Gold transcends its material value in India - it embodies tradition, heritage, and financial security. For centuries, Indians have relied on gold as a stable, liquid, and inflation-resistant asset, blending cultural significance with economic utility.

Taxes typically apply when selling gold jewellery, and for the financial year 2025-26, certain tax regulations have been revised. However, you may qualify for an exemption if the sale proceeds are used to purchase residential property.

Under the Income Tax Act, 1961, gold jewellery is classified as a capital asset. This means any profit earned from its sale is taxable as capital gains, depending on how long you held it.

Holding Period

Short-Term Capital Gain (STCG): If you sell the gold jewellery within 24 months of acquiring it, the gain is considered short-term. STCG is added to your total income and taxed at your applicable income tax slab rates.

Long-Term Capital Gain (LTCG): If you sell the gold jewellery after holding it for more than 24 months, the gain is considered long-term.

LTCG Tax on Gold (FY 2025-26 Update)

As per the Union Budget 2024, if you sell gold on or after July 23, 2024, the long-term capital gains (LTCG) tax rate is 12.5% (flat) without indexation benefit. Earlier, the rate was 20% with indexation.

Tax Exemption on Gold Sale for Home Purchase (Section 54F)

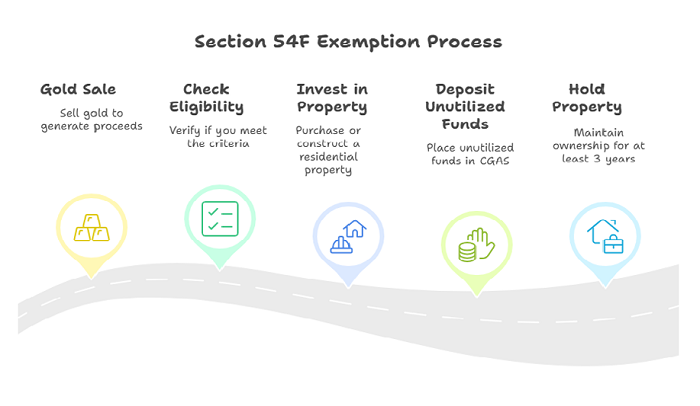

If you sell gold jewellery (a capital asset) and reinvest the full sale proceeds into buying or constructing a residential property, you can claim exemption from Long-Term Capital Gains (LTCG) tax under Section 54F of the Income Tax Act.

Section 54F Exemption: Key Conditions for Gold-to-House Investment (FY 2025-26)

To qualify for full LTCG tax exemption when reinvesting gold sale proceeds into residential property, you must meet these requirements:

Who Can Claim?

Individuals & HUFs only (companies/firms ineligible)

Gold Holding Period

Jewelry must be held for >24 months (long-term capital asset)

Property Investment Timeline

Purchase Option: Buy 1 year before or 2 years after gold sale date

Construction Option: Complete construction within 3 years of sale

Ownership Rules

On gold sale date, you must:

- Own ≤1 residential house (excluding the new one)

- Not acquire another house within 2 years (purchase) or 3 years (construction)

Investment Amount Impact

- Full exemption: If 100% sale proceeds (e.g., ₹25L) reinvested

- Partial exemption: If partially reinvested →

Formula:

| Exemption = (Capital Gain × Amount Invested) ÷ Net Sale Value |

New Limits (FY 2025-26)

Max deduction capped at ₹10 crore per financial year

Capital Gains Account Scheme (CGAS)

- Unutilized funds must be deposited in CGAS before ITR filing deadline.

- Must be used for property within specified timelines, else taxed

Lock-in for New Property

Minimum 3-year holding – if sold earlier, exemption reverses and tax applies

Key Updates for Gold Sales in FY 2025-26

Revised ITR Reporting Requirements

For AY 2025-26 (FY 2024-25 onwards), taxpayers must separately disclose capital gains based on the sale date:

- Pre-July 23, 2024: 20% LTCG tax with indexation

- Post-July 23, 2024: Flat 12.5% LTCG tax (no indexation)

This bifurcation applies even for transactions in FY 2025-26, as the new rates are already effective.

Documentation

- Maintain clear records of:

- Sale/purchase dates

- Brokerage statements (if applicable)

- Property registration documents (for Section 54F claims)

CAclubindia

CAclubindia