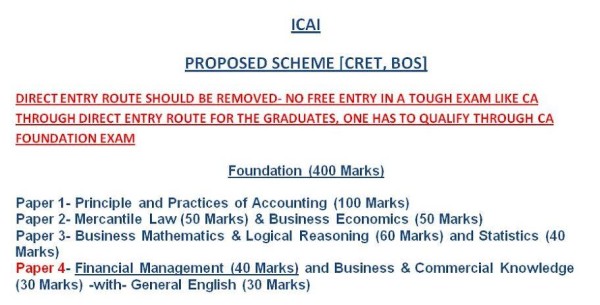

ICAI

PROPOSED SCHEME [CRET, BOS]

DIRECT ENTRY ROUTE SHOULD BE REMOVED- NO FREE ENTRY IN A TOUGH EXAM LIKE CA THROUGH DIRECT ENTRY ROUTE FOR THE GRADUATES, ONE HAS TO QUALIFY THROUGH CA FOUNDATION EXAM

Forward at cret @ icai.in, prem @ icai.in, vandana @ icai.in, psdos @ icai.in, bmurali @ icai.in,

nilesh @ kkc.in,devarajareddy @ yahoo.com,kdhiraj123 @ yahoo.co.in,vijaykapur @ icai.in,icaiho @ icai.in,

babucentralcouncil @ gmail.com, babu.kallivayalil @ gmail.com

All the concerned Members, CA Students kindly Forward this Curriculum and Training to the Mentioned Mail IDs before 31st May, 2016.

FOUNDATION (400 Marks)

Paper 1- Principle and Practices of Accounting (100 Marks)

Paper 2- Mercantile Law (50 Marks) & Business Economics (50 Marks)

Paper 3- Business Mathematics & Logical Reasoning (60 Marks) and Statistics (40 Marks)

Paper 4- Financial Management (40 Marks) and Business & Commercial Knowledge (30 Marks) -with- General English (30 Marks)

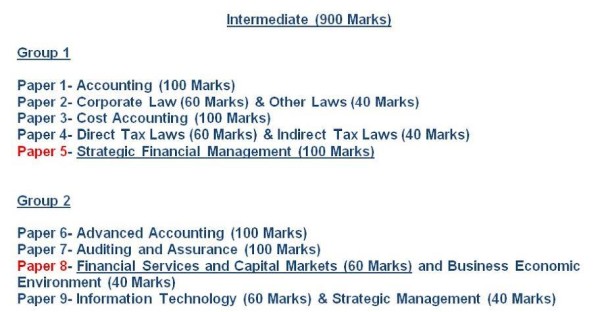

INTERMEDIATE (900 Marks)

Group 1

Paper 1- Accounting (100 Marks)

Paper 2- Corporate Law (60 Marks) & Other Laws (40 Marks)

Paper 3- Cost Accounting (100 Marks)

Paper 4- Direct Tax Laws (60 Marks) & Indirect Tax Laws (40 Marks)

Paper 5- Strategic Financial Management (100 Marks)

Group 2

Paper 6- Advanced Accounting (100 Marks)

Paper 7- Auditing and Assurance (100 Marks)

Paper 8- Financial Services and Capital Markets (60 Marks) and Business Economic Environment (40 Marks)

Paper 9- Information Technology (60 Marks) & Strategic Management (40 Marks)

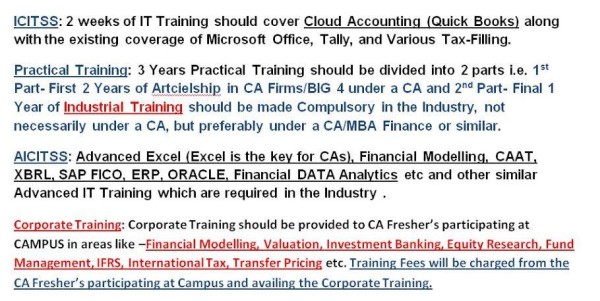

ICITSS: 2 weeks of IT Training should cover Cloud Accounting (Quick Books) along with the existing coverage of Microsoft Office, Tally, and Various Tax-Filling.

Practical Training: 3 Years Practical Training should be divided into 2 parts i.e. 1st Part- First 2 Years of Artcielship in CA Firms/BIG 4 under a CA and 2nd Part- Final 1 Year of Industrial Training should be made Compulsory in the Industry, not necessarily under a CA, but preferably under a CA/MBA Finance or similar.

AICITSS: Advanced Excel (Excel is the key for CAs), Financial Modelling, CAAT, XBRL, SAP FICO, ERP, ORACLE, Financial DATA Analytics etc and other similar Advanced IT Training which are required in the Industry.

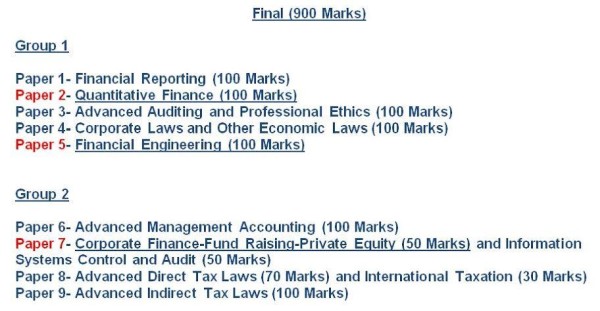

FINAL (900 Marks)

Group 1

Paper 1- Financial Reporting (100 Marks)

Paper 2- Quantitative Finance (100 Marks)

Paper 3- Advanced Auditing and Professional Ethics (100 Marks)

Paper 4- Corporate Laws and Other Economic Laws (100 Marks)

Paper 5- Financial Engineering (100 Marks)

Group 2

Paper 6- Advanced Management Accounting (100 Marks)

Paper 7- Corporate Finance-Fund Raising-Private Equity (50 Marks) and Information Systems Control and Audit (50 Marks)

Paper 8- Advanced Direct Tax Laws (70 Marks) and International Taxation (30 Marks)

Paper 9- Advanced Indirect Tax Laws (100 Marks)

Corporate Training: Corporate Training should be provided to CA Fresher’s participating at CAMPUS in areas like –Financial Modelling, Valuation, Investment Banking, Equity Research, Fund Management, IFRS, International Tax, Transfer Pricing etc. Training Fees will be charged from the CA Fresher’s participating at Campus and availing the Corporate Training.

Reasoning

FOUNDATION

Financial Management at Intermediate in the Existing/Proposed Scheme, is Basic Fundamentals, not as per Intermediate Standards, is only of Foundation Standards. Business & Commercial Knowledge (30 Marks, i.e. enough) Mercantile Law (50 Marks) and Business Economics (50 Marks) are sufficient.

- Business Economics (50 Marks) should have the coverage of Advanced Micro and Macro Economics and with quantitative sums.

Intermediate

Group 1- Additional Paper on Finance- Which will be in Group 1 as

Paper 5: Strategic Financial Management (100 Marks) – From Final Group 1 Level, as Strategic Financial Management at Final Level, is only of Intermediate Level, not sufficient to create Finance Jobs, it’s widely considered as CFA Level 1 Finance.

Group 2

Paper 7: Part I: Financial Services and Capital Markets (60 Marks) - From Final Group 2 Level will be merged with Business Economic Environment (40 Marks) and this paper will be the 8th Paper in Intermediate Group 2. [Since, 5th will be the New Additional Paper on Finance thus existing papers from 5th to 8th will be 6th to 9th in that order]

- Business Economic Environment (40 Marks) should have the coverage of Advanced Micro and Macro Economics and with quantitative sums.

Paper 8: Part I- Information Technology (60 Marks) - Should be more Practical as per Industry Requirements.

Part II- Strategic Management (40 Marks) – Should be as per MBA Level with coverage of Corporate Strategy, Business Decision Making, Analysis etc as these are very important in MBA and this area actually creates Jobs for MBAs in High Profile Posts for Strategy Analysis under Strategy & Operations and also helps in getting into high end Consultancy Companies. Without this, CAs cannot become Decision Makers, Strategist, Consultant, Analysts in the Big Corporate Houses. CASE STUDY BASED Curriculum with Practical Cases should be covered.

FINAL

Group 1-

New Additional Paper on Finance- Since, Paper 2: Strategic Financial Management (100 Marks) has been put into Intermediate Level, New Additional Paper on Finance will come into this place as Paper 2.

Paper 2: Paper Title: Quantitative Finance (100 Marks)

New Additional Paper on Finance-

Paper 5: Paper Title: Financial Engineering (100 Marks)

Group 2-

New Additional Paper on Finance- Since, Paper 6: Part I- Financial Services and Capital Markets (50 Marks) has been moved to Intermediate Level, here the 50 Marks will be allotted to New Additional Finance Paper

Paper 7: Paper Title: Corporate Finance, Fund Raising, Private Equity (50 Marks)

Part II- Information Systems Control & Audit (50 Marks) - should be more Practical as per the Industry requirements.

[Since, 5th will be the New Additional Paper on Finance thus existing papers in Group 2, from 5th to 8th will be 6th to 9th in that order]

***** P.S. All the Papers should have adequate CASE STUDIES; CASE STUDIES BASED CURRICULUM always helps in gaining Practical Knowledge, Applicability in the Working Domains like for example Real Cases on some Merger & Acquisition, Valuation in the Finance Papers.

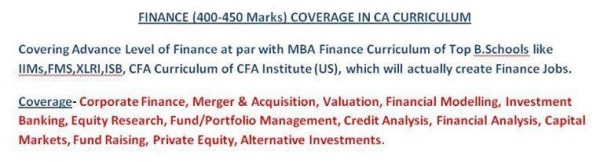

FINANCE (400-450 Marks) COVERAGE IN CA CURRICULUM

Covering Advance Level of Finance at par with MBA Finance Curriculum of Top B.Schools like IIMs,FMS,XLRI,ISB, CFA Curriculum of CFA Institute (US), which will actually create Finance Jobs.

Coverage- Corporate Finance, Merger & Acquisition, Valuation, Financial Modelling, Investment Banking, Equity Research, Fund/Portfolio Management, Credit Analysis, Financial Analysis, Capital Markets, Fund Raising, Private Equity, Alternative Investments.

IIM-A Curriculum related to Finance, Economics (Micro and Macro), Business Decision Making, Corporate Strategy should be implemented

https://www.iimahd.ernet.in/programmes/pgp/programme/curriculum/courses-offered.H T M L

https://www.iimahd.ernet.in/programmes/pgp/programme/curriculum/courses-offered-second-year.H T M L

https://www.cfainstitute.org/programs/claritas/Documents/claritas_syllabus_overview.pdf

***** P.S.- In case, ICAI is reluctant with the above, ITSM and ISCA could be MERGED and be made a Single Paper with Weight to IT-30 Marks, SM- 40 Marks, ISCA- 30 Marks [ADVANCED Practical Training in IT,ISCA are more than sufficient, as NO RECRUITERS ASK, THEORIES FROM IT,ISCA, only thing that is looked whether the Candidate has adequate Advanced Practical Training in IT,ISCA in areas like Advanced Excel, Financial Modelling, XBRL,CAAT,SAP FICO,ORACLE,ERP,CLOUD COMPUTING, Financial DATA Analytics etc]

But, NO WAY, ICAI CAN AFFORD TO COMPROMISE WITH FINANCE (400-450 Marks), IT SHOULD BE GIVEN THE MOST PRIORITY, WEIGHT, COVERAGE, BECAUSE UNLIKE MANY PAPERS, FINANCE WILL CREATE JOBS WORLDWIDE WITH HIGHER SALARIES. WITH OUT ADEQUATE FINANCE, ECONOMICS, CORPORATE STRATEGY, BUSINESS DECISIONS MAKING CA’s CANNOT BE MADE COMPETENT TO BECOME CEOs, CFOs, Decision Makers, Business Leaders etc.

ICAI SHOULD TALK TO THE COMPANIES LIKE

Who doesn’t want to see these companies at ICAI Campus recruiting CAs for Finance Domain and making CAs Global with 1 Crore + Salaries [MBAs are Global because of Finance]

McKinney & Co

Bain & Co

Boston Consulting Group

Goldman Sachs

Morgan Stanley

J P Morgan

Deutsche Bank

Barclays

Bank of America

BIG 4 CONSULTING (For Finance, not for Tax and Audit)

Even, Industrialist like Kumar Mangalam Birla (CA-MBA) who publicly stated that CAs lack Finance and Economics thus MBAs are earning much more than CAs, CA Curriculum should give maximum priority to Finance and Economics. Only with Accounting CAs cannot fulfil the Industry Requirements.

Not only, MBAs from Top 10 B.Schools, even CFAs and in some cases CFA Level II candidates are earning more than CAs just because of FINANCE.

Bankers like Deepak Parekh (HDFC), Aditya Puri (HDFC), Naina Lal Kidwai (HSBC), T V Raghunath-IIT-M,IIM-B-ICAI (KOTAK MAHINDRA BANK), Amit Mimani-St.Xavier’s College,ICAI,IIM-C (STANDARD CHARTERED), NSE CEO Chitra Ramakrishna, Nirmal Jain, ICAI,IIM (India Infoline) (All are CAs, and always believe Finance needs to be made as CORE to CA Course)

WHAT THIS CURRICULUM WITH 400-450 MARKS FINANCE, INDUSTRIAL TRAINING, And CORPORATE TRAINING WILL MAKE TO CAs [CA COURSE WILL BE A COMPLETE BUSINESS COURSE WITH COMPREHENSIVE COVERAGE OF ACCOUNTS 400,FINANCE 400-450,TAX 300,AUDIT 200, COSTING 200, LAW 200, ECONOMICS 100, MATHS & STATS 100 Marks of TOTAL 2200 MARKS CA COURSE]

- FINANCE JOBS [Without Compromising the Existing Domains, thus, CAs will be recruited in all the 4 Domains of Business i.e. Accounts, Finance (including Consultancy, Analysis, Strategy), Tax, Audit].

- 100 % PLACEMENTS

- HIGHER SALARIES (From AVG INR 7.9 LPA IN INDIA TO AVG INR 12 LPA IN INDIA, WITH HIGHEST FROM INR 24 LPA IN INDIA TO INR 40 LPA IN INDIA)

- INTERNATIONAL PLACEMENTS (US,UK,CANADA,SINGAPORE,AUSTRALIA and other developed countries of Europe and throughout the Globe, Potential Salary Increment from INR 30 LPA to INR 1 Crore + for International Placements, presently International Placements of CAs from Tax and Audit Field is very limited in Numbers and restricted largely to Middle-East Countries)

- Potential CEOs,CFOs,Business Leaders, Decision Makers

- NEW PRACTICE AREAS IN Various FINANCIAL SERVICES for CA Practitioners

CA Curriculum must be in tune with MBA Finance, CFA Curriculum of CFA Institute, FRM Curriculum of GARP Institute to be an International Level Course.

This will make Indian CAs International like Indian MBAs, with all due respect to Accounts, Taxation and Auditing (the core areas of CA) if, ICAI can incorporate 400-450 marks of Finance covering the CFA/IIMs that will transform ICAI and CAs in many ways i.e. Finance Domain such as- CORPORATE FINANCE,VALUATION, M & A, EQUITY RESEARCH, PORTFOLIO MANAGEMENT, CREDIT ANALYSIS, CAPITAL MARKETS, INVESTMENT BANKING, Financial Analysis etc, to make CAs ready for these high end Finance areas we need to have the coverage in these areas, which should be of ADVANCED LEVEL and with CASE STUDIES.

ICAI needs to be at par with Top B.Schools

IIMs

XLRI

FMS

ISB

ICAI

S P JAIN

SYMBIOSIS

JAMNALAL BAJAJ

MDI

NMIMS

After IIMs,XLRI,FMS,ISB- ICAI would easily come in as per talent and if managed professionally like these B.Schools in Areas like International Curriculum, Internship, Corporate Training, Waiver off Tariff from Corporate at ICAI CAMPUS, Placements through Professional Placement Agencies (as it’s used in the Top B.Schools for making Presentation to the Industry about Core Areas, Inviting them at Campus Free of Tariff, Screening, Negotiation etc) not by CAs in to Practice and International Placements through ICAI Foreign Chapters following the same procedure applies to India through the list of Recruiters of MBAs,CPAs,CFAs etc, Branding [Many Schools and Colleges/Universities have BRANDED themselves much better than ICAI, considering the Immense Contributions of ICAI to India, ICAI should be BRANDED as the 3rd Largest Educational BRAND of Institute in India just after IIT and IIM.

ICAI may talk to Industry which Curriculum and Training is designed better for Finance Jobs, It is guaranteed that CAs will be at par with top 10 B.School Grads that too with so much lesser cost of CA Course as it will become THE COMPLETE BUSINESS COURSE WITH COMPREHENSIVE COVERAGE OF ACCOUNTING, FINANCE, TAXATION and AUDIT.

...................................................................................................................................................

Attached File : 24428 20160514050822 final proposed scheme for cret.doc downloaded: 210 times

CAclubindia

CAclubindia