General Rule:

The income of a previous year is assessed in the assessment year following the previous year.

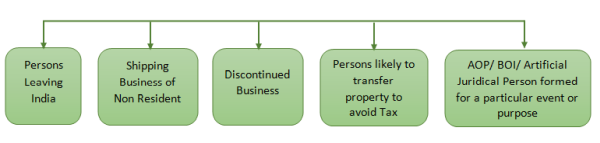

Exceptions to this rule:

Cases where the income of a previous year is assessed in the previous year itself:-

The income of an assessee for a previous year is charged to income-tax in the assessment year following the previous year. For instance, the income of the previous year 2020-21 is assessed during 2021-22. Therefore, 2021-22 is the assessment year for assessment of income of the previous year 2020-21.

However, in a few cases, this rule does not apply and the income is taxed in the previous year in which it is earned. These exceptions have been made to protect the interests of revenue:-

1) Persons Leaving India [Sec.174 of I.T Act]:

Where it appears to the A.O (Assessing Officer) that any individual may leave India during the current assessment year or shortly after its expiry and he has no present intention of returning to India, the total income of such individual for the period from the expiry of the respective previous year up to the probable date of his departure from India is chargeable to tax in that assessment year.

Ex:-Mr. Aarya is leaving India for UAE on 10.09.2020 and it appears to the A.O that he has no intention to return. Before leaving India, Mr. Aarya will be required to pay income tax on the income earned during the P.Y. 2019-20 as well as the total income earned during the period 1.4.2020 to 10.09.2020.

2) Shipping business of Non-Resident [Sec.172 of I.T Act]:

Where a ship, belonging to or chartered by a non-resident, carries passengers, livestock, mail or goods shipped at a port in India, the ship is allowed to leave the port only when the tax has been paid or satisfactory arrangement has been made for payment thereof @7.5% of the freight paid or payable to the owner or the charterer or to any person on his behalf, whether in India or outside India on account of such carriage is deemed to be his income which is charged to tax in the same year in which it is earned.

Ex:- Mr. Abraham of England engaged in the business of shipping operation carrying goods. His ship Titanic is effectively engaged in carrying goods from Visakhapatnam Port to London Port and from this operation, he received Rs.40 Lakhs as his Income.

By applying the provisions of Sec.172, his deemed income under PGBP head will be 7.5% of 40 Lakhs i.e. Rs.3 Lakh. Now Mr. Abraham has to make a tax payment to the credit of Central Govt on his income of Rs.3 lakh before he is allowed to leave India.

3) Discontinued business [Sec.176 of I.T Act]:

Where any business or profession is discontinued in any assessment year, the income of the period from the expiry of the previous year up to the date of such discontinuance may, at the discretion of the Assessing Officer, be charged to tax in that assessment year.

Ex:-Mr. Ganapathy was running a retail business. He discontinued his business on 25-09-2020. In this case, the Assessing Officer has two options:-

- • To tax the income of the period 01-04-2020 to 25-09-2020 in the assessment year 2020-21, i.e., the assessment year in which business is discontinued.

- • To tax the income of the period 01-04-2020 to 25-09-2020 in the assessment year 2021-22.

4) Persons likely to transfer property to avoid tax [Sec.175 of I.T Act]:

During the current assessment year, if it appears to the Assessing Officer that a person is likely to charge, sell, transfer, dispose of, or otherwise part with any of his assets to avoid payment of any liability under this Act, the total income of such person for the period from the expiry of the previous year to the date, when the Assessing Officer commences proceedings under this section is chargeable to tax in that assessment year.

Ex:-In October 2020, while making the assessment of income of Mr. Sasikumar for the assessment year 2020-21, i.e., the previous year 2019-20, the Assessing Officer came to know that Mr. Sasikumar is transferring his building with an intention to avoid payment of Income-tax liability. Considering the intention of Mr. Sasikumar, the Assessing Officer issued a notice (in October 2020) to Mr. Sasikumar to furnish his return of income for the period April 2020 to October 2020.

In the above case, it can be observed that income of the period April 2020 to October 2020 is covered in the previous year 2020-21, i.e., the assessment year 2021-22 and it can be charged to tax in the assessment year 2021-22 only. However, by invoking the provisions of section 175, the Assessing Officer can assess the income for the period of April 2020 to November 2020 in the assessment year 2020-21 itself.

5) AOP/ BOI/ Artificial Juridical Person formed for a particular event or purpose [Sec.174A of I.T Act]:

If an AOP/ BOI etc. is formed or established for a particular event or purpose and the Assessing Officer apprehends that the AOP/ BOI is likely to be dissolved in the same year or in the next year, he can make an assessment of the income up to the date of dissolution as income of the relevant assessment year.

Note:

It should be noted that in cases given in 1, 2, 4, and 5 it is mandatory to tax the income in the previous year itself. However, in case 3, (i.e., the income of discontinued business/profession, income can be charged to tax in the previous year itself or in the assessment year (at the discretion of the A.O).

CAclubindia

CAclubindia