Aadhaar Authentication / e-KYC for Existing Taxpayers on GST Portal

GSTN has issued an advisory on 6th Jan 21 for existing taxpayers to complete Aadhaar Authentication or e-KYC.

Functionality for Aadhaar Authentication and e-KYC where Aadhaar is not available has been deployed on GST Common Portal w.e.f. 6th January 2021, for existing taxpayers.

A. Category of Taxpayers for whom the functionality is available:

1. Regular Taxpayers (including Casual Taxable person, SEZ Units/Developers),

2. Input Service Distributors (ISD); and

3. Composition taxpayers

B. Below category of taxpayers who are not required to undertake Aadhaar Authentication or e-KYC -

1. Government Departments,

2. Public Sector Undertakings,

3. Local Authorities; and

4. Statutory Bodies

C. Aadhaar Authentication or e-KYC - Introduction

It is a process of authentication of the Aadhaar details provided while obtaining registration and if the Aadhaar details are not provided then by submitting other documentary details for the verification process.

a. If Aadhaar number is available:

The Primary Authorized signatory and one person who is Proprietor/Partner/Director /Managing Partner/ Karta of the entity registered can go for the Aadhaar Authentication

b. If Aadhaar number is not available:

The taxpayers can upload any of the following documents to undergo e-KYC

- Aadhaar Enrolment Number

- Passport

- EPIC (Voter ID Card)

- KYC Form

- Certificate issued by Competent Authority

- Others

D . Process for completion of Aadhaar Authentication/ e-KYC on GSTN Portal:

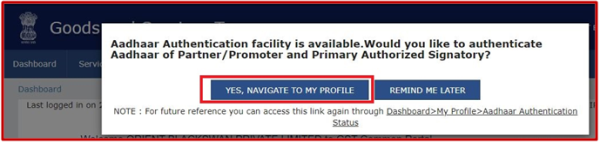

When an existing registered taxpayer logs in to GSTN Portal, a pop-up with Question will be shown "Would you like to authenticate Aadhaar of the Partner/Promotor and Primary Authorized Signatory" with the two options "Yes, navigate to My Profile" and "Remind me later".

If you click "Remind me later" pop up will be closed and the user can navigate anywhere on the GST portal

If you click "Yes, Navigate to My Profile", the system will navigate to My Profile.

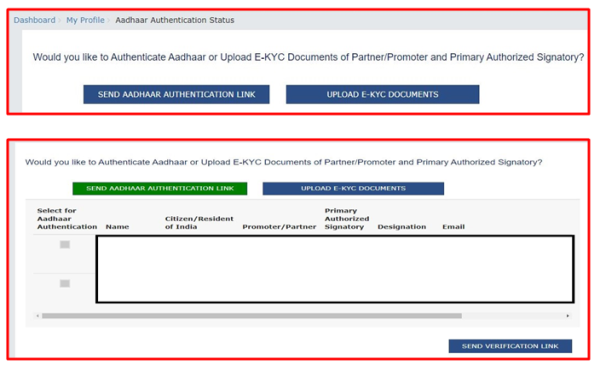

In MY PROFILE, a new tab "Aadhaar Authentication status" has been shown from where the link for Aadhaar Authentication to the Primary Authorized Signatory and one of promoters/partners as selected by him will be sent. You need to provide Aadhaar number and an SMS & email OTP shall be sent for the authentication.

If the same person is Primary Authorized Signatory and Partner/Promoter, Aadhaar authentication is only required to be done for that person.

Care to be taken -

It has been observed that in a few cases the citizenship of authorised signatory/ Promoter is defaulted to "NO" i.e. not a citizen of India and hence Aadhaar verification is disabled. If you observe that in your case, please take a screenshot and raise a grievance on GSTN portal (to rectify the error).

On the My profile page, in addition, to SEND AADHAAR AUTHENTICATION LINK, UPLOAD E-KYC DOCUMENTS option would also be displayed to the taxpayer from where they can upload the e-KYC documents on Portal. In this case, the process of e-KYC authentication would be subject to the approval of uploaded e-KYC documents by Tax Official.

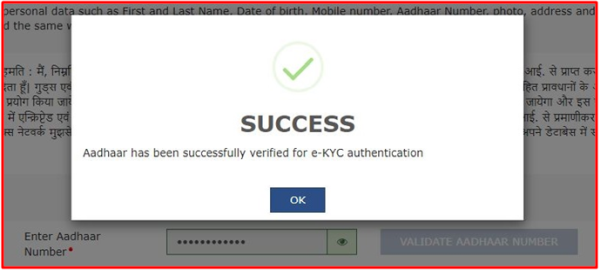

E. On successful Authentication of Aadhaar or EKYC –

Post successful authentication the screen will show a success message.

CAclubindia

CAclubindia