In terms of Section 9(3) of the CGST Act, in respect of specified categories of goods and services, the recipient of supply is required to pay tax under reverse charge and these provisions have been specified in Notification 4/2017 Central Tax (Rate) and Notification 13/2017 Central Tax (Rate) respectively, as amended from time to time.

The person liable to pay tax under reverse charge shall be required to issue an invoice in respect of goods /services received by him from the unregistered supplier within the time limits specified, and shall issue a payment voucher at the time of making payment to such supplier these are popularly known as “self-generated Tax Invoice”. As per the 2nd Proviso to rule 46, these invoices may be issued on a consolidated basis at the end of the month covering all supplies received under RCM. Therefore these invoices will act as a document for taking GST Credit in case of Goods/Services covered under RCM received from URD.

Note: In case the supplier of Service is registered suppliers then the Self-invoice is not required.

Time Limits for Issuing Invoice shall be earliest of the following:

- Date of Receipt of goods/service

- Date of payment to supplier

- Date immediately following 30 days (For goods) / 60 days (For service) from the date of issue of invoice by the supplier.

In case of when the time of supply is not determinable, it shall be the date of entry in the books of Ac's of the recipient.

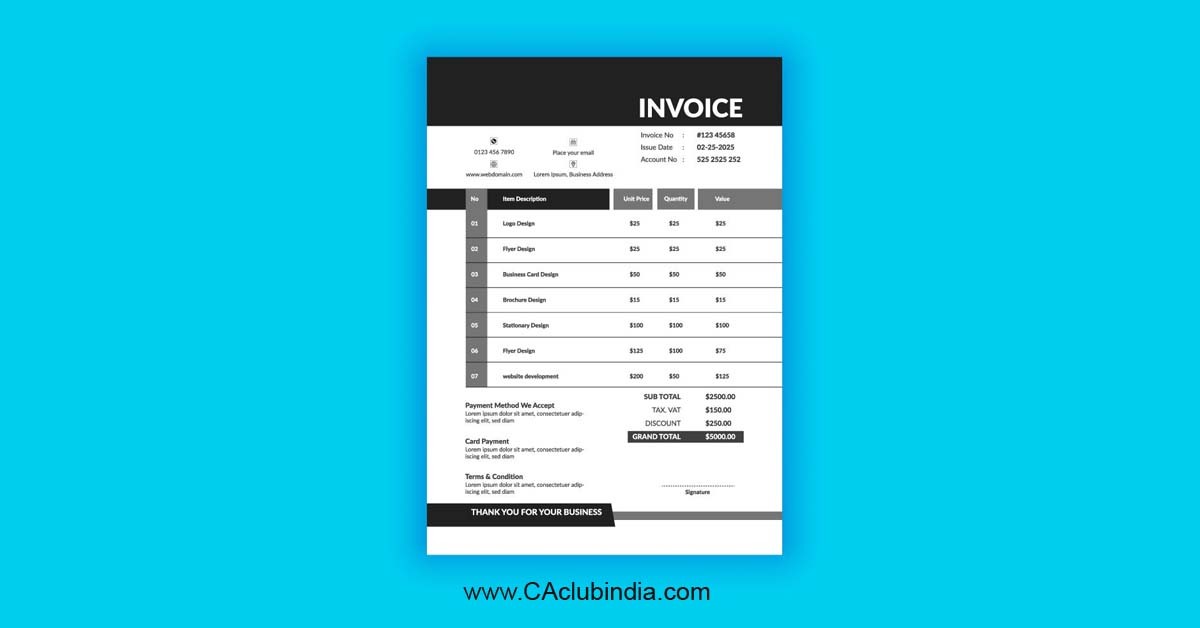

As per Rule 46 following Component are mandatory

- Name and address of the supplier;

- Unique invoice number;

- Date of its issue;

- Registered person's own GSTIN, name and address;

- HSN code and description

- Quantity in case of goods and unit or Unique Quantity Code thereof;

- Total value of supply of goods or services or both;

- Taxable value of the supply of goods or services or both taking into account discount or abatement, if any;

- Rate of tax and tax amounts;

- Place of supply;

- address of delivery where the same is different from the place of supply;

- whether the tax is payable on reverse charge basis

Consequences of not issuing self-invoice:

No Specific Penalty is provided in the Law therefore General penal provision would be applicable. Further ITC Claim can be challenged and lost in case of non-issuance of self-invoice.

Click here to download the tax invoice format

CAclubindia

CAclubindia