TCS on sale of any goods - Section 206C (1H) of Income Tax Act,1961

Tax Collected at Source (TCS) is the tax payable by a seller which he collects from the buyer. The rate of TCS is different for goods specified under different categories. Section 206C of the Income Tax Act, 1961 specifies the categories of goods on which the seller has to collect tax from the purchasers.

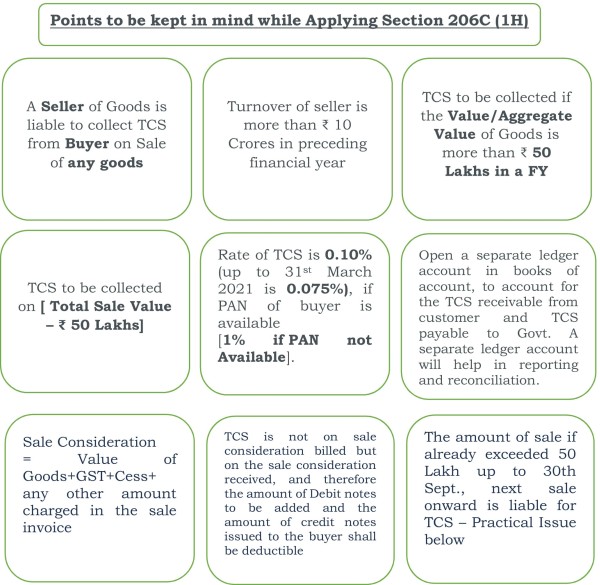

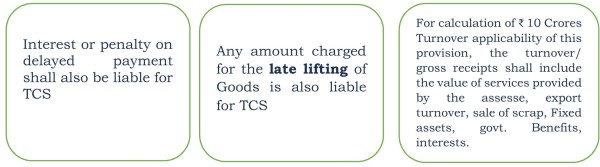

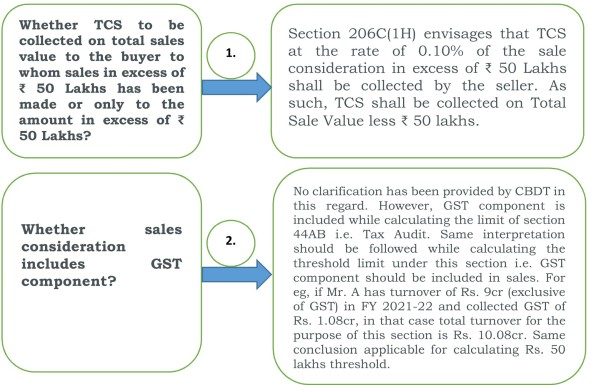

Sub-section (1H) has been inserted in Section 206C by the Finance Act, 2020 for collection of TCS by the seller on the sale of any goods. Though the collection of TCS on sale of certain goods is already covered under different sub-sections of Section 206C, however, all the remaining goods, which are not so covered under other provisions of section 206C, have now been brought under the ambit of TCS by inserting sub-section (1H) in Section 206C.

Section 206C (1H) shall be made effective from 1st October 2020. It states that:

Due Date of Submission the Return and Issuance of Certificate

|

Quarter Ending on |

Due date of submission of return (Form 27EQ) |

Due date for issuance of certificate of tax collected (Form 27D) |

|

30th June |

15th July |

30th July |

|

30th September |

15th October |

30th Oct |

|

31st December |

15th January |

30th Jan |

|

31st March |

15th May |

30th May |

Some Practical Issues while calculating 50 Lakhs Limit, whether the sales before 01-10-2020 shall be considered?

This section was introduced by the Finance Act 2020 and was initially to be made effective from 01-04-2020 i.e. from the beginning of the financial year 2020-21. Now, since, it is being made effective from 01-10-2020 i.e. middle of the FY 2020-21, the pertinent question that arises is whether the sales effected up to 30-09-2020 shall be considered while determining the threshold sale of Rs. 50 Lakhs

No clarification has been issued by the CBDT in this respect. Therefore, in the absence of any clarifications and to be on the safer side, the seller should consider the sale of goods made up to 30-09-2020 while calculating the threshold of Rs. 50 lakhs

Issue 1: Sales made to a buyer is less than Rs. 50 Lacs up to 30-09-2020

|

1 |

Sales up to 30-09-2020 |

Rs. 45 Lacs |

|

2 |

Amount received up to 30-09-2020 |

Rs. 35 Lacs |

|

3 |

Invoices raised from 01-10-2020 |

Rs. 30 Lacs |

TCS shall be applicable beyond receipts of Rs. 50 Lacs. Therefore, on the initial receipt of Rs. 35 Lacs after 01-10-2020, TCS shall not be applicable. Consequently, TCS shall be applicable as and when Rs. 25 Lacs [Rs. 45 Lacs + Rs. 30 Lacs – Rs. 50 Lacs] shall be received

Issue 2: Sales made to a buyer is more than Rs. 50 Lacs up to 30-09-2020:

|

1 |

Sales up to 30-09-2020 |

Rs. 85 Lacs |

|

2 |

Amount received up to 30-09-2020 |

Rs. 30 Lacs |

|

3 |

Invoices raised from 01-10-2020 |

Rs. 20 Lacs |

As TCS shall be applicable beyond receipts of Rs. 50 Lacs. Therefore, on the initial receipt of Rs. 20 Lacs after 01-10-2020, TCS shall not be applicable. Consequently, TCS shall be applicable as and when Rs. 55 Lacs [Rs. 85 Lacs + Rs. 20 Lacs – Rs. 50 Lacs] shall be received

Issue 3: The amount received from a buyer is more than Rs. 50 Lakh up to 30-09-2020:

|

1 |

Sales up to 30-09-2020 |

Rs. 65 Lacs |

|

2 |

Amount received up to 30-09-2020 |

Rs. 55 Lacs |

|

3 |

Invoices raised from 01-10-2020 |

Rs. 20 Lacs |

As TCS u/s 206C(1H) shall be effective from 01-10-2020, therefore TCS cannot be charged on collections made prior to 01-10-2020. Therefore, in this case, TCS shall be charged on the receipt of the amount on or after 01-10-2020 i.e. on Rs. 30 Lacs [Rs. 65 Lacs + Rs. 20 Lacs – Rs. 55 Lacs]

CAclubindia

CAclubindia