Why is Zomato in Red

The love for food, the comfort of home and procrastination to cook has made Zomato a household name in India. Zomato is currently one of the biggest players in the food delivery space, competing majorly only against Swiggy.

However, the stock of Zomato has been largely unimpressive since its stellar debut. Let us have a look at the price movement since its listing.

(Source: Google Finance) [1]

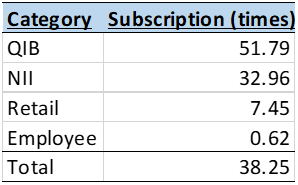

The stock was listed on 23rd July 2021 at a price of INR 116, against the issue price of INR 74, a premium of 52.63%. This was not completely unexpected, considering the following subscription of the issue-

(Source: chittorgarh.com) [2]

However, the price has continually been on a downhill trajectory after hitting an all-time high of 169.00. The stock hit the all-time low of INR 40.60 on 26th July 2022. Do note the date as we will circle back to the importance of the same.

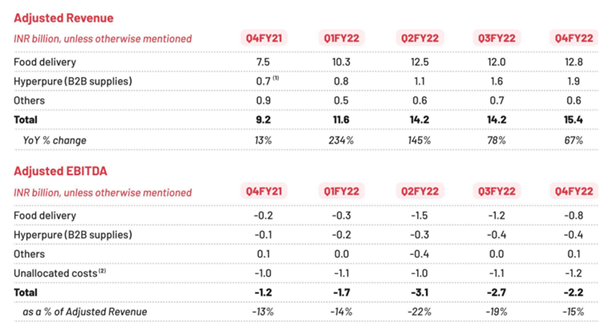

To understand the fall, our first go-to option is to analyse the numbers of the company. We will have a look at the post-listing quarterly result to give us an idea if is it something that changed in the financials, which led to a decline in enthusiasm from listing to now.

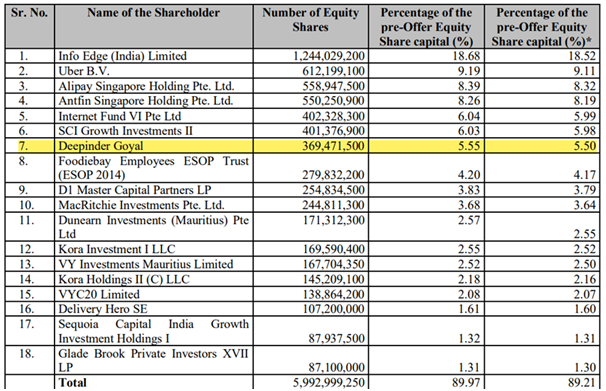

(Source: Zomato Q4FY22 Results) [3]

Although Zomato is a loss-making company, it still doesn't explain the fall in price post listing. Zomato has been a loss-making company, like any other typical e-commerce start-up. In fact, if anything, the financial and operating metrics have improved over the quarters. It won't be prudent to assume that the investors wanted the company to turn profitable over a period of four quarters and not being able to do so led fall in price.

Since the surface-level analysis of financials doesn't provide us with a reason for the decline, we will have a look at the major incidents that have happened since the listing, and how these incidents might have impacted the price of the share.

But before, we must understand a critical component of the listing of Zomato. The first page of the prospectus mentions-

"OUR COMPANY IS A PROFESSIONALLY MANAGED COMPANY AND DOES NOT HAVE AN IDENTIFIABLE PROMOTER"

To simplify this, the company has stated that it has no promoters. It further also mentions that

"Deepinder Goyal is our Founder and was an initial subscriber to our MoA. None of our other Directors have any interest in the promotion and formation of our Company other than in the ordinary course of business."

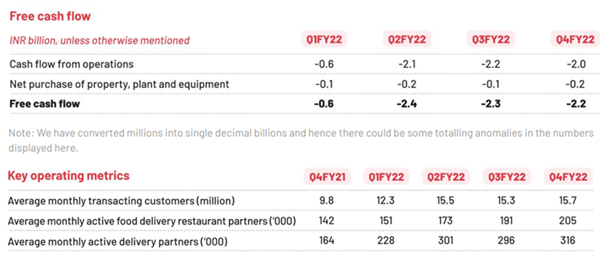

The minimum promoter requirement as per the listing norm is 20%. According to Zomato's shareholding pattern, CEO Deepinder Goyal held a 5.50% stake in the company.

Source: Zomato RHP [4]

Hence there is no identifiable promoter and the company is a professionally managed company.

But let us have a look at the implications of having no identifiable promoter while listing. As per the listing norms by SEBI, promoters are required to maintain a minimum shareholding of 20% for a period of 3 years from the date of listing. In absence of any promoters, such a requirement is not applicable to the current shareholders of the company.

However, to safeguard the interests of the public, there is a lock-in period of one year for pre-IPO shareholders of the company. This one-year lock-in for Zomato pre-IPO investors ended on 23rd July 2022. [5]

Major incidents that occurred after listing are as follows-

- September 14, 2021- The co-founder of Zomato, Mr Gaurav Gupta resigned from his position citing personal reasons for the same. The co-founder of a company leaving within months of an IPO is never good news for the investor and can generally shake the confidence they have in the company's future prospects. However, for the day, the stock opened at INR 145.10, rose to 152.75, fell to 136.20 upon news of resignation and closed at 145 levels, thus ending the day flat. [6]

- April 2022- Zomato launched an ambitious 10-minute delivery plan, which not only faced backlash due to safety concerns but also failed during its pilot in Gurugram. [7] [8]

- June 29, 2022 - Zomato acquired Blinkit in an all-stock deal which was earlier valued at INR 4,447 cr. [9]

The deal has been under scrutiny mainly for two reasons-

i) Blinkit is a loss-making venture and acquiring it will further delay the process of Zomato making profits. As we had seen in the data above, Zomato had been successful in shrinking its losses, and the investors would have expected to break even in due course. However, adding a loss-making venture to its business would now make the future predictions uncertain, and losses are most likely to expand.

ii) The valuation at which Zomato has acquired Blinkit might be on the higher end of the valuation band.

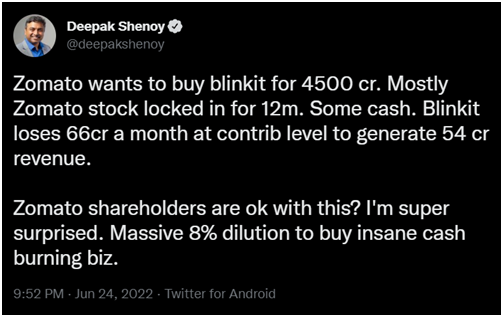

Mr Deepak Shenoy, Founder and CEO of Capital Mind, expressed the same concerns over Twitter in the following tweet-

(Source)

Upon announcement of the news, Zomato shares tumbled from INR 70.50 to INR 55.10, a fall of ~20% in 6 trading sessions. [10]

Now the other part of the story here are the pre-IPO investors. These are institutional investors, who were following the stock, the exit of a co-founder and a questionable acquisition, but had their hands tied. They could not have sold the shares before the lock-in period of one year.

However, as soon as the lock-in period was over, and the restrictions were lifted, the stock price of Zomato slipped by 14% to reach an all-time low of INR 46 and closed at INR 47.55 for the day [11]. This was mainly due to the selling pressure which was mounting due to the lock-in. Major exits post the lock-in are as follows-

26th July - Moore Strategic Ventures sold 4.25 crores shares, at INR 44 per share, totalling ~ INR 187 crores. They made a loss of INR 4 crores on the deal. [12]

4th August - UBER BV sold 61.2 crore shares, amounting to a 7.8% stake in the company at INR 50.44 apiece, totalling 3,087.93 crores. [13]

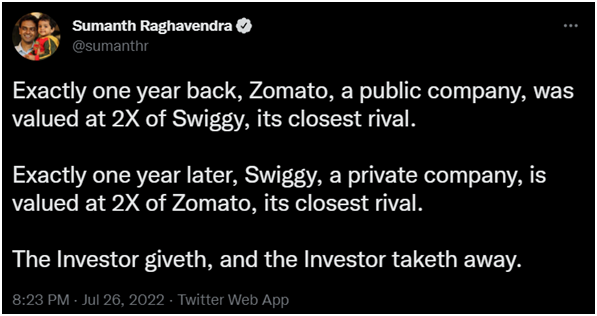

Mr Sumanth Raghavendra, the co-founder of The Ken presented an interesting stat concerning the relentless fall in the share price of Zomato-

(Source)

Currently, at the time of writing the article, Zomato's share price has staged a recovery and is currently trading at a price level of INR 64. This was mainly on the back of strong Q1FY23 results, with net loss shrinking and revenue increasing by 67.44%. There has also been a pragmatic transition where Zomato founder and CEO Deepinder Goyal has announced the appointment of four new CEOs, to enable a structure in which multiple CEOs running separate business verticals, acting as peers to each other. The market has reacted positively to this news and is being reflected in a strong recovery after hitting an all-time low.

The key takeaway from this saga is how the selling pressure which was being built over the period of one year, led the stock to hit an all-time low as soon as the restrictions were lifted. In the current capital structure trend of startups, where the founder's equity might be diluted below 20% due to multiple rounds of funding, the no identifiable promoter might become a new norm. In such scenarios, the stock might take an impact of accumulated selling pressure at the end of 1-year lock-in, if it has failed to perform during this one year.

To draw parallels, another major IPO last year had a 'no identifiable promoter' feature, and coincidentally, it has also underperformed since its listing. We are talking here about Paytm, which was issued at INR 2,150, listed at INR 1,950 and is currently at INR 784 levels. Will the end of the lock-in period cause the price to hit an all-time low? Only time can tell, while we speculate the outcome.

We would like to close here by mentioning that as the landscape of entrepreneurship in India, with startups being backed by numerous VCs and PEs, the SEBI has recognised the need to shift from the concept of 'promoter-driven companies' to 'shareholders-driven companies'. [15]

On 5th August 2022, the SEBI Board approved the process of changing the concept of 'promoters' to 'person in control' or 'controlling shareholders. It has also halved the lock-in period for promoters to 18 months (earlier 3 yrs) and non-promoters to 6 months (earlier 1 yr), subject to certain usage of funds conditions. This is a welcome move and in line with current industry trends and practices globally. [16]

Disclaimer:

i) The above-mentioned observations should not be construed as a piece of investment advice.

ii) Not Invested in the company.

CAclubindia

CAclubindia