application of section 41(4) of Income Tax Act, 1961: Section 41(4) deals with write off of Bad Debts. Debtors from whom you have taken deposits and are outstanding let’s say for more than 5 years or more or even crossing the time limits mentioned in Limitation Act, 1963, IT department cannot force the assessee to write off the same from the books of assessee on the opinion that such debtors are outstanding for more than time period mentioned in Limitation Act, 1963. Unless assessee himself write off the debts from his books, department cannot force the assessee to write off the same from his books.

g. Application of Limitation Act, 1963: According to Limitation Act, 1963, debt recovery has a limitation period of 3 years only. But Limitation Act, 1963 has no implication in GST on Transactions Valuation and its taxability thereof; on amount due from customers even though the due is outstanding for a period of more than 3 years also.

The author is the practicing CS in Krishna Nagar, East Delhi and can also be reached at cs.pj2016@gmail.com

CAclubindia

CAclubindia