Introduction: The recipient of the services from GTA for transportation of goods is required to discharge tax liability under RCM in terms of section 9(3) of CGST Act, 2017 (hereinafter referred to as ‘Act’). Whether such liability needs to be discharged as CGST/SGST or IGST? It depends on the location of the supplier and the place of supply. This article summarises how to identify the type of tax to be paid in case of GTA and the RCM applicability on the security services procured.

Discussion on RCM on GTA services

Let us understand the above referred terms i.e. location of the supplier and the place of supply.

According to Section 7 of the IGST Act, 2017, if the location of supplier (GTA) and the place of supply (PoS) are in the same State then CGST & SGST shall be leviable treating it as an intra-State supply. However, in case the location of the GTA and PoS are in different States then IGST shall be levied; treating it is an inter-State supply.

Location of supplier of services is defined u/s 2(15) of the IGST Act, whereby the following would be the location of the supplier:

- In case supply is made from a registered place of business – such registered place.

- In case supply is made from a fixed establishment that is not registered - location of such fixed establishment.

- In the absence of the above – usual place of residence of the supplier.

Generally, the service recipient would not be aware of the place of business from where the service is provided. In such cases, the service recipient shall consider the details of the service provider mentioned in the invoice. However, to avoid complications, it would be better to get the address of the supplier or his local branch address, if the service is provided from the branch.

PoS shall be determined in terms of section 12(8) of the IGST Act, which is as follows:

a. In case of registered recipient- such location of recipient.

b. In case of unregistered person- the location where the goods are handed over for transportation.

Hence if the customer obtains GTA services from a transporter located outside the Telangana (say) then it shall pay IGST under RCM, else CGST and SGST.

Let us understand the same by taking different scenarios:

|

Sl. No |

Scenarios |

Location of Supplier |

PoS |

Type of tax |

|

1 |

Where GTA is in Kerala and details of Kerala’s registration are mentioned in LR |

Kerala – registered place of business |

Registered place of business of the recipient (i.e Telangana). |

IGST |

|

2 |

Goods are handed over in Telangana, GTA is registered in both West Bengal & Telangana but West Bengal GSTIN and address mentioned in LR |

West Bengal -usual place of residence/fixed establishment |

Registered place of business of the recipient (Telangana). |

IGST |

|

3 |

Where details of Telangana registration are mentioned in LR |

Telangana – registered place of business |

Registered place of business of the recipient (Telangana). |

CGST/SGST |

|

4 |

Where details of its Hyderabad address is mentioned in LR |

Hyderabad |

Registered place of business of the recipient (Telangana). |

CGST/SGST |

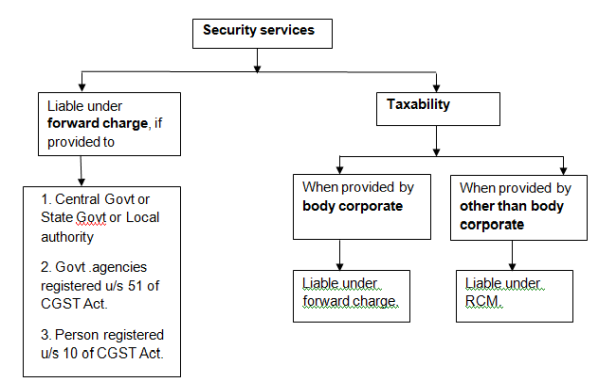

Discussion on RCM on security services

With effect from 01.01.2019 security services have been made liable under RCM vide notification No.29/2018-Central Tax (Rate) dated 31.12.2018. The relevant text of the notification is as follows:

“Security services by way of services of security personnel provided other than body corporate to any registered person shall be paid by such registered person”, subject to certain exceptions.

The term security service is defined under the said notification as “services by way of supply of security personnel”.

Forward charge shall be applicable when security services are provided to the following persons:

(1) A department or establishment of the Central Government or State Government or Union Territory or

(2) Local authority or

(3) Government agencies who have taken registration under the GST only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services.

(4) A person registered under composition scheme (as per section 10 of CGST Act).

The above discussion on security services can be summarized in form of a flow chart which is as follows:

By: CA Monika Motta and Hema Muralidharan

CAclubindia

CAclubindia