ANALYSIS OF SERVICE TAX RATE INCREASE FROM 12.36%TO 14% (SUBSUMING EC AND SHEC) EFFECTIVE FROM 01.06.2015

The Hon’ble President has given assent to the Finance Bill, 2015 on May 14, 2015. Post that the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified an increase in the rate of Service tax from 12.36% to flat 14% (Subsuming Education Cess and Secondary & Higher Secondary Education Cess) to be effective from June 1, 2015.

Service Tax Rate Earlier 12.36% New 14.00% (all inclusive)

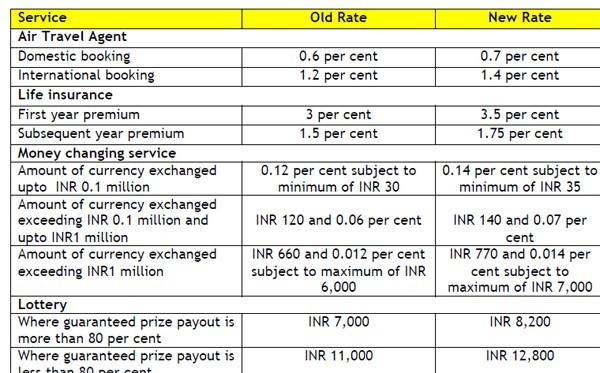

In respect of certain services like money changing service, service provided by air travel agent, insurance service and service provided by lottery distributor and selling agent the service provider has been allowed to pay service tax at an alternative rate subject to the conditions as prescribed under rule 6 (7), 6(7A), 6(7B) and 6(7C) of the Service Tax Rules, 1994. Consequent to the upward revision in Service Tax rate, the said alternative rates shall also be revised proportionately. The new rates are summarized in the table below:

ANALYSIS OF POINT OF TAXATION WHEN THERE IS CHANGE IN EFFECTIVE RATE OF TAX

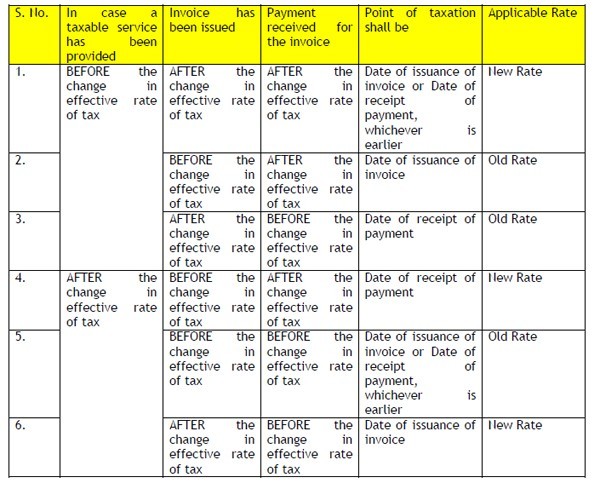

Point of taxation involving change in effective rate of tax is governed by Rule 4 of the POT Rules, which provides for determination of Point of taxation when there is change in effective rate of tax as mentioned in the table below:

SWACHH BHARAT CESS

Swachh Bharat Cess is not notified till date, it will be notified separately at a later date. Only an enabling provision is being incorporated in the Finance Bill, 2015 to empower the Central Government to impose a Swachh Bharat Cess on all or any of the taxable services at a rate of 2% on the value of such taxable services. The cess shall be levied from the date to be notified after the enactment of the Finance Bill 2015.

Hence, an illustrative clarification to this effect is much warranted from the Board before the new rate of Service becoming effective from June 1, 2015.

BALANCE OF EDUCATION CESS AND SECONDARY AND HIGHER EDUCATION CESS AS ON 01- 06-2015

The question arises what will happen to the balance lying in ‘Education Cess’ and ‘Secondary and Higher Education Cess’ as on June 1, 2015. Will it be allowed to be adjusted with Service tax liability as this is being denied in terms of Rule 3(7)(b) of the Cenvat Credit Rules, 2004 (“the Credit Rules”).

The same issue arose in Excise when the rate of duty was changed from 12.36% to 12.50% subsuming the Education Cess and Secondary and Higher Education cess on 01-03-2015. Recently, the CBEC has issued a Notification No. 12/2015-Central Excise (N.T.) dated 30- 04-2015 in this regard in case of Central Excise.

It is thus expected CBEC should come with a clarificatory circular on the above mentioned issue in case of Service Tax also.

By CA. Chitresh Gupta,

B.Com(H), FCA, IFRS (Certified), IDT (Certified)

Author of Book “An Insight Into Goods & Service Tax”

Managing Partner M/s Chitresh Gupta & Associates

CAclubindia

CAclubindia