Income Tax Articles

Understanding the Reinvestment Requirement u/s 10AA

Ishita Ramani 14 September 2024 at 08:34Section 10AA of the Income Tax Act, of 1961, provides big tax blessings for corporations running inside Special Economic Zones (SEZs). The provision ambitions to reinforce export-orientated companies with the aid of providing giant tax exemptions on income derived from export sports.

Reporting of TDS or TCS Details in Tax Audit Report

Mitali 11 September 2024 at 15:07The tax auditor must report specific details related to TDS compliance under four key sub-clauses. Check out what are those.

Penalties and Consequences of Not Filing Nil TDS Return on Time

Ishita Ramani 11 September 2024 at 08:36To maintain compliance with tax laws and prevent fines, filing this return on time is essential. We shall discuss the penalties that arise from filing a Nil TDS return after the deadline in this article.

Taxability on Gift of Capital asset by a Company

Namita Agarwal 10 September 2024 at 08:411. Sec. 47 on transfers not regarded as transfers states as follows: (iii) any transfer of a capital asset by an individual or a Hindu undivided family, under a gift or will or an irrevocable trust;

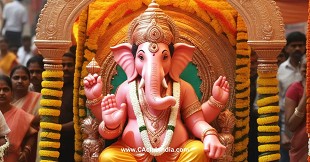

Understanding Income Tax and GST for Mandal's and Religious Temples!

CA Umesh Sharma 09 September 2024 at 16:33While the focus is on devotion and charity, religious and charitable entities such as Ganpati mandals and temples should also be mindful of their tax obligations.

Good News for Taxpayers: CBDT Launches Online Mechanism to Resolve Income Tax Disputes

Sachin 07 September 2024 at 08:37Taxpayers, rejoice! The Central Board of Direct Taxes (CBDT) has unveiled a game-changing initiative that will bring much-needed relief to millions of taxpayers.

Tax Trends Among India's Top Celebrities: Shah Rukh Khan Leads, Akshay Kumar Absent from 2024 List

Sachin 06 September 2024 at 08:42To make the information more appealing to Chartered Accountants (CAs) and finance professionals, the focus should be on tax trends, financial insights and the significance of high tax payments by celebrities. Here's how the key points can be tailored to engage them

Disallowance of payment to MSME - Beyond the due date

J. D. Shah Associates 06 September 2024 at 08:4243B(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), shall be allowed

Legal Provisions on Reconstitution of a firm and its Tax Impact

Namita Agarwal 05 September 2024 at 08:38Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 54, 54B, 54D, 54E, 54EA, 54EB, 54F, 54G and 54H be chargeable to income-tax under the head "Capital gains"

Beware of Cash Transactions under Income Tax

J. D. Shah Associates 05 September 2024 at 08:33Cash transactions have long been a subject of scrutiny by the Indian Income Tax Department due to their potential for tax evasion and unaccounted money circulation. It is important for taxpayers to know these limits in order to make sure their expenditure does not get disallowed under the Income Tax Act

Popular Articles

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Revised Return Due Date Extension

- Tax Deduction Rules for Employee Contributions From April 2026

- Simplified GST Changes in Budget 2026: Finance Bill 2026 CGST and IGST Amendments

- 26 Important Income Tax Proposals in Union Budget 2026

- Comprehensive Guide to Statutory, Tax & Regulatory Compliances for Hotels

- Section 144C Time-Limit Finally Clarified: No More Litigation on Draft vs Final Assessment Deadlines

- Foreign Assets Disclosure Gets A Fresh Window Under Finance Bill, 2026: Part I

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia