Introduction

This article is to understand as to how the refund of ITC on account of Exports made without payment of tax can be maximised or optimized without affecting any legal bindings/ restrictions/ obligations. In line with Rule 89(4) the formula defined for calculating the refund amount = (ITC taken in GSTR 2B / Adjusted turnover) x Exports turnover;

And Circular 125/044/2019 dated 18/11/2019 clearly made it as the bunching of periods can be at the choice of the dealer and as such there is no restrictions on it. Initially there was restrictions for bunching the period well with in the financial year and later on it has been extended to cover the bunching the period beyond the period of financial year concerned;

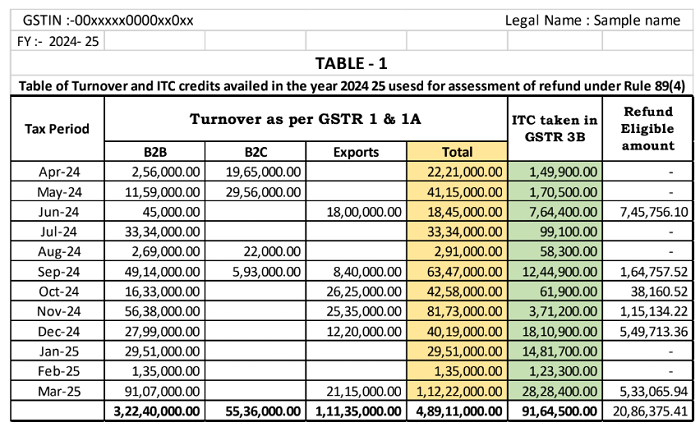

Within the above noted provisions, I am here to assess the amount of refund eligibility to be considered by a dealer while maximising the benefit of refund well within the legal provisions with a hypothetical stimulated data of ITC credits availed under GSTR 2B and turnover reported in GSTR 1 for the year 2024-25:

Notes on the above tables

(i) Table 1 is presented with stimulated data of sales and ITC available for a dealer X in the financial year 2024-25 and the last column represents the calculated amount of refund eligible for the respective month and accordingly in the last row is for the total of turnover and ITC available and in last row and last column represents the assessed value of refund for the year together in single application and not the total value of the six different refund applications refund value.

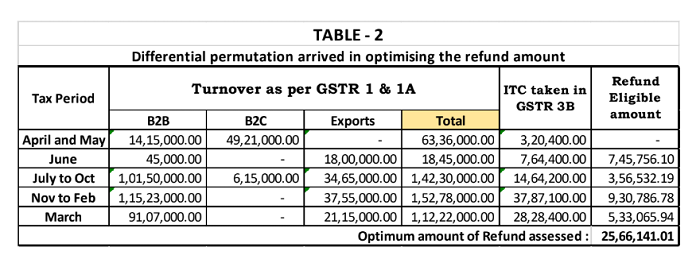

(ii) Table 2 is presented with the assessed optimized value of refund eligible by the dealer in the financial year with differential permutations and combinations arrived in optimizing the values, by applying the method of maximising transportation values with respect to clubbing of Rows only and the value in last column represents the value of refund in each applications bunched for the months noted in the first column and the value in last row and last column is the maximum or optimum value of refund assessed.

Options assessed with the stimulated data's

(1) One single application for the entire 12 months the eligible amount of Refund assessed is Rs. 20.86 lakhs

(2) Six different application for the respective months in which the exports were made, with nil returns for the months in which no exports were made, the amount of eligible refund assessed is Rs. 21.47 lakhs

(3) Nil amount application for the first 2 months and a common single application for all the 10 months fetches the eligible refund amount of Rs.23.13 lakhs

And, after great exercise of multiple permutation and combinations, this 4th option is arrived to file Nil amount application for the first 2 months and 4 different applications as noted in the Table 2 above, fetches the refund amount of Rs. 25.66 lakhs.

Reasons as to why the refund amounts differ from one permutation to other permutation

(a) The mathematical formula designed under the rule is one and the same for all the applications and the amount of refund will be on the total value of the turnover, exports and ITC credits taken on the relevant period clubbed by the dealer in its application.

(b) in the case on hand the refund for the month of July and August is Nil and for the month of September is Rs.1.65 lakhs and for October Rs. 0.38 lakhs (totalling to Rs.2.03 lakhs but when we club all the above 4 months together the refund amount works to Rs. 3.57 lakhs and the reason for the magic is the inherent properties like total value of ITC, Exports and total turnover in the relevant period only.

Conclusion

Now, the optimum refund amount assessed can be decided by the dealer to file the application and this assessment is subject to the following restrictions and clearances;

Clearances

(a) the above assessment in the options 1 to 4 or even such higher number of options are well within the norms of the said rules and circulars issued by the department on the caption and hence it is an intelligence of the dealer to arrive most optimistic value as provided under the rules by applying differential permutation of different period in the chronological order of the months and further clubbing of the months can be beyond the financial years too;

(b) In case where goods have been bought in a particular month and ITC were taken but not exported and the actual exports were taken in the subsequent months, then the dealer has right to take the months together clubbed for the purpose of claiming the refund of ITC;

Restrictions

(a) Clubbing of months should be chronological and not vice versa and the months should be continuous and not discrete months together;

(b) This strategy can be applied only for exports without payment of tax under LUT and claim of refund of ITC credits and not for other nature of refunds under the GST Act/rules.

Jai Hind

Disclaimer: The readers are informed to note that the facts and information's stated in this article is extracted from different provisions and summarized along with his suggestions for the purpose of presentation and this presentation itself cannot be assumed to be a legal opinion. For any specific requirement of legal opinion on thefacts of the case, the reader may reach the author for professional support.

The author is a Practitioner under GST Act and under the earlier VAT acts of multiple states in the country. One of the authors for the book published in the name of "Simplifying Multi State VAT on Works Contracts" in 2015-16 & 2016-17, authored by 23 leading eminent CAs & Advocates in the country AND Winner of Best Innovative GST Consultant for the year 2018-19 from Achromic Point Indirect Tax Award. Intended readers may reach him at

P.Jagadeeswaran, Partner,

Laws Reward Solutions

GST/ VAT/ IT Practitioners & Consultants, Project Finance Management Consultants No.33, Elango St., Chelliamman Nagar, Athipet, Ambattur, Chennai - 600058. Branch 210/2E, Vandavasi Main Road, Sevilimedu, Kancheepuram - 631501.

Mobile: 9840746721/9176038176,

email: eswaran60@yahoo.com, eswaran1960@gmail.com

CAclubindia

CAclubindia