Section 206C

Tax Collected at Source:

“TCS is the Tax Collected at Source by the seller (collector) from the buyer(collectee)”. Every person, being a seller, shall collect tax at source (TCS) from the buyer of goods specified in section 206 C (1).

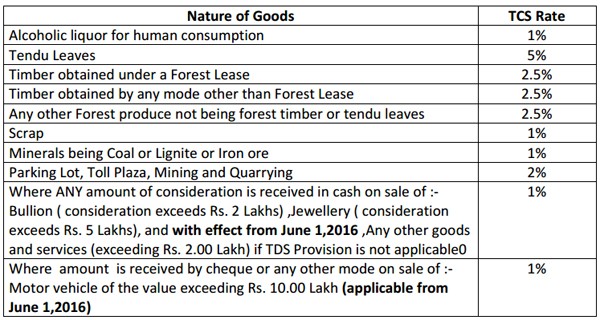

As per section 206C, tax has to be collected at source in the following case:

Finance Act, 2016 imposed TCS on sale of goods or services on receiving consideration in cash with effect from 2016, June 1. Finance Act 2016 has made the following amendments in section 206C of the Act : -

In order to reduce the quantum of cash transaction in sale of any goods and services and for curbing the flow of unaccounted money in the trading system and to bring high value transactions within the tax net, it is proposed to amend the Section 206C of Income Tax Act,1961 to provide that the seller shall collect the tax at the rate of one per cent(i.e. 1% of sale value) from the purchaser on -

- Sale of motor vehicle of the value exceeding ten lakh rupees (Where amount is received by cash, cheque or any other mode); or

- Sale in cash of any goods (other than bullion and jewellery), or providing of any services (other than payments on which tax is deducted at source under Chapter XVII-B) exceeding two lakh rupees.( Amount of consideration is received in cash or partly in cash).

When Tax has to be Collected: Sec. 206 C(1)

-Tax (TCS) has to be collected at the time of debiting of the amount payable to the buyer or at the time of receipt of payment, whichever is earlier.

Definition of various Term in TCS

(a) Seller:

According to this provision every following person is covered under the scope of the seller for the purpose of TCS:

1. The Central and State Government.

2. Local authority

3. Statutory corporation or Authority

4. Company

5. Firm

6. Co-operative society

7. Individual or Hindu undivided family(HUF) ,whose books of accounts are liable to be audited under section 44AB of Income Tax Act.

(b) Buyer:

(i) According to the this provision Buyer Means a person who obtains in any sale, by way of auction, tender or any other mode, goods of the nature specified in the Table in sub section(1) or right to receive any goods but does not include

1. Public sector company, Central Government/State Government, Embassy, a High commission, legation, consulate and the trade representation of a foreign state and a Club ;

2. A buyer in the retail sale of such goods purchased for personal consumption .

(ii). sub section (1D) means a person who obtains in any sale, goods of the nature specified in the said sub section;

‘Therefore goods purchased by end use consumers are not covered under TCS.

Tax collection at lower rate: Section 206C (9):-

Buyer can apply to his Assessing Officer in Form 13 for tax collection at lower rate. On receiving application in Form 13, Assessing officer, if satisfied, may issue such certificate directly to seller under advice to the buyer. This rates is applicable for a specific seller, whose name is given in the certificate and not applicable as blanket approval for purchase of specified goods from anybody else. Where such certificate is given, the person responsible for collecting tax shall, until such certificate is cancelled by the Assessing Officers, collect the tax at the rates specified in such certificate. The certificate shall be valid for the assessment year specified in that certificate unless cancelled by the AO at any time before the expiry of the period of the validity of the earlier certificate.

Nil rate /Exemption: Section 206C (1A)/ (1B)

Notwithstanding anything contained in sub section (1) of section 206C, No tax shall be deducted from a buyer(resident in India) who purchases specified goods not for the purpose of trading but for the manufacturing, processing, or production of goods/article or thing and gives a declaration in duplicate in Form 27C to the seller. The seller shall deliver one copy, form 27C collected from buyer, to Chief Commissioner/ Commissioner of Income tax .

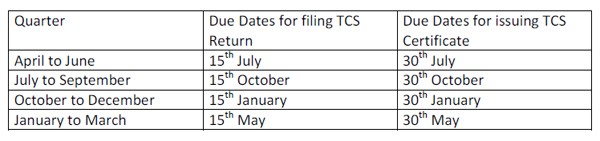

TCS Return:

The seller\ contractor i e. deductor has to file a quarterly return in form 27EQ and in Form 27A and has to issue the TCS certificate to Deductee in Form 27D on or before following Due Date:

Section 206C (7) prescribe Interest at the rate of 1% per month or part thereof for late collection and/or late deposit of TCS with Government.

The author can also be reached at fcasmc@gmail.com

CAclubindia

CAclubindia