What Is Form 15G? Who needs to Fill Form 15G?

It is a declaration form to be filled up by individuals less than 60 years of age and HUFs stating their income is less than the Exemption limit to ensure that no TDS is deducted from their interest income in a year. As per the income tax rules, it's mandatory for banks to deduct tax at source in case the interest earned on your fixed deposit, recurring deposit, etc. is more than Rs. 10,000 in a financial year.

Eligibility for submitting Form 15G

• Should be Individual or HUF

• Must be a Resident of India.

• Should be less than 60 years of Age.

• Tax liability on total taxable income for the Financial year is zero.

• Total interest income is less than the basic exemption limit.

Where and how to Download Form 15G

Form 15G is available on every bank's website and also it can be downloaded from the Income tax department's website.

The link for downloading Form 15G in PDF is given below:

https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007845.pdf

Components of Form 15G

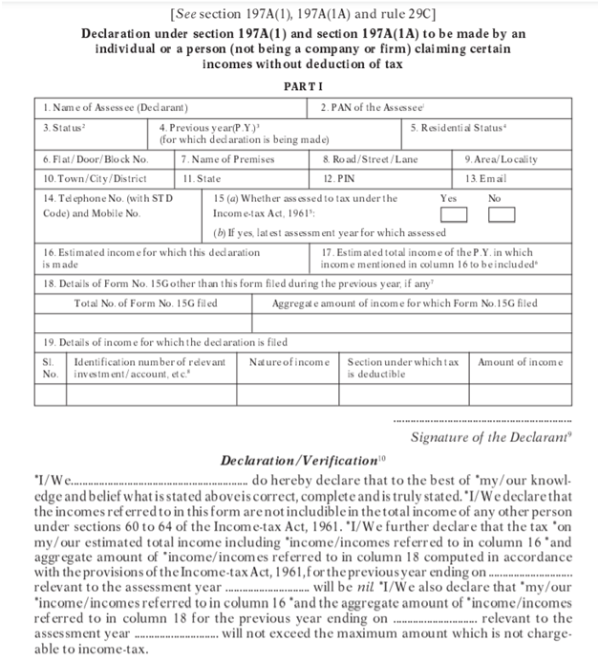

There are two parts in the form- Part I and Part II.

Part I is filled by Individual or person (other than a company or a firm) claiming certain income without Deduction of Taxes.

Part II is to be filled by the person responsible for paying the Income.

Components of Part I and How to fill them.

• Name of Assessee: Name as mentioned on PAN Card.

• PAN of Assessee: Valid PAN Card is mandatory

• Status: Whether Individual or not( Company or Firm not allowed)

• Previous Year: The Financial Year for which you are claiming income without deduction of Tax.

• Residential Status: Residential stats for the Individual is needed as NRIs Can not submit Form 15G.

• Address: Complete address of the assessee is required

• Email: Email address of Assessee is required on which he can be contacted

• Telephone no and Mobile no: Valid Contact details are to be filled.

• Whether assessed to tax under the Income Tax act,1961: Tick Yes, if assessed to tax for previous years.

• If Yes, latest Assessment year for which assessed: Latest year for which the returns had been assessed.

• Estimated Income for which declaration is made: Estimated income for the previous year for which the declaration is being made.

• Estimated total income of the P.Y. in which income mentioned in column 16 to be included?: Total estimated income for the financial year including the income claimed.

• Details of Form No. 15G other than this form filed during the previous year, if any: It requires the details of any other Form 15G filled during the year.

• Details of Income for which the declaration is filed: The details of the income being claimed without deduction of tax is to be given here for e.g Investment account number etc.

After all the details are filled, cross check for errors and sign the declaration at the end.

Part II is to be filled by the person responsible for paying Income.

Purposes for which Form 15G can be submitted

1. TDS on interest income from Bank Deposits: It is mandatory for banks to deduct tax at source in case the interest earned on your fixed deposit, recurring deposit, etc. is more than Rs. 10,000 in a financial year.

2. TDS on EPF Withdrawn: Epf withdrawn before 5 years of service is subject to tax deduction at source. If the amount of EPF before 5 years of service is more than Rs 50,000, it can be submitted if the total income including EPF is less than the basic Exemption limit and no tax is payable on the same.

3. TDS on Rent: If rent is more than 2.4 lakhs annually then TDS is deducted by the tenant. If tax on your total income is nil, Form 15G can be submitted to the tenant for non deduction of TDS.

4. TDS on Insurance commision: If Insurance Commission exceeds Rs 15,000 in a Financial Year, Tds is deductible. Insurance agents can submit Form 15G if the tax on their total Income is Nil.

Is Form 15G and Form 15H same?

No, Form 15G is to be filled by Individual less than 60 years of age and tax on total income being zero or nil.

Form 15H is to be filled by individuals who are 60 or above years of age and tax on total income being zero or nil.

FAQs

1. Is Form 15G to be Submitted to the Income Tax Department?

No, the form should be submitted to the Deductor of the tax on the income being claimed and not to the Income tax department.

2. Does filling Form 15G mean Interest Income is Not taxable?

Form 15G or Form 15H is only a declaration that no TDS should be deducted on your interest income since tax on your total income is nil. Interest income from fixed deposits, recurring deposits is taxable above the exemption limit.

3. Can NRIs submit Form 15G?

Only Individuals who are resident of India are eligible to fill Form 15G and Form 15H. NRIs are not eligible for the same.

CAclubindia

CAclubindia