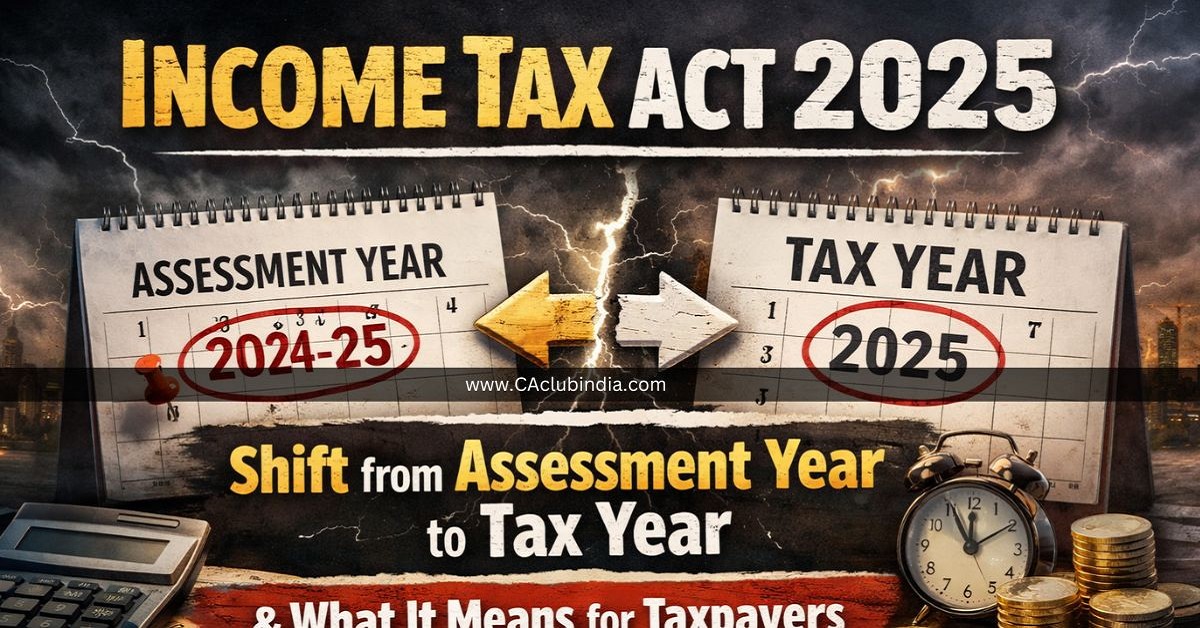

The Income Tax Act 2025 has introduced one of the most talked-about reforms in recent years: the shift from the traditional Assessment Year system to a simpler Tax Year concept. For decades, taxpayers asked one common question: Why should tax filing be so confusing? Now, finally, the government seems to have listened. Just like switching from an old paper map to GPS navigation, this change promises clarity, direction, and ease. So, what exactly has changed, and more importantly, how does it affect you? Let's break it down step by step.

Table of Contents

|

Sr# |

Headings |

|

1 |

Understanding the Income Tax Act 2025 |

|

2 |

What Was the Assessment Year System? |

|

3 |

Why the Shift to Tax Year Was Needed |

|

4 |

What Is the New Tax Year Concept? |

|

5 |

Key Differences: Assessment Year vs Tax Year |

|

6 |

How This Change Impacts Salaried Taxpayers |

|

7 |

Effect on Business Owners and Professionals |

|

8 |

Benefits of Tax Year Under the Income Tax Act 2025 |

|

9 |

Challenges During the Transition Phase |

|

10 |

Compliance and Filing Simplicity |

|

11 |

Impact on Tax Planning Strategies |

|

12 |

Role of Digital Tax Systems |

|

13 |

What Taxpayers Should Do Now |

|

14 |

Long-Term Vision of Income Tax Act 2025 |

|

15 |

Final Thoughts on the Reform |

1. Understanding the Income Tax Act 2025

The Income Tax Act 2025 aims to modernise India's tax system. Firstly, it focuses on simplicity. Secondly, it prioritises transparency. Thirdly, it reduces confusion for the general public. Previously, many taxpayers struggled to understand timelines. Now, the Act attempts to make tax compliance as straightforward as paying a utility bill.

2. What Was the Assessment Year System?

Earlier, income earned in one year was taxed in the next year, called the Assessment Year. For example, income earned in FY 2023-24 was assessed in AY 2024-25. Consequently, people often mix up years. Moreover, first-time taxpayers felt overwhelmed. Therefore, confusion became the norm rather than the exception.

3. Why the Shift to Tax Year Was Needed

So, why change something that existed for decades? Simply put, the old system no longer served modern needs. Additionally, global tax practices already follow a tax-year model. Furthermore, digital filing demanded real-time clarity. Hence, the Income Tax Act 2025 stepped in with reform.

4. What Is the New Tax Year Concept?

Under the new system, income earned in a year is taxed in the same year, known as the Tax Year. In other words, what you earn and what you file now align neatly. As a result, taxpayers can finally breathe easy.

5. Key Differences: Assessment Year vs Tax Year

Assessment Year:

- Income taxed next year

- Complex timelines

- High confusion

Tax Year:

- Income taxed in the same year

- Simple structure

- Better understanding

Thus, the difference is like watching a recorded match versus watching it live-everything feels immediate and clear.

6. How This Change Impacts Salaried Taxpayers

For salaried individuals, this shift is mostly positive. Firstly, Form 16 aligns better with filings. Secondly, refunds process is faster. Moreover, mistakes are reduced significantly. Therefore, compliance becomes less stressful.

7. Effect on Business Owners and Professionals

Business owners benefit too. However, initially, adjustments may be required. Still, accounting becomes smoother. Meanwhile, cash flow planning improves. Ultimately, long-term benefits outweigh short-term efforts.

8. Benefits of Tax Year Under Income Tax Act 2025

The Income Tax Act 2025 offers several advantages:

- Clarity in timelines

- Consistency in reporting

- Convenience in filing

- Confidence among taxpayers

Additionally, it builds trust between citizens and the tax system.

9. Challenges During the Transition Phase

Every change has hurdles. Initially, taxpayers may feel uncertain. Likewise, software updates may take time. Nevertheless, proper guidance can ease this phase. Eventually, stability will follow.

10. Compliance and Filing Simplicity

Thanks to the tax year model, filing returns becomes intuitive. Instead of remembering two different years, taxpayers now focus on one. Consequently, errors decrease. Furthermore, notices are reduced.

11. Impact on Tax Planning Strategies

Tax planning now becomes timely. Earlier, planning felt delayed. Now, decisions happen in real time. Therefore, investments, deductions, and savings align better with actual income.

12. Role of Digital Tax Systems

Digital portals play a key role here. With automation, calculations sync instantly. Moreover, data pre-fills accurately. Hence, technology supports the vision of the Income Tax Act 2025.

13. What Taxpayers Should Do Now

Firstly, understand the new system. Secondly, consult a tax expert if needed. Thirdly, update records. Meanwhile, stay informed through official updates.

14. Long-Term Vision of Income Tax Act 2025

This reform is not just about dates. Instead, it reflects a mindset shift. Gradually, India moves toward a citizen-friendly tax ecosystem. As a result, voluntary compliance increases.

15. Final Thoughts on the Reform

In conclusion, the shift from Assessment Year to Tax Year under the Income Tax Act 2025 is a welcome move. Although adjustment takes time, the long-term gains are undeniable. Like decluttering a messy room, the process may feel tiring, but the result is refreshing and empowering.

Frequently Asked Questions (FAQs)

1. What is the main change introduced in the Income Tax Act 2025?

The main change is the replacement of the Assessment Year system with a Tax Year system for simpler tax filing.

2. Does the Tax Year system apply to all taxpayers?

Yes, the Tax Year concept applies to salaried individuals, professionals, and businesses alike.

3. Will this change reduce tax filing errors?

Yes, because income and tax timelines now match, errors are expected to reduce significantly.

4. Is the Assessment Year completely removed?

Under the Income Tax Act 2025, the focus shifts primarily to the Tax Year, reducing reliance on the old concept.

5. How should taxpayers prepare for this change?

Taxpayers should stay updated, organise records, and seek professional advice if required.

CAclubindia

CAclubindia