Udyam Registration is an online, self-declaration system launched by India's Ministry of MSME. It officially recognizes businesses as Micro, Small, or Medium Enterprises, making them eligible for numerous government benefits, subsidies, and support schemes. This digital process has replaced the earlier Udyog Aadhaar system.

Steps for Udyam Registration

Access the Portal: Go to the official Udyam registration website at udyamregistration.gov.in.

Initiate Registration: Select the option for "For new entrepreneurs who are not registered as MSME."

Aadhaar Authentication: Enter the entrepreneur's Aadhaar number and name, then validate the details using an OTP sent to the linked mobile number.

PAN Verification: Provide the business's PAN details and complete the verification process.

Enter Business Information: Fill in the detailed application form with enterprise specifics, including:

- Business name and address

- Bank account information

- Nature of business activity and NIC code

- Number of employees

Provide Financial Details: Specify the total investment in plant and machinery/equipment and the annual turnover.

Review and Submit: Accept the self-declaration and finalize the submission by verifying with a final OTP.

Receive Certificate: After verification, the Udyam Registration Certificate (featuring a QR code) will be issued to your registered email and will be available for download on the portal.

Essential Documents for Udyam Registration

Identity & Authorization: Aadhaar card of the business owner or authorized representative.

Business PAN: PAN card of the business entity.

Proof of Business Existence: Business registration document (e.g., Partnership Deed, Certificate of Incorporation, etc.).

Address Verification: Proof of business address (such as an electricity bill, telephone bill, or property tax receipt).

Banking Information: Business bank account number and IFSC code.

GSTIN (if applicable): Goods and Services Tax Identification Number, if registered.

Financial Proof: Latest financial statements or turnover details to validate the declared investment and turnover.

Key Benefits of Udyam Registration

Lifelong Validity: Receive a permanent registration number with no requirement for renewal.

Access to Government Schemes: Become eligible for specific MSME schemes, including the Credit Guarantee Scheme and the Public Procurement Policy.

Priority Sector Lending: Gain easier access to loans from banks, which are mandated to lend to the priority sector.

Safeguard Against Delayed Payments: Benefit from legal protection under the MSMED Act for timely payment from buyers.

Streamlined Incentives: Simplify the process of availing various government incentives, subsidies, and support.

Enhanced Business Opportunities: Enables and facilitates participation in government tenders and dedicated MSME support services.

Ultimately, Udyam Registration equips Indian MSMEs for success. It transforms them into formally recognized entities, unlocking financial benefits, legal security, and a competitive edge. This single, paperless registration is a strategic move for any small business aiming to scale and secure a stronger market position.

FAQs

How to link PAN and Aadhaar for Udyam registration?

Linking your PAN and Aadhaar for Udyam registration is an automatic process. When you enter both numbers on the official portal, they are verified and linked online as part of your application, eliminating any need for a separate manual step.

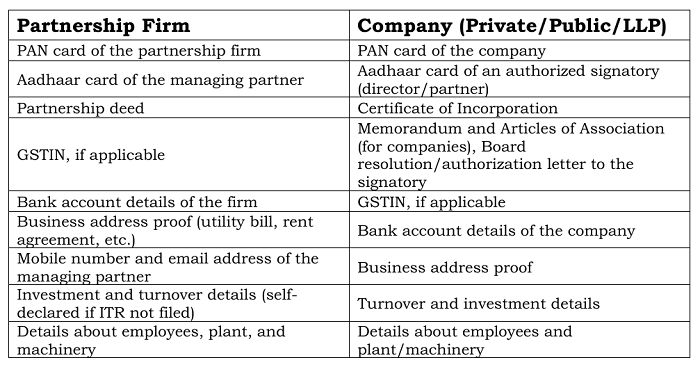

What documents are needed for partnership and company types?

How to correct errors on an existing Udyam certificate?

To correct errors on an existing Udyam certificate:

- Visit the official Udyam portal and login with your Udyam Registration Number.

- Select "Update or Modify Udyam Certificate."

- Make required corrections (except name, state, or district).

- Submit the form with OTP verification.

- Download the updated certificate once changes are approved.

What government schemes require Udyam registration?

Udyam registration is a mandatory prerequisite for MSMEs to avail themselves of most government benefits and participate in official procurement. Key schemes that require it include:

- Priority Sector Lending: Easier access to bank loans.

- CGTMSE Scheme: Collateral-free credit guarantee.

- Public Procurement Policy: Preference in government tenders.

- NSIC Scheme: Simplified registration for raw materials and more.

- Subsidies & Financial Aid: For development and innovation projects.

- Grants & Initiatives: Specifically for startups and rural industries.

CAclubindia

CAclubindia