A. Concept:

Voucher in terms of clause (118) of Section 2 of Central Goods and Services Tax Act, 2017 has been defined as follows:

''voucher' means an instrument where there is an obligation to accept it as consideration or part consideration for a supply of goods or services or both and where the goods or services or both to be supplied or the identities of their potential suppliers are either indicated on the instrument itself or in related documentation, including the terms and conditions of use of such instrument.'

In other words, voucher is any instrument that can be used as consideration for procuring goods or services, containing its own terms and conditions for being used as such.Following are the factors to determine whether instrument is a voucher or not:

1. Legal obligation to accept as consideration for supply of goods or services to be affected in future;

2. Legal obligation is created under a contractual agreement. The European Court of Justice ('ECJ') in Argos Distributors Ltd v. Commissioner of Customs & Excise, ECJ, 1996, C-288/94, stated that 'vouchers are, by its nature, no more than a document evidencing the obligation assumed by the Agros (supplier) to accept the voucher,instead of money, at its face value'.

3. Discounts are offered till the voucher changes hands and finally redemption is at the face value.

4. Council Directive 2016/1065 dated 27.06.2016(' EU Council Voucher Directive') inserted directives relating to chargeability of VAT on vouchers by amendment in 'EU Council VAT Directives'. Following is relevant to note from these voucher directives:

• It defines voucher exactly in the same words as Section 2(119)and recognises two types of vouchers viz. 'single-purpose voucher' ('SPV') and 'multi-purpose voucher' ('MPV').

• SPV:Where the VAT treatment attributable to the underlying supply of goods or services can be determined with certainty upon issuance it is considered to be SPV.In that case, VAT should be charged on each transfer. The actual handing over of the goods or the actual provision of the services in return for a SPV should not be regarded as an independent transaction.

• MPV:Vouchers other SPV are considered as MPV. VAT is charged when the goods or services to which the voucher relates is supplied.Any prior transfer of MPV is not subject to VAT.

• Only the intermediary services or separate supply of services such as distribution or promotion services in relation to voucher are subject to VAT. Therefore, where a taxable person who is not acting in his own name receives any separate consideration on the transfer of a voucher, that consideration should be taxable according to the normal VAT arrangements.

Even though Indian GST law doesn't specifically states of SPV or MPV type of vouchers but the reference for the same can be find in Section 13(4) while determining time of supply.

B. Vouchers in the form ofPre-paid payment Instruments ('PPIs') is 'Money' and thus not chargeable to GST :

Money in terms of clause (75) of Section 2 has been defined as follows:

''money' means the Indian legal tender or any foreign currency, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any other instrument recognised by the Reserve Bank of India when used as a consideration to settle an obligation or exchange with Indian legal tender of another denomination but shall not include any currency that is held for its numismatic value.'

It is relevant to note that 'Money' is excluded from the definition of both 'Goods' and 'Services' and hence not chargeable to GST.

Money includes instrument recognised by RBI:

a. When used as a consideration to settle an obligation or

b. Exchange with Indian legal tender of another denomination.

One such instrument which isused as consideration to settle an obligation& are recognised by RBI are PPIs.PPIs are payment instruments that facilitate purchase of goods and services, including financial services, remittance facilities, etc., against the value stored on such instruments.

The value is already stored in PPIs at the time of issuance which facilitate purchase of goods or services. The value stored on such instruments represents the value paid for by the holders by cash, by debit to a bank account, or by credit card.

The Payment and Settlement Systems Act, 2007 ('PSS Act') provides for the regulation and supervision of payment systems (including PPIs) in India and designates Reserve Bank of India ('RBI') as the authority for that purpose and all related matters.

In exercise of power conferred by Section 18 read with Section 10(2) of Payment and Settlement Systems Act, 2007, RBI issued RBI (Issuance and Operation of Prepaid Payments Instruments) Directions, 2017 ('Master Directions') dated 11.10.2017, the purpose to provide a framework for authorisation, regulation and supervision of entities operating payment systems for issuance of PPIs in the country.

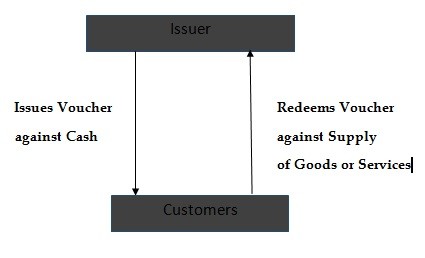

A typical transaction flow of Closed PPI system based transaction is depicted by way of a diagram below:

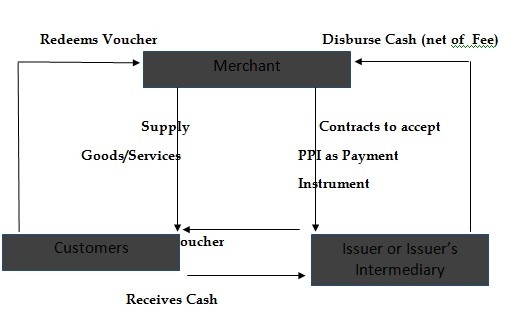

A typical transaction flow of Semi-closed PPI system based transaction is depicted by way of a diagram below:

Issuance of Vouchers in the nature of PPIs:

[Issuer: Entities operating the payment systems issuing PPIs to individuals / organisations. The money so collected is used by these entities to make payment to the merchants who are part of the acceptance arrangement and for facilitating funds transfer / remittance services (Para 2.1 of Master Directions).

Role of intermediaries (payment aggregators/gateways) for facilitation of payment mechanism of PPIs: With the growing acceptance of PPIs in e-commerce payments, including in digital market places, the payment mechanism is often facilitated using the services of payment aggregators / payment gateways. In such a scenario, the emerging practice observed is that the PPI Issuer has the necessary agreements with the digital market place and / or the payment aggregator / gateway rather than the individual merchants who are accepting the PPIs issued by the Issuer as a payment instrument. In view of the above, PPI issuers shall obtain an undertaking from the digital market place and / or payment aggregator / gateway that the payments made by the Issuers are used for onward payments to the respective merchants. Such undertaking shall be submitted by the Issuers to the bank maintaining the escrow account (Note (ix)of Para 12.3(iv) of Master Directions ).]

Even though it seems that the issuance of vouchers in the nature of PPIs would not be covered within the meaning of money since issuance of instrument is not settlement of obligation rather creation of an obligation, its issuance in essence is a mere transaction in money as far as issuer is concerned since money that has been received is for disbursements to merchants (in case of semi-closed payment instrument) and represents an advance for the future supply of goods or services (in case of closed payment instrument). In the case of Union of India vs. Delhi Chit Fund Association (W.P. (C) 4512 of 2012), Hon'ble Delhi High Court held that 'a mere transaction in money represents the gross value of the transaction. But what is chargeable to service tax is not the transaction in money itself since it can by no means be considered as a service' (affirmed by Hon'ble Supreme Court). Though the case pertains to service tax regime, however it is relevant to note the definition of Money under erstwhile service tax law was essentially same as under GST law.Further as per Master Directions, amount received from holders (customers) is always kept in escrow account and is used strictly only for settlement of vouchers and isnot accounted for or used as income in the hands of the PPI issuer.

Therefore, there would not be any GST implications on the issuance of vouchers in the nature of PPIs.

Redemption of Vouchers in the nature of PPIs:

[Holder: Individuals / Organisations who obtain / purchase PPIs from the issuers and use the same for purchase of goods and services, including financial services, remittance facilities, etc. (Para 2.2 of Master Directions).]

Holder is the person who actually uses (redeems) PPI for purchase of goods or services. The definition of money under GST law considers instruments used as a consideration to settle an obligation as equivalent to money. It is relevant to note that obligation can be of any person and not necessarily of holder only. Therefore, redemption of PPI can be safely considered to be Money.

The definition under GST law of 'Money' is an one step further to the definition of Money as was provided under Section 65B(33) of Finance Act, 1994 (erstwhile Service Tax law) which states that, ''money' means legal tender, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any such similar instrument but shall not include any currency that is held for its numismatic value'. The words 'when used as a consideration to settle an obligation' are addition to the definition of money under GST law.

Supply of Goods or Services against redemption of Vouchers in the nature of PPIs:

[Merchants: These are establishments who have a specific contract to accept the PPIs issued by the PPI issuer (or contract through a payment aggregator / payment gateway) against the sale of goods and services, including financial services (Para 2.8 of Master Directions).]

It is relevant to note that in case of Closed-System PPI, there is no merchant and issuer itself acts as merchant.

Merchants are the ones who actually supplies goods or services against redemption of PPI. Supply of goods or services against vouchers in the nature of PPIs is chargeable to GST since voucher represents consideration for the said supply of goods or services.

The above analysis can be summed up by way of below table:

|

Particulars |

GST Chargeable (Yes/No) |

Reason in Crux |

|

Issuance of Voucher in the nature of PPI |

No |

Mere transaction in Money |

|

Receipt of Cash against above |

See next column |

Closed System PPI: Represents Advance/Taxable in the hands of Issuer Semi-Closed System PPI: 1. Not taxable in the hands of Issuer (Received for onward disbursement to Merchants). 2. Taxable in the hands of Merchants. |

|

Supply of Goods or Services by Merchant |

Yes |

It is taxable supply. Consideration/Taxable Value will include value of voucher redeemed. |

Further analysis is covered in later part of this article.

The following types of PPIs can be issued (Para 2.3 to Para 2.6 of Master Directions):

a. Closed System PPIs: These PPIs are issued by an entity for facilitating the purchase of goods and services from that entity only and do not permit cash withdrawal. As these instruments cannot be used for payments or settlement for third party services, the issuance and operation of such instruments is not classified as payment systems requiring approval / authorisation by the RBI.

Authors' Comment: Closed system PPI though classified as PPI does not require approval/authorisation of RBI.

b. Semi-closed System PPIs: These PPIs are used for purchase of goods and services, including financial services, remittance facilities, etc., at a group of clearly identified merchant locations / establishments which have a specific contract with the issuer (or contract through a payment aggregator / payment gateway) to accept the PPIs as payment instruments. These instruments do not permit cash withdrawal, irrespective of whether they are issued by banks or non-banks.

Authors' Comment: Semi-closed system PPI requires approval/authorisation of RBI.

c. Open System PPIs: These PPIs are issued only by banks and are used at any merchant for purchase of goods and services, including financial services, remittance facilities, etc. Banks issuing such PPIs shall also facilitate cash withdrawal at ATMs / Point of Sale (PoS) / Business Correspondents (BCs).

Authors' Comment: These PPI cannot be issued by non-bank entities.

Following are other extracts from Master Directions which are relevant to our discussion:

a. Reloadable/Non-reloadable PPIs:All entities approved / authorised to issue PPIs by RBI are permitted to issue reloadable or non-reloadable PPIs depending upon the permissible type / category of PPIs as laid down in paragraph 9 and 10 of these Directions (Para 7.1 of Master Directions ).

b. PPI in cards/wallets: PPIs can be issued as cards, wallets, and any such form / instrument which can be used to access the PPI and to use the amount therein. PPIs in the form of paper vouchers shall no longer be issued from the date of this Master Direction...(Para 7.7 of Master Directions).

Authors' Comment: It implies that PPI can be in a form of a plastic card or in a form of digital wallet butnot in paper form.

C. Vouchers in the form of Discount Coupons/Loyalty Points/Coupon Codes, etc.:

Discount Coupons/Loyalty points accrues in one transaction that can be redeemed as discount in subsequent transaction. Similarly, upfront discount coupons are provided in the form of coupon codes lure customers to undertake transaction.

D. Illustration:

|

Type |

Voucher in the form of |

Remarks |

|

Amazon Stop Gift Vouchers |

PPI |

Gift vouchers represents loaded value |

|

'10% discount coupon issued on account of first purchase of Rs.1000, to be applied against second purchase' or 'credit card reward points' Or |

Discount Coupons |

Discount on account of points accrued on first purchase or These coupons are issued by the same entityand are non-transferrable. Not includible in value of supply (see point 3 of conclusion). |

|

PayTM Wallet |

PPI |

Wallet is loaded value. Linking to RFID Tag is irrelevant for determination. |

|

Train Tickets/Movie Tickets |

Neither Voucher nor PPI |

These are invoice cum receipt for the services to be provided or are being provided. |

|

Google Pay Cashback |

Neither Voucher nor PPI |

Cashback is Indian Legal Tender |

|

Meal Vouchers |

PPI |

Meal Vouchers represents loaded value |

Any convenience charges recovered in respect of any of the above cases (such as for issuance of RFID tag) is liable to GST.

E. Following case studies can be presented for further understanding and deriving taxability.

Case Study 1:

Easemytrip agrees to issue a travel voucher having face value of Rs.500/- through PayTM (payment aggregator) at the rate of Rs.400/- on 01.03.2020. This travel voucher can be redeemed for purchase of travel arrangement related services through Easemytrip website only. PayTM issued this travel voucher through its online application to individual customer at the rate of Rs.450/- on 01.04.2020.PayTM disbursed amount of Rs.400 (after deducting its service charges) to Easemytrip on 05.04.2020.Customer redeemed (used) this voucher for online booking of travel package of Rs.5000 from Easemytrip website on 01.06.2020. Below captures taxability issues that arises out of above:

a. Whether voucher in the present case qualifies to be PPI? If yes, under which category does this PPI be classified?

Travel voucher has value of Rs.500 loaded on it and thus qualifies to be PPI. Since it can be redeemed by the same entity which issued this voucher i.e. Easemytrip and therefore, the same would qualify as Closed System PPI.

b. Whether Easemytrip is liable to pay GST while issuing voucher through PayTM. If yes, whether GST would be paid on face value of voucher amounting Rs.500 or on issue price of Rs.400?

Voucher is in the nature of PPI and therefore, no GST would be applicable on its issuance by Easemytrip through PayTM on account of reasons discussed above.

c. Whether PayTM is required to collect TCS on provisions provided in Section 52 of the Act?

No, since TCS provisions are applicable on the net value of taxable supplies made through e-commerce operator platform by other suppliers (Section 52(1)). Present issuance of vouchers doesn't qualify to be taxable supply.

d. Whether PayTM is required to pay GST on the amount of Rs.450 collected from the customer?

PayTM is payment aggregator in this case. There would be no requirement on PayTM to pay GST on the amount collected (Rs. 450) or on disbursement to Easemytrip(Rs. 400).

e. Whether PayTM is required to pay GST on the amount of Rs.50 on account of the margin earned? If yes, at what time, liability is to be discharged?

Yes. Amount of Rs.50 is on account of payment aggregator services provided by PayTM to Easemytrip. In this case, time to pay GST liability shall be determined as per Section 13(2).

Following is relevant for point (d) and (e):

1. In the case of Sodexo SVC India Pvt. Ltd. v. State of Maharashtra, (2015) 16 SCC 479, the Hon'ble Supreme Court observed, while holding that sodexo meal vouchers are not goods and accordingly no Octroi or Local Body Tax can be levied, as follows:

'....Vouchers are not the commodity which are sold. If the face value of the said vouchers is rs 50, by giving these ₹ vouchers to its customers, the appellant only takes specified service charges from its customers, which is normally Rs.2 for Rs.50 voucher'.

'The intrinsic and essential character of the entire transaction is to provide services by the appellant and this is achieved through the means of said vouchers. Goods belong to the affiliates which are sold by them to the customers' employees on the basis of vouchers given by the customers to its employees. It is these affiliates who are getting the money for those goods and not the appellant, who only gets service charges for the services rendered, both to the customers as well as the affiliates'.

2. Reference can also be made to Ind AS 115 which deals with 'Revenue from Contracts with Customers'. Paras B34 to B38 of this Ind AS deals with 'Principal versus agent considerations'. Relevant extracts are as follows:

a. Para B36 states that 'an entity is an agent if the entity's performance obligation is to arrange for the provision of goods or services by another party. When an entity that is an agent satisfies a performance obligation, the entity recognizes revenue in the amount of any fee or commission to which it expects to be entitled in exchange for arranging for the other party to provide its goods or services. An entity's fee or commission might be the net amount of consideration that the entity retains after paying the other party the consideration received in exchange for the goods or services to be provided by that party'.

b. Para B37 states of the basis of the parameters which entity can be considered as an agent. Few of the parameters are:

i. The entity does not have inventory risk before or after the goods have been ordered by a customer, during shipping or on return;

ii. The entity does not have discretion in establishing prices for the other party's goods or services and, therefore, the benefit that the entity can receive from those goods or services is limited;

iii. The entity's consideration is in the form of a commission.

f. Customer booked a travel package of Rs.5,000 with Easemytrip and the consideration for the same is paid by applying discount voucher of Rs.500 and balance by online banking, whether taxable value for Easemytrip would be Rs.4,500 or Rs.5,000? At what time, liability is to be discharged?

It is relevant to take note of the valuation provisions provided under GST law before proceeding further:

[Section 15 Act deals with valuation of supply:

1. The value of a supply of goods or services or both shall be the transaction value which is the price actually paid or payable for the said supply of goods or services or both where the supplier and recipient of the supply are not related and the price is the sole consideration for the supply.

2. ...

3. The value of the supply shall not include any discount which is given- -

a. before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply; and

b. after the supply has been effected, if-

i. such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

ii. input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply.

4. ...

5. Notwithstanding anything contained in sub-section (1) or sub-section (4), the value of such supplies as may be notified by the Government on the recommendations of the Council shall be determined in such manner as may be prescribed.

In exercise of powers conferred by Section 15(5), Rule 32(6) was notified as provided below. This rule provides for special provision for valuation of vouchers, coupons and such related instruments which at the option of supplier can be opted:

'The value of a token, or a voucher, or a coupon, or a stamp (other than postage stamp) which is redeemable against a supply of goods or service or both shall be equal to the money value of the goods or services or both redeemable against such token, voucher, coupon or stamp'.]

Value of voucher is considered to be equal to money value of goods or services redeemable against such voucher. It is relevant to note that there is no GST on vouchers per se since voucher in the present case are in the nature of PPI. GST is on the goods or services which are to be supplied against this voucher.Rule 32(6) states of valuation methodology and doesn't determines GST chargeability.

Taxable value for Easemytrip would be Rs.5,000(Rs.4,500 received from customer directly and Rs.500 against issue of voucher determined as per Rule 32(6)).

It is relevant to note that applicability of rule 32(6) is at the option of supplier. Taxable value if determined as per the provisions of Section 15(1) would be Rs.4,950/- (Rs.4,500 received from customer in cash and Rs.450 i.e. actual price received against issue of voucher). Rs.4,950/- istransaction value which is the price actually paidfor the supply of aforesaid services. Further support in this regard can be taken from reasons provided in EU Council Voucher Directive. Relevant extracts are reproduced below:

• 'Such a taxable person would in that case need to account for VAT on the consideration received for the single-purpose voucher according to Article 73 of Directive 2006/112/EC.'

• 'In the case of multi-purpose vouchers, ................ the supplier of the goods or services should account for theVAT based on the consideration paid for the multi-purpose voucher.In the absence of such information the taxable amount should be equal to the monetary value indicated on the multi-purpose voucher itself or in the related documentation.......'.

It is relevant to note that Rs.50 being fee of PayTM cannot be reduced from this transaction value as the same pertain to payment aggregator services provided by PayTM and arises a result of independent transaction having no relation whatsoever with supply of travel arrangement services to customer.

Time of supply in this case would be determined as per the provisions of Section 13 as reproduced below:

Section 13: Time of supply of services

1. The liability to pay tax on services shall arise at the time of supply, as determined in accordance with the provisions of this section.

2. ...

3. ...

4. In case of supply of vouchers by a supplier, the time of supply shall be- -

a. the date of issue of voucher, if the supply is identifiable at that point; or

b. the date of redemption of voucher, in all other cases.

As per Section 13(1), time of supply of services would be determined as per this provision which in the present case is travel package (arrangement) services. As per Section 13(4), time of supply of services would be date of issuance of voucher in case supply is identifiable which in the present case falls on 01.04.2020 (it is relevant to note that the voucher is issued (supplied) on 01.04.2020 to customer and not on 01.03.2020 when Easemytrip agreed to issue voucher through PayTM. Even otherwise Voucher in the form of PPI can be issued only to holder and not aggregator as per RBI Master Directions.

• Supply is identifiable implies that the necessary components to pay GST are available such as rate of tax, place of supply.

• In case supply is not identifiable such as in case where the place of supply is not determinable at the time of issuance, then time of supply would be the date of redemption which in the present case is 01.06.2020.

g. Whether above taxability changes if the voucher is issued to Agilent Ltd. and which is later providedby Agilent Ltd. to one of its employee in lieu of salary?

In that case also, GST liability (if any) and time to pay such liability remains same. One additional leg which needs to be examined is whether there is any liability to pay GST when voucher is provided to one of its employee.

Relationship of employer and employee qualifies to be related persons by virtue of explanation to Section 15 and supply of goods or services needs to be examined. Distribution of voucher to employee in lieu of salaries is practically tested. In that case, there won't be any tax implications due to the reason that the same is outside the ambit of GST law by virtue of para 1st of IIIrd Schedule.

h. Whether above tax positions changes if the voucher is issued by Amazon to Agilent Ltd or to individual customer (whether or not any payment aggregator is involved) which can be redeemed by multiple identified merchants?

No. Tax position continues to remain same.Voucher in the present case would qualifyas a Semi-Closed System PPI.

i. What if the voucher is lost by Customer/Agilent or its Employee on 01.5.2020 or not redeemed within the validity period and accordingly, no actual redemption took place?

There won't be any additional GST implications for period post loss of voucher/lapse of validity period. The taxable events prior to loss/lapse remains as it is.

j. What if the voucher is sold by Customer or given away by Agilent as part of their sales promotional scheme?

Master Directions doesn't specially mention that the voucher in the form of Closed System PPIs can be sold. Considering that there are KYC requirements of PPI holders (customers) which needs to be complied with by issuer, it seems selling of PPI directly or indirectly by making it part of sales promotional scheme is not allowed.

Even otherwise if the selling of vouchers is allowed, the same may be classified as actionable claim to the extent voucher are redeemable against goods since it represents claim to a beneficial interest in a movable property and can be considered as actionable claim. However, a counter argument that if the customer loses or misplaces voucher and is unable to produce it before the issuer (Easemytrip), the voucher itself becomes invalid. In that case, customer cannot use it to pay for any goods and by that sense, it cannot be considered as an actionable claim.

Actionable claim is outside the ambit of GST laws by virtue of para 1st of IIIrd Schedule except for lottery, betting and gambling. GST law borrows meaning of actionable claimfrom Section 3 of the Transfer of Property Act which provides as follows:

''actionable claim' means a claim to any debt, other than a debt secured by mortgage of immoveable property or by hypothecation or pledge of moveable property, or to any beneficial interest in moveable property not in the possession, either actual or constructive, of the claimant, which the Civil Courts recognize as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent'.

Voucher to the extent redeemable against services cannot be considered as actionable claim since it does not represent beneficial interest in movable property.

Transaction in respect of vouchers not qualifying as actionable claim may be liable to GST provided the other qualifying conditions to classify the transaction as goods or services are duly met.The selling of voucher represents future right to goods or services.

Vouchers w.r.t. actionable claim is altogether a separate subject. Author does not wish to delve deep into the analysis of Vouchers w.r.t. actionable claim in this article.

Case Study 2:

Patanjaliissues reloadable smart cards to individual customers. Value loaded in smart card can be used for purchase of goods from Patanjali affiliated mega stores. A customer spentRs.5000for loading of value in smart card during offer period. Value actually loaded into the smart card is Rs.5500. Customer purchases goods worth of Rs.5500 from Patanjali affiliated mega store. The following GST implications would follow:

In the present case, value of supply of goods by mega store to customer would be 5500representing price actually paid by customer. Further, Rs.500 may be taxed separately as well in the hands of Patanjali if in case this amount (with or without margin) is recovered by Patanjalifrom mega store or if both parties qualify to be related persons by virtue of explanation contained in Section 15. Department may try to bring these transactions in GST netby alleging that marketing and sales promotion service are provided by Patanjalito mega store.

Case Study 3:

Reliance entered into an arrangement with Zomato wherein it is agreed that Reliance would be giving away a voucher having face value of Rs. 100 on every purchase of Rs.1000of mobile phone from its store in cash. This voucher can be redeemed using application of Zomato on purchase of Pizza having minimum value of Rs.500. A customer ordered pizza from Jubilant using application of Zomato of Rs.600 and redeemed voucher of Rs.500 & Rs.100 was paid in cash.

Reliance paid Rs.150 to Zomato (Rs.100 on account of voucher and Rs.50 as fee of Zomoto).

Jubilant received Rs.544 from Zomato (i.e. Rs.600 less Rs. 50 on account of Zomoto fee less Rs.6 as TCS).The following GST implications would follow:

Reliance: The value of supply of mobile phone can be Rs.1000 or it can be Rs.900 (after netting off Rs.100 on account of voucher distributed).

View in favour of Rs.900 can be due to the following reasons:

1. Section 15(1) states the transaction value would be the price actually paid or payable for the said supply. Actual price paid is Rs. 900 as amount of Rs.100 was never actually paid to Reliance for the supply of mobile phone. Use of word 'said supply' would imply supply of mobile phone in this case.

Even if one states that the Rs.1000 was paid in cash to Reliance, however, Rs.100 doesn't pertains to supply of mobile phones.Rs.100 is for onward disbursement to Zomato. Even from customer's (recipient) point of view actual price paid is Rs.900 only. Actual price paid should be true reciprocally as well i.e. actual amount received by Reliance.

2. Section 15(3)(b) excludes any discount which is given before or at the time of supply and duly recorded in the invoice issued. Word 'Discount' has not been defined in GST law. Ratio from below cited judgments can be referred:

Discount is a commercially acceptable measure which may be resorted to by a vendor for a variety of reasons(CC v. J.D. Orgochem Ltd., (2008) 16 SCC 576, 581.

Discount means a reduction in sales consideration(Indica Laboratories Pvt. Ltd. v. CCE, 2007 (213) ELT 20 (Tri. - LB).

From above, it is clear that commercial measures which are adopted for various business reasons, leading to reduction in sales consideration can be understood to mean discount. In the present case, Discount is a commercial measure which has led to reduced sales consideration.

Therefore, issuance of voucher can qualify as discount and thus, value of supply would be Rs.900(provided duly recorded in the invoice).

Contrary view to any of the above reasons would lead to value of supply of mobile phone to Rs.1000.

Zomato:

1. Value of supply of services would be Rs.100 i.e. Rs.50 each received from Reliance and Jubilant.

2. It qualifies to be an E-commerce operator. TCS at the rate of 1% needs to be collected in compliance with the provisions of Section 52.

Jubliant:

Value of supply of goods would be Rs.600.for the reasons already discussed in point (f) of 1st case study.

Vouchers can be in the form of Crypto Currency as well. Author does not wish to delve deep into the analysis of Vouchers w.r.t. crypto currency in this article since it is a separate subject altogether.

F. Key Takeaways/Concluding remarks:

1. Issuance and redemption of vouchers in the form of PPIs are outside the ambit of GST since PPIs are 'mere transactions in money'/or are 'money' and thus not chargeable to GST, neither as 'Goods' nor as 'Services'. Vouchers in the form of PPIs are means to an end and not an end in themselves.

2. Services of Intermediary (payment aggregator or market place) are chargeable to GST as per the relevant provisions of the GST law.

3. Issuance of loyalty points that can be redeemed in next (second) transaction can qualify as discount provided the same has been specially recorded in the invoice raised for first transaction or established in terms of prior agreement. In that case, value of supply of second transaction should not include monetary value of loyalty points by virtue of Section 15(3). Further, any upfront discount offered by way of coupon codes would also be not includible in value of supply.

4. The ruling of AAR-Tamil Nadu in the application of Kalyan Jewellers (Order No. 52 /ARA /2019)wherein it was ruled that the gift vouchers/cards are goods and separately chargeable to GST apart from GST chargeable on jewellery to be supplied on redemption of gift voucher/cards as per author's understanding does not rules the correct position of the law. The same leads to double taxation and is entirely contrary to the provisions contained in EU Council Voucher directives from where the concept of voucher has been borrowed under Indian GST law.

5. Distributor of vouchers in terms of commercial arrangements involving two or more entities should be analysed critically. There are various tricky issues involved in such transactions such as RBI master directions, valuation provisions, exclusion of part consideration representing discount, sales promotion, etc.

6. Voucher may be classified as actionable claim to the extent voucher are redeemable against goods since it represents claim to a benfieficial interest in a movable property (though not conclusive and to be examined on case to case basis). The selling of voucher represents future right to goods or services.

CAclubindia

CAclubindia