The Central Board of Direct Taxes (CBDT) has introduced a new electronic form called Form 71 to help people correct errors in tax deduction at source (TDS). This change is part of the Income Tax Rules, 1962 and will come into effect on October 1, 2023.

Form 71 is important because it solves a common problem where taxes are withheld one year but income is reported in another year. Many people report their income when it is owed to them, not when it is actually in their bank account. This results in a difference in TDS credit. Form 71 simplifies the error correction process, making it easier for individuals to seek help from tax authorities.

Here's what you need to know about Form 71

New Rule 134

A new rule, Rule 134, has been added after Rule 133, which deals with applications relating to TDS credit. Form No. 71 is now required for submitting such requests.

How to submit Form 71

- Visit the Income Tax Department's e-filing portal at https://www.incometax.gov.in/ and download the form OR you can fill the form online when it is readily available.

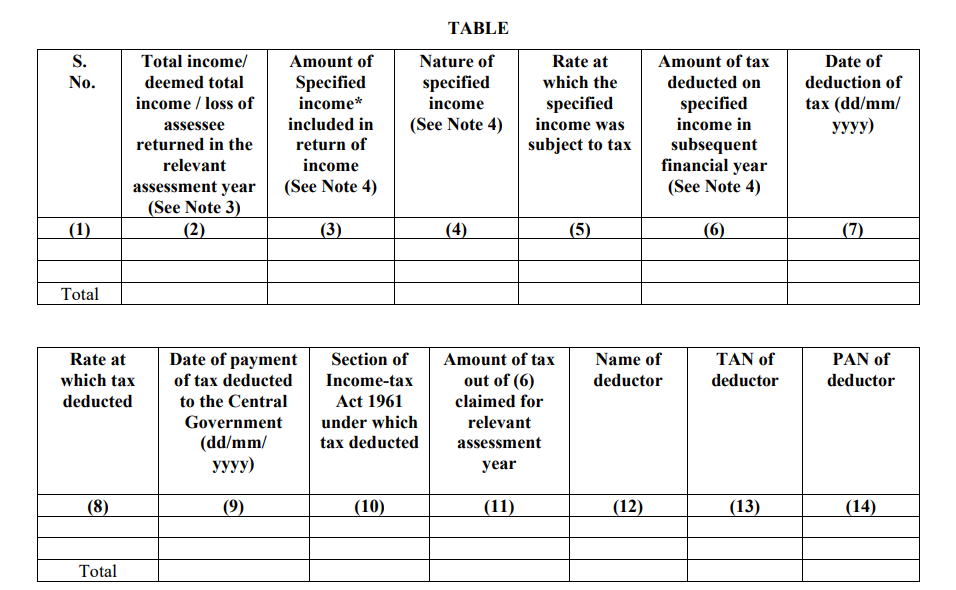

- Fill in your details including name, PAN, address, tax year (year income is declared in your tax return), tax year (year TDS is deducted), TDS amount deducted and reason for claiming credit TDS.

- Sign the form and submit it for verification. You can use an Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

What happens next

If the tax authorities believe your claim is correct, they will take action and refund your money.

Limited time

You have two years to use Form 71 to correct the TDS credit error under the Income Tax Act, 1961.

Form No. 71 will be issued electronically

The Director General of Income Tax (System) or the Director General of Income Tax (System) is responsible for issuing Form No. 71. They will also establish appropriate security and record-keeping procedures for this form.

Form No. 71 must be submitted to the Assessing Officer by the competent tax authority or authorized person. This simplifies the process of correcting TDS errors and ensures a smoother tax payment experience.

Authored by: CA Brijmohan Lavaniya

Co-Authored by: Siddharth Sachan

CAclubindia

CAclubindia