Summary of GST notifications are tabulated below

Relevant Notifications (Central Tax dated 01.05.2021) |

|

|

Notification No. Central Tax |

Description |

|

08/2021 |

Interest Relaxation for Tax Payable of Mar-Apr-21 |

|

09/2021 |

Late Fee Relaxation for GSTR3B of Mar-Apr-21 |

|

10/2021 |

Extension of GSTR-4 for FY 2020-21 |

|

11/2021 |

Extension of filing ITC-04 for Q4 of FY 2020-21 |

|

12/2021 |

Extension for GSTR-1 Due Dates for Apr-21 |

|

13/2021 |

Relaxation for Rule 36(4) and furnishing IFF for Apr-21 |

|

14/2021 |

Other relaxations for Completion or Compliance of Action under GST |

Relevant Notifications (CT dated 01.06.2021) |

|

|

Notification No. Central Tax |

Description |

|

Retrospective Amendment to Section-50 |

|

|

Due Date Extension GSTR1 for May’2021 |

|

|

Reduced ROI for Mar’21 to May’21 |

|

|

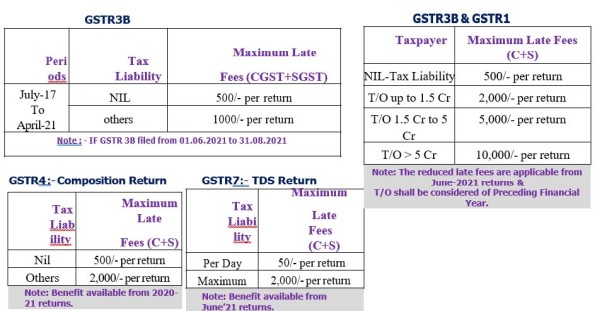

GST Amnesty Scheme and Rationalized Late Fees |

|

|

Rationalized Late Fees for GSTR1 |

|

|

Rationalized Late Fees for GSTR4 |

|

|

Rationalized Late Fees for GSTR7 |

|

|

Taxpayers Exempted from E-Invoicing |

|

|

Various Compliances Extended |

|

|

GSTR4 Extended for 2020-21 |

|

|

ITC04 for QE Mar’2021 Extended |

|

|

Extended IFF, Relaxations to Rule 36(4) |

|

INTEREST ON NET CASH BASIS

Section 50 of the CGST Act, 2017 which is also replicated in SGST Acts, contains the provision for levy of interest on delay or non-payment of GST.

In this regard, the Quantum of interest to be levied was under dispute from first day of introduction of GST. The dispute was whether GST will be charged before adjusting ITC (on Gross Liability) or after adjusting ITC (Net Liability).

GST Council in its 43rd Meeting held that W.E.F 01.07.2017 - Retrospective amendment in section 50 of the CGST Act, providing for payment of interest on net cash basis (after adjusting ITC).

Interest Waiver as per Notification 08/2021 and relaxation as recommended by 43rd GST Council

For Turnover > 5 Crores in preceding FY in case of GSTR 3B Return

|

Returns |

Due Date |

Interest @9% |

Late Fees @18% |

|

|

From |

To |

After |

||

|

Mar-2021 |

20.04.2021 |

21.04.2021 |

05.05.2021 |

05.05.2021 |

|

Apr-2021 |

20.05.2021 |

21.05.2021 |

04.06.2021 |

04.06.2021 |

|

May-2021 |

20.06.2021 |

21.06.2021 |

05.07.2021 |

05.07.2021 |

If return not filed within due dates, then late fees @ Rs. 50/- (Nil Return: Rs. 20/-) per day will be applicable from the next day after the due date as may be prescribed/specified.

For Turnover up to 5 Cr. in Preceding FY in case of GSTR 3B Return

Category A States

|

Taxpayer |

Months |

Due Date |

Interest @NIL |

Interest @9% |

Late Fees @NIL |

|||

|

From |

To |

From |

To |

From |

To |

|||

|

Monthly |

Mar-2021 |

20.04.2021 |

21.04.2021 |

05.05.2021 |

06.05.2021 |

19.06.2021 * |

21.04.2021 |

20.05.2021 |

|

Apr-2021 |

20.05.2021 |

21.05.2021 |

04.06.2021 |

05.06.2021 |

04.07.2021 * |

21.05.2021 |

19.06.2021 |

|

|

May-2021 |

20.06.2021 |

21.06.2021 |

05.07.2021 |

06.07.2021 |

20.07.2021 * |

21.06.2021 |

20.07.2021 |

|

|

Quarterly |

Mar-2021 |

22.04.2021 |

23.04.2021 |

07.05.2021 |

08.05.2021 |

21.06.2021 * |

23.04.2021 |

22.05.2021 |

|

Apr-2021 |

25.05.2021 |

26.05.2021 |

09.06.2021 |

10.06.2021 |

09.07.2021 * |

N.A. |

||

|

May-2021 |

25.06.2021 |

26.06.2021 |

10.07.2021 |

11.07.2021 |

25.07.2021 * |

|||

*thereafter 18% and Category A: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra

Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep

For Turnover up to 5 Cr. in Preceding FY in case of GSTR 3B Return

Category B States

|

Taxpayer |

Months |

Due Date |

Interest @ NIL |

Interest @9% |

Late Fees @NIL |

|||

|

From |

To |

From |

To |

From |

To |

|||

|

Monthly |

Mar-2021 |

20.04.2021 |

21.04.2021 |

05.05.2021 |

06.05.2021 |

19.06.2021 * |

21.04.2021 |

19.06.2021 |

|

Apr-2021 |

20.05.2021 |

21.05.2021 |

04.06.2021 |

05.06.2021 |

04.07.2021 * |

21.05.2021 |

04.07.2021 |

|

|

May-2021 |

20.06.2021 |

21.06.2021 |

05.07.2021 |

06.07.2021 |

20.07.2021 * |

21.06.2021 |

20.07.2021 |

|

|

Quarterly |

Mar-2021 |

24.04.2021 |

25.04.2021 |

09.05.2021 |

10.05.2021 |

23.06.2021 * |

25.04.2021 |

23.06.2021 |

|

Apr-2021 |

25.05.2021 |

26.05.2021 |

09.06.2021 |

10.06.2021 |

09.07.2021 * |

N.A. |

||

|

May-2021 |

25.06.2021 |

26.06.2021 |

10.07.2021 |

11.07.2021 |

25.07.2021 * |

|||

*thereafter 18% and

Category B: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of J&K, Ladakh, Chandigarh or Delhi.

Relaxations to Composition Taxpayers

|

Form |

Frequency |

Due Date |

Interest @ NIL |

Interest @ 9% |

||

|

From |

To |

From |

To |

|||

|

CMP-08 (Self assessed tax) |

Quarterly (Mar-2021) |

18.04.2021 |

19.04.2021 |

03.05.2021 |

04.05.2021 |

17.06.2021 * |

*thereafter 18%

Extended Due Dates for GSTR-1, IFF and GSTR 4

|

Form |

Period |

Due Date |

|

|

Normally |

Revised |

||

|

GSTR1 |

Apr-21 |

11.05.2021 |

26.05.2021 |

|

IFF |

13.05.2021 |

28.05.2021 |

|

|

GSTR1 |

May-21 |

11.06.2021 |

26.06.2021 |

|

IFF |

13.06.2021 |

28.06.2021 |

|

|

GSTR4 |

FY 2020-21 |

30.04.2021 |

30.06.2021 |

GST Amnesty Scheme for Late Fees waiver as per 43rd GST Council

Other Relaxations

- Due date for filing ITC04 (Goods dispatched to /received from Job work) for the Q4 (Jan-Mar) of 2020-21 has been extended to 06.2021.

- Government Departments and local authorities are exempted from E-Invoicing provisions

- Rule 36(4) pertain to restriction of ITC shall apply cumulatively for the period April, May and June 2021 in the return FORM GSTR-3B for the tax period June-2021

- The time limit for completion of action of verification by the proper officer of the application for GST registration and its approval (Rule-9 of CGST rules pertaining to Verification of the Application and Approval) falls between 05.2021 to 30.06.2021 has been extended to 15.07.2021.

- Taxpayers registered under Companies Act can furnish returns by using EVC instead of DSC till 08.2021

TIME LIMIT EXTENDED

Whose last date of completion falls between 15th April to 29th June is extended to 30th June 2021

1. Completion of any proceeding or passing of any order or issuance of any of the following:

- Notice, Intimation, Notification

- Sanction and Approval (by any authority, commission or tribunal)

2. Filing of any Appeal, Reply and Application

3. Furnishing of any

- Report

- Document

- Return

- Statement or such other record

4. Refund Orders under Section 54(5) and Section 54(7) shall be extended up to 15 days after the receipt of reply to the notice OR 30th June-2021 (W.E. later)

NO BENEFIT OF EXTENSION IN FOLLOWING THE SECTION

- Sec 12 to 15: Time and Value of Supply Sec 25 Procedure for Registration

- Sec 27: CTP & NRTP Provisions

- Sec 31: Tax Invoice Provisions

- Sec 37: Filing GSTR1

- Sec 47 & Sec 50: Late Fees and Interest

- Sec 68: Inspection of Movement of Goods

- Sec 69: Power to Arrest

- Sec 90: Liability of Partners of firm to pay tax

- Sec 122: Penalty for certain offences

- Sec 129: Detention, seizure, & release of goods & conveyance in transit

Disclaimer: The purpose of this is to share knowledge and it is for education purpose only. This does NOT constitute NOR does this form part of neither it is to be construed as, A LEGAL OPINION. The analysis is solely based on the reading abilities of the Author. They may be correct/incorrect as per you. No representation or warranty, express or implied, is made or given in respect of any information provided. UNDER NO circumstances should any recipient rely on this communication as a basis for any legal decision. The views expressed are of personal to the author. They do not reflect the views of any organization he may be directly/indirectly associated with. Neither author nor any of its affiliates accepts any legal liability, or responsibility, for, or provides any assurance or guarantee of accuracy, authenticity, completeness, correctness, dependability, reliability, suitability or timeliness of, any part of this article. The contents of this article are based only on the understanding of the Law, Rules, Notifications, etc. of the author and THEY ARE NOT BASIS FOR ANY LEGAL OPINION.

CAclubindia

CAclubindia