- In case of Death of Proprietor, if the business is continued by any person then it'll be considered as Transfer of Business under GST (Section 18 (3) - CGST Act).

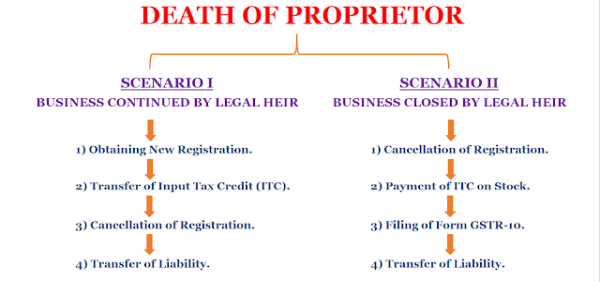

- There can be 2 Scenarios in case of Death.

- I'll try to cover both scenarios along with the procedure in each scenario.

- Following is the Chart for the topics we'll cover in this blog.

Scenario 1: Business is Continued by the Legal Heir.

Step 1: Obtaining the New Registration by Legal Heir.

- Legal Heir or Successor will be liable to be registered w.e.f. the date of such transfer i.e. death in our case. (Section 22 (3) - CGST Act)

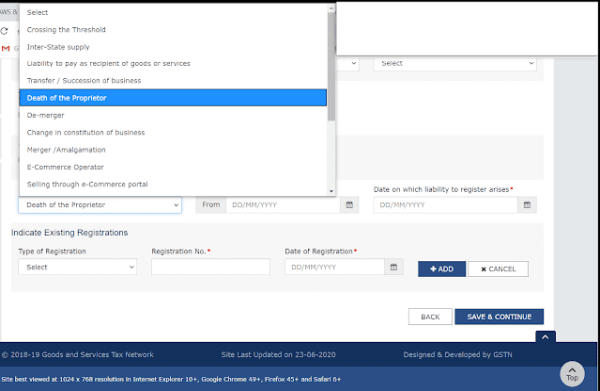

- File application for registration in Form GST REG - 01.

- Select reason to obtain registration as "Death of Proprietor".

- The date on which liability of Registration arise => Date of Death of Proprietor.

- Death certificate of deceased proprietor also need to be upload while filing REG - 01.

Step 2: Transfer of Unutilized Input Tax Credit (ITC).

- The unutilized ITC lying in Electronic Credit Ledger of deceased can be transferred to successor.

- The procedure to transfer unutilized ITC has been stated in Rule-41 (CGST Rules).

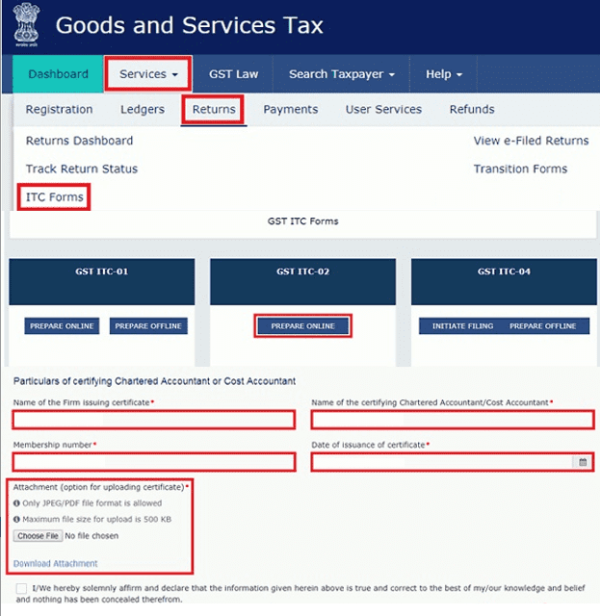

- Procedure for Authorized Representative of Transferor (Deceased): -

- Form GST ITC - 02 to be furnished providing details of Transfer along with request for transfer of unutilized ITC.

- A copy of Certificate issued by practicing CA or CMA certifying transfer has been done according to the provision for transfer of liabilities shall also be submitted.

- Procedure for Transferee (Successor): -

- Accept the details so furnished by Transferor on common portal.

- After acceptance, the unutilized ITC stated in ITC-02 will be credited to Electronic Credit Ledger immediately.

- Inputs and Capital Goods should be duly accounted in the books of accounts.

- Imp. Point to be Noted: -

- ITC-02 to be filed only if there is any ITC.

- No time limit for filing ITC - 02.

Step 3: Cancellation of Registration.

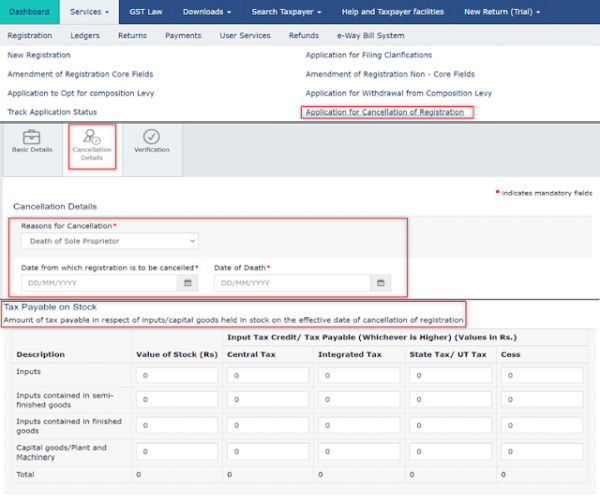

- Application for cancellation to be made in Form GST REG 16.

- Following details to be provided in Form:

- Details of inputs, semi-finished, finished goods held in stock on date of cancellation or registration is applied.

- Liability (i.e. ITC on Stock / Capital Goods held) thereon.

- Details of the payment.

- Form GST REG 16 to be filed within 30 Days from Death.

- The proper officer has to issue order for cancellation in Form GST REG 19 within 30 days of application.

- Imp. Point to be Noted: -

- As business is continued by legal heirs then the stock will be transferred to legal heir as shown in Step 2.

- Thus, there will no stock on date of application of cancellation and no ITC thereon.

- Thus, no need of payment of tax.

Step 4: - Transfer of Liability.

- Section 93(1) - CGST Act states:

- When a person dies then,

- The person who continues the business

- Shall be liable to pay tax, interest or any penalty

- Due from transferor (i.e. Deceased person)

Scenario 2 : Business is Closed by the Legal Heir.

Step 1: Cancellation of Registration.

- The procedure is same as given in Step 3 above.

- In this scenario there is no transfer of business.

- Thus, there will also be no transfer of stock.

- This will result in arising of tax liability of amount equal to ITC on stock held.

Step 2: Payment of ITC contained in Stock / Capital Goods.

- The ITC taken on stock / Capital Goods held at the time of application of cancellation to be paid.

- The requirement to debit Electronic Credit Ledger / Cash Ledger is not prerequisite for applying Cancellation.

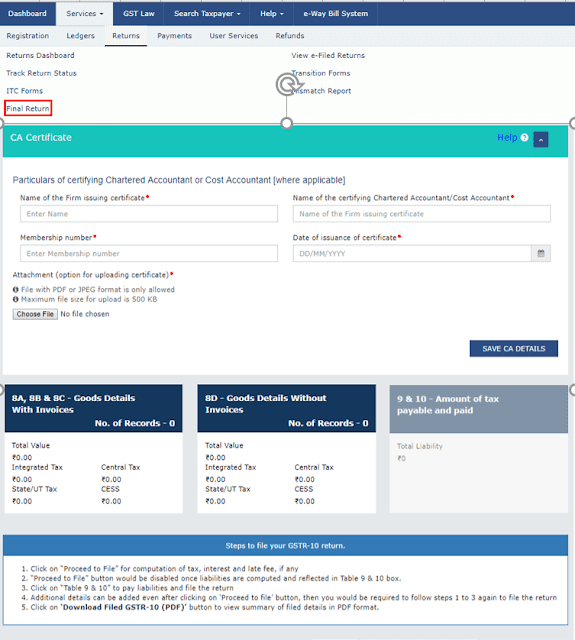

- It can be done at time of submission of Final Return (Form GSTR - 10).

Step 3: Filing of Final Return (Form GSTR - 10).

- Final return must be filed within 3 months from date of cancellation order.

- Incase final return not filed within due date, then Notice in Form GSTR-3A to be issued to taxpayer.

- If taxpayer still fails to file final return within 15 days of receipt of GSTR-3A, then an Assessment Order in GST ASMT-13 will be issued.

Step 4: Transfer of Liability.

- Section 93(1) - CGST Act states:

- When a person dies and business is Discontinued then,

- Legal representative shall be liable to pay

- Tax, interest or any penalty

- Due from transferor (i.e. Deceased person)

- Out of the Estate of the deceased person.

DISCLAIMER: -

- The above details are gathered from GST Act and also with help various articles and blogs.

- I have tried my best to compile all the required data in a simple and bullet wise format.

The author can also be reached at capratikp@gmail.com

CAclubindia

CAclubindia