The taxpayer received professional income with TDS deducted under section 194J, amounting to Rs 220,000 approx. from the total income of Rs 22,00,000. Since this was professional income, the correct section is 44ADA.

Under Section 44ADA, only 50% of gross receipts is considered as "deemed" net profit and taxed, with no requirement to report full income as profit.

But,

The taxpayer made a mistake that instead of filing under 44ADA, they filed under 44AD.

Then,

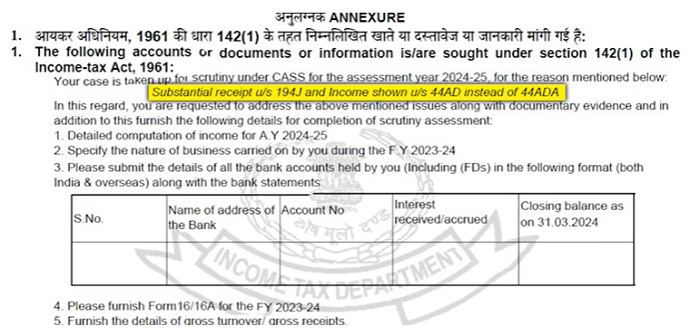

AI-based systems detected mismatches in the TDS section, the nature of income, Form 26AS/TIS data and profit reporting and sent notice u/s 142(1).

Why Department Send a Notice To the Taxpayer?

Section 194J TDS is for professional/technical services, which is eligible for 44ADA, not 44AD as it is a business receipt.

Under 44AD, the taxpayer must show at least 6% or 8% profit on business receipts. Here, the taxpayer is shown as 8% profit on the gross amount, leading to inflated claimed refunds.

By showing 100% refund claim, it implied that the profit ratio was below the allowed norms.

As per Section 44ADA, if a professional declares less than 50% profit, then they must maintain proper books and get a mandatory audit.

In this case, the taxpayer neither maintained proper books nor conducted any audit or complied with audit requirement u/s 44AB,which became a serious compliance violation.

Consequences

- If you failure to conduct a compulsory audit it may result in a penalty under Section 271B.

- The wrongly claimed refund must be repaid with interest.

- If not rectified, demand notices and forced recovery can occur.

Conclusion

File ITR under the correct head of income, disclose small profits/losses, cross-verify with 26AS/TIS as small mistake resulted in penalties for wrong disclosure, unmaintained books, and unperformed audits, leading to significant financial loss and harassment

CAclubindia

CAclubindia