1. Definition of Audit under GST

Audit under GST means an examination of returns, records, and other documents maintained or furnished by the registered person under the GST Act. GST Audit is carried out to verify the correctness of the turnover, taxes paid, ITC refund claimed and ITC availed and to assess the compliance with the provision of the GST Act.

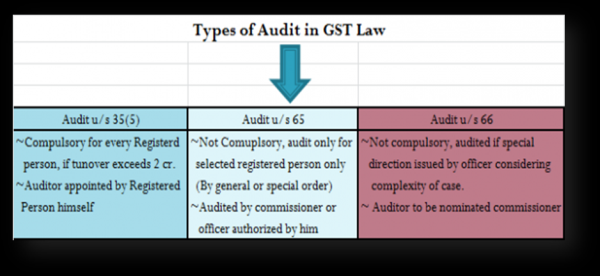

2. Types of Audit under GST

There are three types of Audit under GST:-

- Audit by a Chartered Accountant or a Cost Accountant (Section 35(5), read with section 44(2), read with rule 80(3) of CGST Act);

- Audit by Department (Section 65 of CGST Act);

- Special Audit (section 66 of CGST Act).

Let us understand the types of Audit in detail:-

Audit by a Chartered Accountant or a Cost Accountant

Any registered taxable person whose annual *aggregate turnover exceeds 2 Crore INR during a financial year needs to get their accounts audited. The eligible taxpayer can get their records and account audited either by a Chartered Accountant or a Cost Accountant.

* Aggregate Turnover under GST is calculated as follows:

Value of all taxable supplies whether inter-state or intra-state + exempt supplies + supplies made outside India (export supply ) but excludes the value of inward supplies on which tax is payable by a person on reverse charge basis.

Penalty: - Where the Registered Person fails to comply with the provision mentioned above there is no separate penalty mentioned under the provision of the CGST Act, 2017. However where no penalty is mentioned and the registered person fails to comply with any provision of CGST Act, 2017 a general penalty as per section 125 of the CGST Act, 2017 may be levied which may extend to ₹ 25,000 for each such failure. Hence if a Registered Person fails to comply with the above provision i.e. fails to get its books of accounts audited by CA or CMA, he shall be liable to a penalty up to ₹ 25,000 as per provision of section 125 of CSGT Act, 2017.

Audit by Department

Reason for Conducting audit by Department

The Proper Officer may take recourse to the audit of the registered person as per section 65 of CGST Act, 2017 at the stage of scrutiny if:

- No satisfactory explanation is furnished by the registered person; or

- After accepting the discrepancy it fails to take corrective action in his return for the month in which discrepancy is accepted.

Who can conduct Audit?

The Commissioner or any officer authorized by him may undertake the audit of any registered person at the place of business of the registered person or in their office for a financial year or multiples thereof. Such authorization is given through the issue of General or Special order by the commissioner.

Issuance of Notice of Audit

The Proper officer (PO) shall issue a notice in form GST ADT-01 within, not less than 15 WORKING DAYS, prior to the conduct of the audit.

Time Limit for Completion of GST Audit by Department

The audit is required to be completed by the proper officer within 3 MONTHS which may be extended by the commissioner for a further period of 6 MONTHS from the date of commencement of the audit. The term COMMENCEMENT OF AUDIT means the later of the following:

- The date on which the records/accounts are made available for the conduct of the audit; or

- The actual institution of audit at the place of business of the taxpayers;

Manner Of Conduct Of Audit

The Proper Officer shall with the assistance of the team of officers and officials accompanying him verify the following while conducting the audit:

- Documents on the basis of which books of accounts are maintained & returns & statement are furnished;

- The correctness of the turnover, exemption & deduction claimed;

- Rate of tax applied in respect of each supply of goods or service or both;

- ITC availed & utilized;

- Refund claimed & other relevant issues; & record the observation & findings in audit notes.

Conclusion & Finalisation of Audit

The proper officer may inform the registered person of the discrepancies noticed, if any, as observed in the audit and the said person may file his reply and the proper officer shall finalize the findings of the audit after due consideration of the reply furnished. On the conclusion of the audit, the proper officer shall inform within 30 days about the findings as well as the reasons for the findings of the audit to the registered person in FORM GST ADT-02.

Special Audit

Reason for Special Audit

If at any stage of scrutiny, inquiry or other proceedings before the Commissioner,/span> ANY OFFICER NOT BELOW THE RANK OF ASSISTANT COMMISSIONER, having regard to the nature and complexity of the case and in the interest of revenue is of the opinion that:

- The value has not been correctly declared; or

- The input tax credit (ITC) availed is not within the normal limits,

He may, with the prior approval of the commissioner, issue direction in form GST ADT -03 to such registered person in writing to get his accounts examined and audited by a Chartered Accountant (CA) or Cost Accountant (CMA) as may be nominated by the commissioner.

Note: - It is important to note that Special Audit may be conducted during or at any stage of scrutiny, inquiry or other proceedings before the Commissioner, and not after or before the scrutiny, inquiry or other proceedings before the Commissioner.

Time Limit for Completion of Audit

The CA or CMA shall within 90 days, submit a report of such audit duly certified by him to the Assistant Commissioner mentioning therein such other particulars as may be specified. The period of completion of audit can be further extended by a further period of 90 days on an application done by the CA or CMA or the registered person and for any material & sufficient reason.

The expense of Audit & Auditors Remuneration

The expense of conducting an audit as well as the remuneration of the auditor shall be determined & paid by the Commissioner and such a determination shall be final.

Conclusion & Finalization of Audit

The Registered Person shall be given an opportunity of being heard in respect of any material gathered on the basis of special audit which is proposed to be used in any proceeding against him. On the conclusion of the special audit, the registered person shall be informed of the findings of the special audit in form GST ADT-04.

3. Summary of Audit under GST

Disclaimer: This article is prepared for an easy understanding of Audit under GST and is purely for academic purposes. No action should be taken by anyone on the basis of the content of this article without consulting the Author. The Author accepts no responsibility for the correctness or otherwise of the content of this article. For any doubts or clarification the reader should consult the Author.

CAclubindia

CAclubindia