Maintaining books of accounts is now very crucial for Income Tax and GST compliance, especially for small traders, who often lack proper records.

Why is it needed?

Many small traders do not keep records, which leads to problems during GST or Income Tax scrutiny when proof of income or sales is required.

The IT Act and GST Law both mandate specific record-keeping, which is beneficial for all businesses.

GST Law Requirements

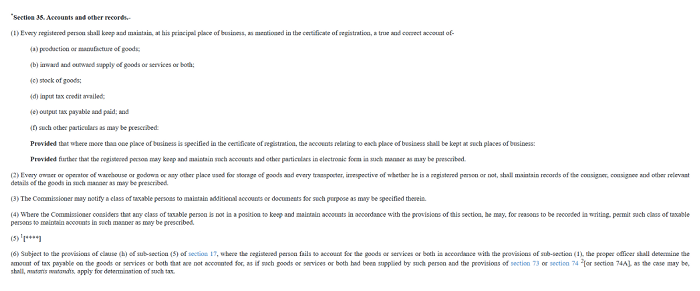

As per Section 35, every registered person shall keep and maintain at his principal place of business, as mentioned in the certificate of registration, a true and correct account-

- Production or manufacture of goods.

- Inward and outward supply of goods or services or both.

- Stock of goods

- Input Tax credit availed

- Output tax payable and paid etc.

- Weight slips for goods received, transport details, and delivery challans.

- Debit/credit notes and GSTR returns (9 and 9C) should also be maintained.

Income Tax Act Requirements

Under the Income Tax Act, Section 44AA and Rule 6F specify when books of accounts are mandatory.

For individuals or Hindu Undivided Families (HUF), which includes most proprietorships, books of accounts are mandatory if:

- Income exceeds Rs 2.5 lakh or

- Sales or gross receipts (for professionals) or turnover exceed Rs 25 lakh.

Components of Books of Accounts

- Cash Book: Records all cash sales, cash receipts, and from which parties must be maintained.

- Bank Book: Details all receipts and paid from the bank account, including source and purpose.

- Registers: Specific registers like Form 3C for doctors, can be maintained.

- Client/Customer Details: Records, from whom money is coming and to whom sales are made, as it helps tax officers verify turnover and profit.

- Balance Sheet & Profit & Loss Statement: While not explicitly mandatory to prepare these, they are automatically generated when proper accounting is done and are crucial for understanding actual profit and net worth.

Consequences If Books Of Accounts are Not Maintained Properly

Many people incorrectly file 44AD presumptive income returns without maintaining records, which may lead to problems during assessment when asked for details on creditors, debtors, inventory and cash.

If these details are not supported by records, the Income Tax department may add these amounts to income and levy a 60% tax.

CAclubindia

CAclubindia