CAclubindia Articles

When Your Identity Becomes A Commodity: Why The DPDP Act Matters More Than Ever

CA Amrita Chattopadhyay 13 March 2026 at 09:58A fake GST registration racket exposed by The Times of India reveals how misuse of personal data led to Rs 734.95 crore in fake invoices. The case highlights the urgent need for stronger data protection and the significance of India's Digital Personal Data Protection (DPDP) Act.

In The Age Of Smartphones, Digital Discipline Is The New Professional Virtue

Raj JaggiExplore how smartphones and social media shape modern professionals' attention, productivity, and learning. Discover why digital discipline, deep reading, and focused thinking are essential for maintaining balance, creativity and long-term professional excellence in the digital age.

Fast-Track GST Registration and Its Hidden Compliance Limits

efiletaxUnderstand GST Rule 14A fast-track registration effective 1 Nov 2025. Learn the Rs 2.5 lakh B2B tax cap, eligibility, risks and who should or should not opt in...

Process of Removal of Auditor

CS Divesh Goyal 13 March 2026 at 09:08Learn the procedure for removal of a statutory auditor under Section 140(1) of the Companies Act, 2013, including special resolution, Regional Director approval, filing of ADT-2, MGT-14, and INC-28, timelines and key compliance requirements.

The Human Compass in an Automated World: Why Ethics Matter More Than Ever

Tanishka goel 13 March 2026 at 09:08As automation, AI, and data analytics transform the accounting profession, ethical judgment becomes more critical than ever. Explore why technology can enhance efficiency but can never replace the moral compass and professional integrity that define the future of Chartered Accountants.

Process To Active The Dormant Company

CS Divesh Goyal 12 March 2026 at 10:26Conversion of a Dormant Company into an Active Company under Section 455 of the Companies Act, 2013. Learn the rules, forms (MSC-3, MSC-4, MSC-5), step-by-step process and compliance requirements to reactivate a dormant company.

Rule 42 In Practice: Illustrative Lists Of Common Inputs And Input Services For ITC Reversal

Raj JaggiUnderstand Rule 42 of the CGST Rules and the real compliance challenge of identifying Common ITC. Learn practical examples of inputs and input services requiring proportionate ITC reversal, exclusions and common mistakes professionals make in GST compliance.

CA Fresher Salary Negotiation in Big Four: What Most Students Don't Do

CA Tushar Makkar 12 March 2026 at 09:04CA fresher joining Deloitte, EY, PwC or KPMG? Learn smart salary negotiation strategies, Big Four fresher salary ranges, CTC structure insights and common mistakes to avoid before accepting your offer.

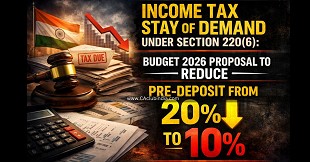

Income Tax Stay of Demand under Section 220(6): Budget 2026 Proposal to Reduce Pre-Deposit from 20% to 10%

CA Varun GuptaBudget 2026 proposes reducing the upfront payment for stay of income-tax demand from 20% to 10% of core tax demand. Learn the legal position, practical implications, and how taxpayers can seek relief during pending appeals.

Pay Zero Income Tax on Rs.24 Lakh: Tax Secret For Freelancers

Yogita 11 March 2026 at 13:18Freelancers in India can use presumptive taxation u/s 44ADA to simplify taxes and potentially pay zero tax on Rs.24 Lakh revenue.

Popular Articles

- Fixed Deposit Limits from 2026 along with New IT Rules

- UPI Transaction Limits Starting From April 2026

- Bank Transaction Limits to Watch from April 2026

- Diksha Goyal, All India Topper (AIR-1), CA Final January 2026 in an exclusive interaction with CAclubindia

- ITR-U After Reassessment Notice? Budget 2026 Proposal Explained with Tax Cost & Penalty Protection

- Freezing of Personal Assets of Directors for GST Liability of the Company

- The Rs 30 Thali Controversy: Perquisite or Taxable Supply Under GST

- Cash Transaction Limits Under The Income Tax Act 2025: With Related Sections and Penalties

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani

CAclubindia

CAclubindia