Hope, some taxpayers may surprised to see the new look of ITR-V, especially when they haven't find their income details in ITR-V. But, don't worry, Income Tax Department has made a change in ITR-V for FY 2019-20 / AY 2020-21 from this year. After submission of ITR, you will get ITR-V and after verification you will get Acknowledgement.

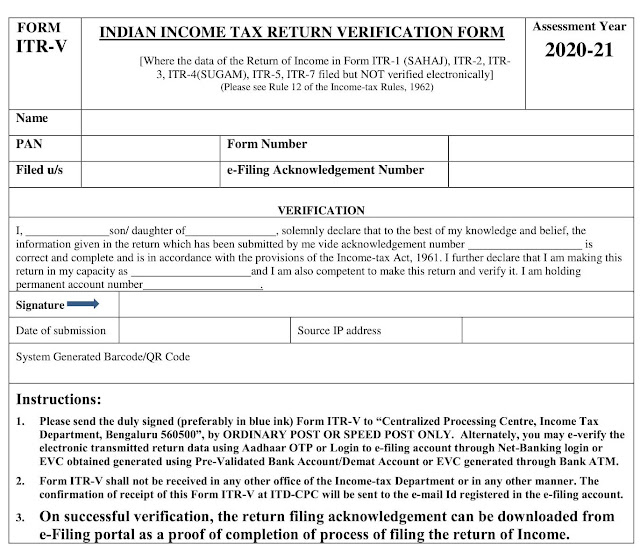

After submission of Income Tax Return, you will get ITR-V 'Indian Income Tax Return Verification Form'. This verification form doesn't contains any income details of assesse and it will not be treated as a useful document for any financial purpose.

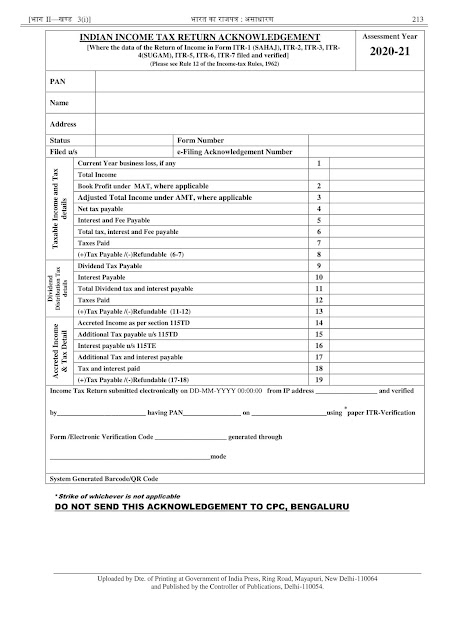

You need to e-verify your Income Tax return or send the signed copy (sign with blue ink) of ITR V to CPC Bengaluru. After successful verification you will get 'Indian Income Tax Return Acknowledgement' which is the proof of your verified submission of Income Tax Return and it will be treated as a useful document.

So, as soon as your ITR verification process complete, you will get ITR Acknowledgement. In case of sending signed copy of ITR V to CPC Bengaluru via postal, it takes some days to complete the verification process and generate ITR Acknowledgement. But, in case of e-verification, you will get ITR Acknowledgement instantly.

You may e-verify your ITR with any of the following options:

- Aadhaar OTP (Mobile no should be registered with Aadhaar)

- Net banking

- Prevalidated Bank A/c (Mobile no. must match the mobile linked to this Bank a/c)

- Prevalidated Demat A/c (Mobile no. must match the mobile linked to this Demat a/c)

CAclubindia

CAclubindia