Income Tax News

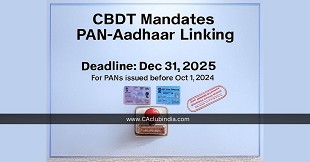

CBDT Mandates PAN-Aadhaar Linking by Dec 31, 2025 for Pre-October 2024 Applicants

05 April 2025 at 08:50CBDT has issued a fresh notification mandating that individuals who were allotted a PAN based on their Aadhaar Enrolment ID before October 1, 2024, must update their Aadhaar number with the Income Tax Department by December 31, 2025.

Income Tax Department Enables Rectification Applications for AY 2023-24 via E-Filing Portal

04 April 2025 at 08:52In a significant move to streamline the ITR rectification process, the Income Tax Department has enabled taxpayers to file rectification applications before an AO for up to AY 2023-24 (Financial Year 2022-23) through the e-filing portal.

No Cut in Capital Expenditure, Claims FM Nirmala Sitharaman

04 April 2025 at 08:44On Tuesday, Finance Minister Nirmala Sitharaman firmly responded to former Finance Minister P Chidambaram's criticism regarding capital expenditure (capex), stating that there has been no reduction in the central government's capex.

CBDT Recovers Rs 92,400 Crore in Outstanding Tax for FY 2024-25

03 April 2025 at 08:48CBDT has successfully recovered ₹92,400 crore in outstanding tax liabilities in the ongoing financial year (2024-25) up to March 15, according to sources familiar with the matter.

CBDT Signs Record 174 Advance Pricing Agreements in FY 2024-25

01 April 2025 at 08:45The Central Board of Direct Taxes (CBDT) entered into a record 174 Advance Pricing Agreements (APAs) with Indian taxpayers in FY 2024-25.

CBI Books Five Hyderabad-Based Income Tax Officials, Chartered Accountant for Alleged Extortion

01 April 2025 at 08:45CBI has registered a case against five officials of the Income Tax department and a CA based in Hyderabad for allegedly extorting money from taxpayers in exchange for favorable treatment in their tax matters.

Finance Act 2025 Notified: Key Tax Reforms and Compliance Enhancements

31 March 2025 at 08:42The Government of India has officially notified the Finance Act 2025, following its passage in both houses of Parliament and the Presidential assent on March 29, 2025.

Income Tax Notices Sent to High-Rent Tenants for TDS Non-Compliance

29 March 2025 at 09:00The Income Tax Department has issued notices to taxpayers who have been paying monthly rent of Rs 50,000 or more but failed to deduct Tax Deducted at Source (TDS) before remitting the amount to their landlords, a tax expert revealed.

CBDT Amends Tax Audit Report (Form 3CD) with Key Changes Effective 1st April 2025

29 March 2025 at 08:56CBDT has notified the Income-tax (Eighth Amendment) Rules, 2025 via Notification No. 23/2025, introducing significant modifications to Form 3CD, the tax audit report required under Section 44AB of the Income-tax Act, 1961

CBDT Allows Waiver of Interest on Delayed TDS/TCS Payments Due to Technical Glitches

29 March 2025 at 08:53The Central Board of Direct Taxes (CBDT) has issued Circular No. 05/2025, providing relief to taxpayers facing interest levies under Section 201(1A)(ii) and Section 206C(7) of the Income-tax Act, 1961.

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia