Objective of the Standard

It prescribes that entity applies to ensure that assets are not carried at more than their recoverable amount. An asset is carried at more than its recoverable amount when it exceeds amount to be recovered through use or sale of the asset. If that is the case, then asset is described as impaired & the standard requires the entity to record an impairment loss. The standard also specifies when the impairment loss should be reversed.

Scope

The standard is applicable for impairment of all assets, except

- Inventories(IND AS 2),

- Assets arising from construction contracts (IND AS 11 Construction contracts),

- Deferred Tax Assets (IND AS 12 Income Taxes),

- Assets arising from employee benefits(IND AS 19 Employee benefits),

- Financial Instruments (IND AS 39 F. Instruments),

- Biological Assets related to Agriculture activity that are measured at fair value less costs to sell.( IND AS 41 Agriculture)

- Deferred acquisition costs, and intangible assets arising from an insurer's contractual rights, under insurance contracts IND AS 104.

- Non Current Assets classified as held for sale in accordance with IND AS 105 Non Current Assets held for sale and Discontinued Operations.

Standard applies to Financial Assets classified as

- Subsidiaries as defined in IND AS 27 Consolidated & Separate Financial Statements,

- Associates as in IND AS 28 Investment in Associates,

- Joint Ventures as in IND AS 31 Interest in Joint Ventures for impairment of other financial assets, refer in IND AS 39.

However, this standard applies to assets that are carried at a revalued amount (i.e. fair value in accordance with other IND AS, such as the revaluation model in IND AS 116, Property, Plant and Equipments.

To identify whether revalued asset is impaired do the following

- If the Assets Fair value is its market, the only difference between asset's fair value and Fair value less costs to sell is the direct incremental costs to dispose off the asset;

- If the disposal costs are negligible, no impairment is to be recorded,

- If disposal costs are not negligible, then fair value less costs to sell is necessarily less than its fair value, therefore, revalued asset may be impaired if the Value in use is less than is carrying amount (Revalued amount or Fair value).

Basis test of the Standard is

Take the higher of

- Value in use i.e. Present value of Future cash inflows of the asset, or

- Fair Value i.e. Market Value less costs of disposal.

The result will be the Recoverable amount , now compare the amount with carrying amount of the asset.

- If Recoverable amount is > Carrying amount, nothing to be done

- If Recoverable Amount < Carrying Amount, impairment loss to be recognized in Profit & Loss Account.

Para 10 of IND AS 36

Says Irrespective of any indication that an impairment loss may have occurred :

- Test Intangible asset with indefinite useful life or intangible asset not yet available for use annually, or may be performed, at any time provided it is performed the same time every year. However, if Intangible Asset was initially (from the inception) recognized during current annual period, then testing to be done before the end of current annual period,

- Test Goodwill acquired in a Business Combination for impairment annually as per Para 80-99.

Para 12-14

Describes some indications that an impairment loss may have occurred, if any of the following indications are present.

Factors external to the organization

- During the period, assets market value has declined significantly more than expected as a result of passage of time or in normal usage.

- Significant changes with an adverse effect on the entity has taken place or will take place in Technology, Market, Economic, legal environment of entity or asset's market.

- Market Interest rates or the Market return on Investment have increased during the period, discount rate might be affected.

- Carrying amount is more than Market capitalization of net assets.

Factors internal to the organization

- Evidence is available of obsolescence or physical damage of the asset,

- Significant changes with an adverse effect on the entity have taken place during the period, or expected to take place in future, in manner of use of asset, i.e. asset becoming idle, plans to discontinue or restructure operation to which the asset belongs, plans to dispose asset before expected date & reassessing life of asset as finite rather than infinite.

- Evidence available that economic performance of asset will be worse than expected.

The list in above Para is not exhaustive, an entity may identify other indications.

As indicated in Para 10, Materiality to be applied even in those provisions, For example :

If previous calculation shows recoverable amount is significantly more than Carrying amount, then no need to re estimate the Recoverable amount, if no events occurred to eliminate the difference. Similarly, previous analysis may show Recoverable amount is not sensitive to indicators in Para 10.

How to measure Recoverable Amount: Higher of Value in use or Fair value less Costs to sell.

It is not always necessary to determine both of the Value in use and Fair Value less costs to sell, if any of them exceeds carrying amount of the asset.

If no fair value available, because of no active market or no basis for making a reliable estimate in an arm's length transaction between knowledgeable parties, then value in use to be taken as Recoverable amount.

If an asset is held for disposal, then there might be a case that of no reason to believe that cash flow to be generated in future exceeds fair value less costs to sell, then Fair value less cost to sell to be taken.

It might sometimes happen that cash flows can't be calculated independently for assets, then cash flows to be taken for Cash Generating Unit (CGU) , unless either

- Assets' fair value less costs to sell is higher than carrying amount,

- We know that Value in use can be estimated to be close to Fair value less costs to sell, and Fair value can be determined.

Previous calculation can be used for intangible asset with indefinite useful life as mentioned in Para 10 if all these conditions are met

- Intangible asset does not generate cash flows independent from its CGU, and CGU assets/liabilities have not changed significantly.

- Most recent Recoverable amount is more than Carrying amount by a substantial margin,

- Based on analysis of events & circumstances, the likelihood that R.A.(Recoverable Amount) would be less than C.A.(Carrying amount) is remote.

How to calculate Fair Value less costs to sell: Best evidence is price in a binding agreement in an arm's length transaction adjusted for incremental costs directly attributable to disposal of the asset.

- If there is no binding sale agreement, but asset is actively traded , we can take current bid price provided no significant change in economic circumstances between transaction date and estimation date.

- If above not available, then on the reporting date if there is a recent transaction for similar assets within the same industry. Not taking sale price in a forced sale.

- Costs of disposal other than which have already been recognized as a liability to be taken in determining FV less cost to sell. However, termination benefits & costs associated with reducing or reorganizing business following disposal of asset are not such incremental costs.

Para 104 contains provisions of how to record impairment loss for an asset

Firstly, Recoverable amount is less than Carrying amount needs to be determined, The impairment loss shall be allocated to reduce the carrying amount of the assets of the unit (group of units) in the following order:

(a) first, to reduce the carrying amount of any goodwill allocated to the cash-generating unit (group of units); and

(b) then, to the other assets of the unit (group of units) pro rata on the basis of the carrying amount of each asset in the unit (group of units).

Reversal of an impairment loss of an asset

The increased carrying amount of an asset other than goodwill attributable to a reversal of an impairment loss shall not exceed the carrying amount that would have been determined (net of amortisation or depreciation) had no impairment loss been recognised for the asset in prior years.

Para 119 says that "A reversal of an impairment loss for an asset other than goodwill shall be recognised immediately in profit or loss, unless the asset is carried at revalued amount in accordance with another Indian Accounting Standard (for example, the revaluation model in Ind AS 16). Any reversal of an impairment loss of a revalued asset shall be treated as a revaluation increase in accordance with that other Indian Accounting Standard".

A reversal of an impairment loss on a revalued asset is recognised in other comprehensive income and increases the revaluation surplus for that asset. However, to the extent that an impairment loss on the same revalued asset was previously recognised in profit or loss, a reversal of that impairment loss is also recognised in profit or loss.

After a reversal of an impairment loss is recognised, the depreciation (amortisation) charge for the asset shall be adjusted in future periods to allocate the asset's revised carrying amount, less its residual value (if any), on a systematic basis over its remaining useful life.

Reversing an impairment loss for goodwill

An impairment loss recognised for goodwill shall not be reversed in a subsequent period.

Ind AS 38 Intangible Assets prohibits the recognition of internally generated goodwill. Any increase in the recoverable amount of goodwill in the periods following the recognition of an impairment loss for that goodwill is likely to be an increase in internally generated goodwill, rather than a reversal of the impairment loss recognised for the acquired goodwill

Reversing an impairment loss for CGU

A reversal of an impairment loss for a cash-generating unit shall be allocated to the assets of the unit, except for goodwill, pro rata with the carrying amounts of those assets. These increases in carrying amounts shall be treated as reversals of impairment losses for individual assets and recognised in accordance with paragraph 119

In allocating a reversal of an impairment loss for a cash-generating unit in accordance with paragraph 122, the carrying amount of an asset shall not be increased above the lower of:

(a) its recoverable amount (if determinable); and

(b) the carrying amount that would have been determined (net of amortisation or depreciation) had no impairment loss been recognised for the asset in prior periods. 29 The amount of the reversal of the impairment loss that would otherwise have been allocated to the asset shall be allocated pro-rata to the other assets of the unit, except for Goodwill.

Some illustrations for Elaborative purposes:

Identification of CGU

Retail chain

Store A belongs to a retail store chain X. A makes all its retail purchases through X's purchasing centre. Pricing, marketing, advertising and human resources policies (Except for hiring A's cashiers and sales staff) are decided by X. X also owns five other stores in the same city as A (although in different neighbourhoods) and 20 other stores in other cities. All stores are managed in the same way as A. A and four other stores were purchased five years ago and goodwill was recognised. What is the cash-generating unit for A (A's cash-generating unit)?

Solution

In identifying A's cash-generating unit, an entity considers whether, for example:

(a) internal management reporting is organized to measure performance on a store-by-store basis; and

(b) the business is run on a store-by-store profit basis or on a region/city basis.

All X's stores are in different neighbourhoods and probably have different customer bases. So, although A is managed at a corporate level, A generates cash inflows that are largely independent of those of X's other stores. Therefore, it is likely that A is a cash-generating unit.

Calculation of value in use and recognition of an impairment loss

At the end of 20X0, entity T acquires entity M for Rs 10,000. M has manufacturing plants in three countries.

Schedule 1. Data at the end of 20X0

|

End of 20X0 |

Allocation of purchase price Rs |

Fair value of identifiable assets Rs |

Goodwill Rs |

|

Activities in Country A |

3,000 |

2,000 |

1,000 |

|

Activities in Country B |

2,000 |

1,500 |

500 |

|

Activities in Country C |

5,000 |

3,500 |

1,500 |

|

Total |

10,000 |

7,000 |

3,000 |

Because goodwill has been allocated to the activities in each country, each of those activities must be tested for impairment annually or more frequently if there is any indication that it may be impaired (see paragraph 90 of Ind AS 36).

At the beginning of 20X2, a new government is elected in Country A. It passes legislation significantly restricting exports of T's main product. As a result, and for the foreseeable future, T's production in Country A will be cut by 40 percent.

The significant export restriction and the resulting production decrease require T also to estimate the recoverable amount of the Country A operations at the beginning of 20X2.

T uses straight-line depreciation over a 12-year life for the Country A identifiable assets and anticipates no residual value.

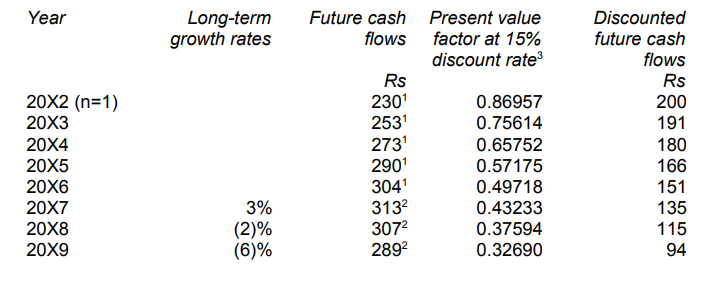

To determine the value in use for the Country A cash-generating unit (see Schedule 2), T: (a) prepares cash flow forecasts derived from the most recent financial budgets/forecasts for the next five years (years 20X2- 20X6) approved by management. (b) estimates subsequent cash flows (years 20X7- 20Y2) based on declining growth rates. The growth rate for 20X7 is estimated to be 3 percent. This rate is lower than the average long-term growth rate for the market in Country A. (c) selects a 15 percent discount rate, which represents a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the Country A cash-generating unit.

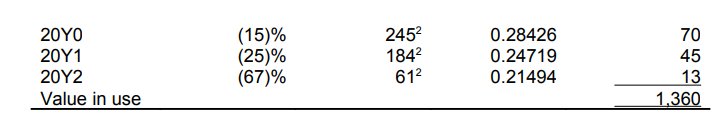

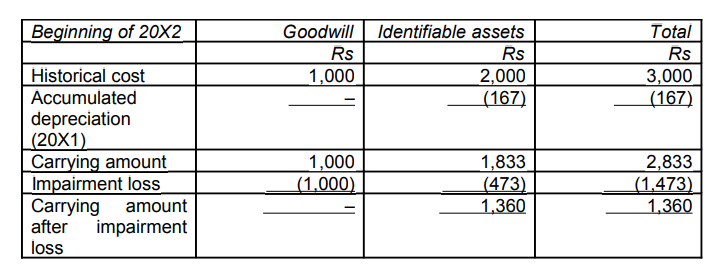

Recognition and measurement of impairment loss

The recoverable amount of the Country A cash-generating unit is Rs 1,360.

Because the carrying amount exceeds the recoverable amount by Rs 1,473, T recognises an impairment loss of Rs 1,473 immediately in profit or loss. The carrying amount of the goodwill that relates to the Country A operations is reduced to zero before reducing the carrying amount of other identifiable assets within the Country A cash-generating unit (See para 104 of IND AS 36).

Schedule 2: Calculation of the value in use of the Country A cash-generating unit at the beginning of 20X2

Schedule 3: Calculation and allocation of the impairment loss for the Country A cash-generating unit at the beginning of 20X2

Definitions

- Carrying Amount: The amount at which asset is recognized after deducting any accumulated Depreciation and accumulated impairment losses thereon.

- Cash Generating Unit: is the smallest identifiable group of assets capable of generating cash inflows independently from other group of assets.

- Corporate Assets: These are assets other than goodwill that contribute to future cash flows of both the CGU under review and other CGU's.

- Costs of Disposal: These are incremental costs directly attributable to disposal of asset or CGU, excluding finance costs & income tax expense.

- Active market: It is a market in which all of the following conditions exist:

- Items traded within the market are having similar characteristics (homogenous),

- Willing buyers & Sellers can be found normally at any time,

- Prices are available to the public.

- Depreciable amount: Is the cost of the asset or the amount substituted for cost in Financial Statements less its residual value.

- Depreciation/Amortisation: IS the systematic allocation of the depreciable amount of asset over its useful life.

- Impairment Loss: Is the amount by which the carrying amount of an asset or a CGU exceeds its recoverable amount.

- Recoverable Amount: Is the higher of (Fair value less costs to sell) or its value in use.

- Value in use: is the present value of future cash flows expected to be derived from an asset or a CGU.

Reference: IND AS 36 by Ministry of Corporate Affairs.

CAclubindia

CAclubindia