COMPANY LAW SETTLEMENT SCHEME

One time opportunity for companies to seek relaxation on filing fees for pending annual filing forms

The Ministry of Corporate Affairs has announced the Company Law Settlement Scheme, 2014 (CLSS, 2014) vide its General Circular No. 34/2014 dated 12.08.2014 which provides a one time opportunity to all companies to clear all their pending annual filings with reduced fees. This scheme comes as a big relief to all corporates which were reeling under the pressure of hefty filing fees which became applicable from even for forms pending under the old Act.

The salient features of the CLSS, 2014 are discussed below for ready and easy reference of the readers so that maximum benefit can be derived out of this scheme which not only helps to save grants immunity against prosecution for default a directors of defaulting companies.

WHAT IS CLSS, 2014?

Company Law Settlement Scheme, 2014 (CLSS, 2014) is a one time opportunity given to companies for condoning the filing related forms, granting immunity for prosecution and charging reduced additional fee of 25% of actual additional fees payable as per Section 403 of the Companies Act, 2013 read with Companies (Registration Offices and Fee) Rules, 2014 and the Rules made thereunder.

Companies Act, 2013 lays down a stricter regime for defaulting companies with imposition of high additional fees and other penal provisions. The CLSS, 2014 is aimed at granting a transitional period/one time opportunity to the defaulting companies to file the pending annual filing forms with reduced fees and save themselves from threat of prosecution.

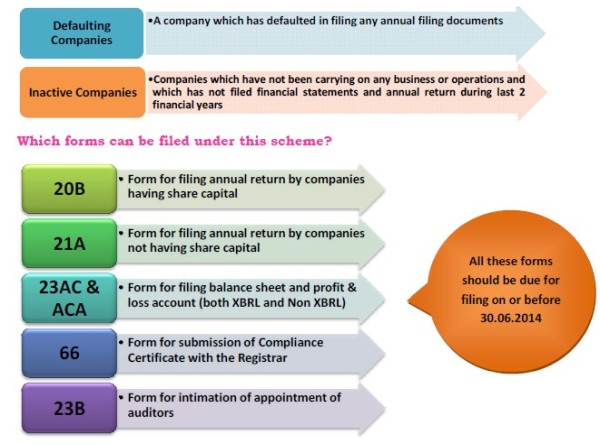

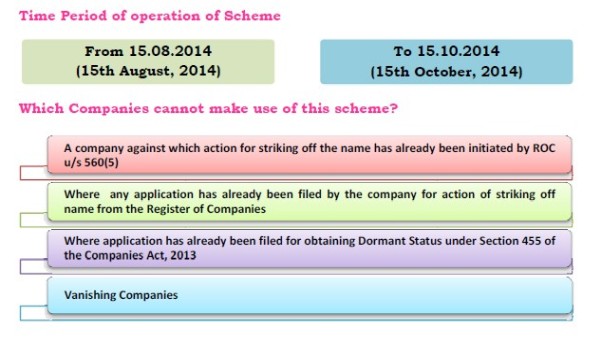

APPLICABILITY OF THE SCHEME

Which Companies can make use of this scheme?

SCHEME FOR INACTIVE COMPANIES

The defaulting inactive companies, while filing due documents under CLSS, 2014 can, simultaneously, either:

a) Apply to get themselves declared as Dormant Company under Section 455 of the Companies Act, 2013 by filing e-form MSC-1 at 25% of the actual filing fee for the said form; or

b) Apply for striking off the name of the company by filing e-form FTE at 25% of the actual filing fee for the said form

ADVANTAGES OF COMPANY LAW SETTLEMENT SCHEME, 2014

1. Charging of additional fee of only 25% of actual additional fee payable for filing belated annual filing documents which are due for filing on or before 30.06.2014.

(75% of additional filing fees is waived by the Government)

2. Availing the benefit of the Scheme will prevent companies from prosecution and other legal action.

After granting the immunity under CLSS, 2014, the Registrar concerned shall withdraw the prosecution(s) pending, if any, before the concerned Court(s).

3. Opportunity for directors to come out of the disqualification prescribed under Section 164(2)(a)

A person who is or has been a director of a company (both public and private) which has not filed financial statements or annual returns for any continuous period of 3 financial years is disqualified to be appointed as director of any company.

In case of defaulting companies which avail of this Scheme and file all belated documents, the provisions of clause (a) of sub section (2) of Section 164 of the Companies Act, 2013 shall apply only for the prospective defaults, if any, by such companies.

4. One time opportunity to the defaulting companies to enable them to make their default good by filing belated documents

5. Opportunity to the inactive companies, for getting their names struck off from the Register of Companies under the Fast Track Exit Scheme (which scheme is already in operation) or applying to get themselves declared as Dormant Company by paying only 25% of the actual filing fees for form FTE/MSC-1.

(75% of filing fees for forms FTE & MSC-1 is waived by the Government for companies which file pending documents under CLSS, 2014)

STEPS FOR OBTAINING IMMUNITY FROM PROSECUTION

1. Complete all the pending filings which are desired and permitted to be filed under CLSS, 2014.

2. Before filing an application for issue of immunity certificate, such companies has to withdraw appeal filed, if any, before the competent court against any notice issued or compliant filed for violation of the provisions under the Companies Act, 1956/2013 and should furnish the proof for such withdrawal.

This Immunity shall not be applicable in the matter of any appeal pending before the court of law and in case of management disputes of the company pending before the court of law or tribunal.

3. Application for seeking immunity has to be made electronically, after the belated document(s) filed by the company are taken on file, or on record or approved by the Registrar of Companies, in e-form CLSS- 2014 which will be available from 01st September, 2014. This form carries no filing fees.

4. No application seeking immunity shall be made after the expiry of three months from the date of closure of the Scheme.

5. Registrar of companies on being satisfied with the documents filed shall grant the immunity certificate in respect of the documents filed under this scheme.

6. After granting the immunity, the Registrar concerned shall withdraw the prosecution(s) pending if any before the concerned Court(s)

CONSEQUENCES IN CASE THE SCHEME IS NOT UTILISED

At the conclusion of the scheme, the Registrar shall take necessary action under the Companies Act, 1956/2013 against the companies who have not availed this Scheme and are in default in filing these documents in a timely manner.

Directors of such companies will be disqualified to be appointed or continue their appointment in any company as director (falling under section 164(2)(a)).

The Company and all its officers in default will be exposed to hefty penalties prescribed under the Companies Act, 2013

Registrar has power to mark such companies as “Dormant” thereby prohibiting any e-filing of documents on MCA portal or even to strike off the name of such companies from the Register of Members.

Any pending annual filing done after the conclusion of the scheme will incur full additional fees of upto Rs. 7200 per form besides penalties which are given below.

PENALTIES PRESCRIBED UNDER THE COMPANIES ACT, 2013 WITH RESPECT TO NON-COMPLIANCE WITH PROVISIONS RELATING TO ANNUAL FILING

1. Non - Holding of AGM (Section 166 of Companies Act, 1956/Section 96 of Companies Act, 2013)

For Company and every Director individually - Fine which may extend to Rs. 10,000, and where the contravention is continuing one, with a further fine which may extend to Rs. 1000/- for every day after the first during which the contravention continues.

2. Non placement of financial statements in AGM (Section 210 of Companies Act, 1956/Section 129 of Companies Act, 2013)

All the directors shall be punishable with imprisonment for a term which may extend to 1 year or with fine which shall not be less than Rs. 50,000/- but which may extend to Rs. 5,00,000/-, or with both.

3. Non filing of copy of Balance Sheet and Profit & Loss with ROC (Section 220 of Companies Act, 1956/Section 137 of Companies Act, 2013)

The company shall be punishable with fine of Rs. 1,000/- for every day during which the failure continues but which shall not be more than Rs. 10,00,000/- and all the directors of the company, shall be punishable with imprisonment for a term which may extend to 6 months or with fine which shall not be less than Rs. 1,00,000/- but which may extend to Rs. 5,00,000/-, or with both.

4. Non filing of copy of Annual Return with ROC (Section 159 of Companies Act, 1956/Section 92 of Companies Act, 2013)

The company shall be punishable with fine which shall not be less than Rs. 50,000/- but which may extend to Rs. 5,00,000/- and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to 6 months or with fine which shall not be less than Rs. 50,000/- but which may extend to Rs. 5,00,000/-, or with both.

5. Non-compliance with provisions dealing with appointment of auditor and filing intimation of appointment with ROC (Section 224 of Companies Act, 1956/Section 139-146 of Companies Act, 2013)

The company shall be punishable with fine which shall not be less than Rs. 25,000/- but which may extend to Rs. 5,00,000/- and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to 1 year or with fine which shall not be less than Rs. 10,000/- but which may extend to Rs. 1,00,000/-, or with both.

NOTE ON ANNUAL FILING REQUIREMENTS

1. Every company registered under the Act must hold an ANNUAL GENERAL MEETING (AGM) every year.

2. AGM has to be held within 15 months of previous AGM or 6 months from closure of financial statements whichever is earlier.

3. Within 30 days of holding the AGM, copy of Balance Sheet and Statement of Profit & Loss needs to be filed with the ROC in e-form 23AC and ACA, digitally signed by any one director of the company and certified by a professional – CA/CS/CWA.

4. Within 60 days of holding the AGM or due date by which AGM should have been held, Annual Return/Schedule V (drawn up to the date of AGM) needs to be filed with the ROC in e-form 20B, digitally signed by any one director of the company and certified by a professional – CA/CS/CWA.

5. Companies having paid up capital in excess of Rs. 10,00,000/- need to obtain a Compliance Certificate from a Practising Company Secretary and a copy of the same needs to be filed with the ROC within 30 days of AGM in e-form 66, digitally signed by any one director of the company.

6. Within 7 days of the appointment of auditor in the AGM (15 days as per Companies Act, 2013), form ADT-1 for intimation of appointment of auditor, annexed to e-form GNL-2, needs to be filed with the ROC, digitally signed by any one director of the company.

7. APPLICABILITY OF XBRL FILING

Those Companies which fall in any of the below mentioned categories need to file their balance sheet and P&L in XBRL mode compulsorily within due date (30 days of AGM):

· Paid up capital in excess of Rs. 5,00,00,000/- (Rupees Five Crores)

· Turnover in Excess of Rs. 100,00,00,000/- (Rupees Hundred Crores)

· All listed companies and their Indian Subsidiaries

· All companies to whom XBRL was applicable for the FY ended 31.03.2011 irrespective of whether those companies have filed or not and notwithstanding of any change in above Paid up capital /Turnover /Status in the subject FY 2012 - 2013.

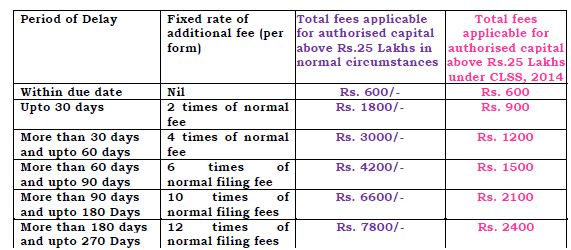

8. Additional Fee applicable in case of delay in filing

Wrap up

The Scheme has come at the right time to relieve corporate from some of the pressures they are facing in their management and administration. This is a golden opportunity for companies to complete all their pending filings with minimal filing fees and also to protect themselves from being exposed to prosecution and disqualification of directors.

Post your reflections to:

S. DHANAPAL

FCS, B.Com, B.A.B.L.

CAclubindia

CAclubindia