In 2012, Govt. of India has changed the overall taxation of Service tax and that time they had presented a different taxation method to levy service tax on services which was negative List Based taxation method. All the services except services provide in Negative List and Exempted Services are taxable in India. This year in the Finance Bill 2015 Govt. of India again added some services in the list of taxable services and deletes the same from the list of Exempted services and made taxable for the first time. These are further taxable through the route of Reverse Charge mechanism.

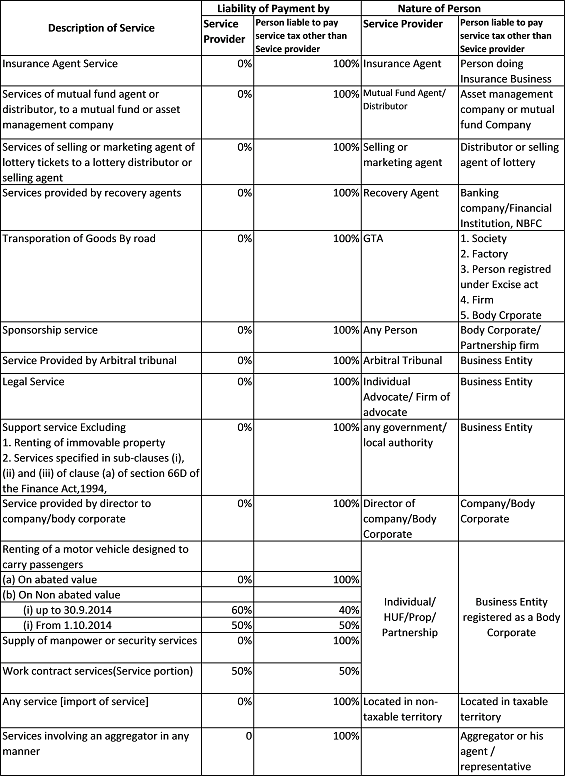

Changes in Reverse Charge Mechanism i.e Notification No. 30/2012 is as follow:

1. Service which are taxable for the first time and taxable through the route of Reverse Charge mechanism from 01st April 2015 is as follow:

i. Service by Mutual fund agent or distributer to Mutual Fund Company or Assets Management Company.

ii. Service by selling or marketing agent of lottery ticket to a lottery distributor or selling agent

2. Service provided by a person involving an aggregator in any manner is taxable for first time from 01st March, 2015. Further definition of Aggregator has been from added under new clause (aa) of Sub-rule (1) of Rule 2 of Service Tax Rules 1994.

“Aggregator” means a person, who owns and manages a web based software application, and by means of the application and a communication device, enables a potential customer to connect with persons providing service of a particular kind under the brand name or trade name of the aggregator.

3. From 01st April 2015, Services by way of supply of manpower or security service has been brought under full reverse charge. Earlier it was under partial reverse charge and Service provider was liable to pay 25% of service tax and service receiver was liable to pay 75% of service tax.

4. Definition of Support Service has been deleted and All Service except Renting of immovable property, and services specified in sub- clauses (i), (ii) and (iii) of clause (a) of section 66D of the Finance Act, 1994 provided By Any Government or Local authority to business entity will be covered under Reverse Charge mechanism unless any service exempt under anywhere. These Changes will be notified by Central Govt. through Gazetted Notification.

Updated Chart of Reverse Charge is given below:

Other Points to be considered

1. Under full Reverse Charge Mechanism Cenvat Credit of service tax can be taken on payment of taxes to Govt. even service amount have not been paid to Service provider.

2. Under Partial Reverse Charge Mechanism Cenvat Credit of Service tax paid by service provider can be taken after receipt of Bill but Cenvat credit of service tax paid by service receiver can be taken only after payment of Taxes to Govt. as like Full Reverse charge Mechanism.

Earlier Cenvat Credit of service tax paid by service receiver under Partial Reverse Charge Mechanism can be taken when Service tax has been to Govt. and bill amount has also been made to Service provider. This change has been applicable from 01st April, 2015.

3. Cenvat Credit of service Tax can be availed within one year from date of payment of service Tax to Govt. Earlier Time limit was only 6 Month. This change is applicable from 01st April, 2015.

4. Point of Taxation in case of Reverse Charge is Date of Payment provide if payment is not made within 6 month from the date of invoice then Point of taxation shall be determined as if this rule does not exist.

CAclubindia

CAclubindia