Overview:

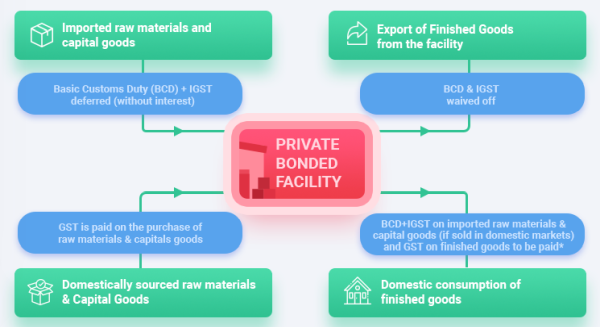

With the Government's continuous efforts to promote India as the manufacturing hub globally and the commitment towards ease of doing business, another initiative in this direction by the Central Board of Indirect Taxes (CBIC) is allowing import of raw materials and capital goods without payment of duty for manufacturing and other operations in a bonded manufacturing facility.

When the raw materials or capital goods are imported, the import duty on them is deferred. If these imported inputs are utilized for exports, the deferred duty is exempted. Only when the finished goods are cleared to the domestic market, import duty is to be paid on the imported raw materials used in the production. Import duty on capital goods is to be paid if and when the capital goods are cleared to the domestic market.

*When finished goods are exported, in addition to the waiver of BCD + IGST on the imported goods used, the GST on the finished goods can be zero-rated.

Advantages of Bonded Manufacturing:

Highlights:

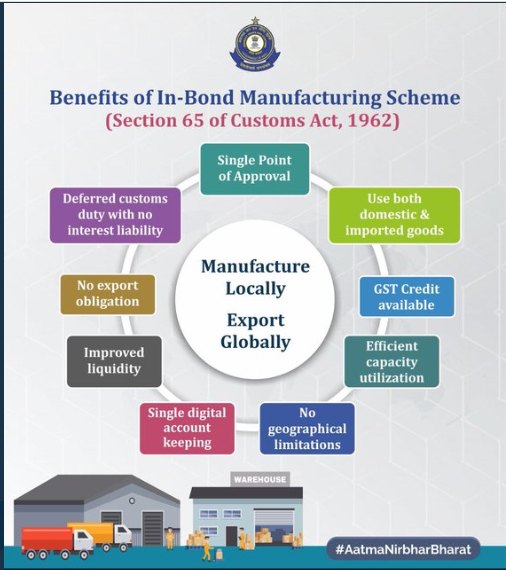

- Deferred Duty on Imported Capital Goods: Duty on capital goods used in manufacturing or other operations is deferred until their clearance from bonded facility. Capital Goods can be sold to foreign manufacturers after utilization deferred duty also can be avoided

- Deferred Duty on Imported Raw Materials: Duty on imported Raw Materials used in manufacturing or other operations is deferred until clearance of finished goods. Deferred duty is waived in case finished goods are exported.

- Warehouse to Warehouse Duty Free transfer allowed

- No fixed export obligation: No limit on the share of clearance of finished goods in domestic market. An entity can manufacture in a bonded facility and sell 100% of finished goods in domestic market.

Types of Beneficiaries:

Through bonded manufacturing, all types of businesses can avail exemption on customs duty on imported inputs used in the production of finished goods to be exported. In the case of domestic consumption, the duty on imported inputs is deferred until the finished goods are cleared to the domestic market.

or better understanding, illustrations below show how a manufacturer and an e-commerce service provider benefit from bonded manufacturing.

- A leading Japanese automobile manufacturer intends to manufacture vehicles in India

- They file an application for licensing a facility near Nagpur, Maharashtra and import required inputs for production like airbags, gearboxes and capital goods.

- The duty on such imports is deferred, which provides additional working capital support to the manufacturer.

- The manufacturer exports 70% of the total produced vehicles and deferred duty on that portion is waived while deferred Custom Duty and IGST are paid on the remaining 30% vehicles at the time of their sale domestically across India.

- The manufacturer benefits from deferred duty on imported inputs and from reduced production cost due to duty-free imports.

Steps to Start Manufacturing:

STEP ONE:

Fill online application as per Annexure A along with the following details:

- Nature of manufacturing

- Particulars of imported inputs

- Anticipated trade volume, etc.

List of documents required:

- Certificate of Incorporation (For companies)

- MoO and AoA (For partnership firm)

- Partnership Deed (For partnership firm)

- Copy of ID proofs of proprietors/ partners/ directors

- Copy of Aadhar Card of Authorised Signatory

- Documents supporting property-holding rights, such as rent agreement

- Copy of warehouse license, if issued earlier

- Ground plan of the site with details

- Fire safety audit certificate

STEP TWO:

- Execute a bond as per Annexure C and submit a physical copy to your Jurisdictional Commissioner of Customs.

- Maintain detailed accounts as per Annexure B

Note: Before execution of a Bond, a Customs Officer visits the facility to evaluate the compliances in order to issue the license.

STEP THREE:

Grant of Sanction

- Commissioner of Customs grants the permission for manufacturing or other operations in the bonded facility

- Permission also includes:

- Manufacturing process or other operations permitted

- Conditions regarding manufacturing

STEP FOUR:

Start Manufacturing or Other Operations

The processes for availing the license for a private bonded facility (as per Section 58) and for manufacturing or performing other operations (as per Section 65) are combined under single application as per Annexure A.

Steps for Clearance of Warehoused Goods:

TO DOMESTIC MARKET FOR CONSUMPTION:

When warehoused goods are used for manufacturing or other operations & finished goods are domestically consumed or

TO A CUSTOMS STATION FOR EXPORT:

When warehoused goods are used for manufacturing or other operations & finished goods are exported

TO ANOTHER BONDED MANUFACTURING FACILITY*

When warehoused goods are used as raw materials by another industry

*When goods are transferred from one bonded facility to another, incidence to pay deferred duty is also transferred to the owner of the new facility.

Warehoused goods are permitted for clearance after:

- All compliances are met by the owner of goods as per executed Bond.

- Deferred duty on imported raw materials or capital goods is paid.

- GST is paid on the finished goods.

- Any other compliance as per the Customs Act or any other applicable regulations are met.

Follow Simple Steps to Transport Warehoused Goods:

- Form for Transfer of goods from a facility appended in Warehouse Goods (Removal) Regulations Act, 2016 to transport warehoused goods.

- Licensee of the originating warehouse affixes a one-time-lock, unless permitted by the Commissioner of Customs to transport without the lock, depending upon the nature of goods or the manner of transport.

- Produce ‘Acknowledgement' received from the licensee of the recipient warehouse stating arrival of goods to Bond Officer of the originating warehouse.

- Acknowledgement is to be produced in 1 month.

Requirements for Record-keeping:

1. Maintenance of records:

- Maintain detailed records of receipt, handling, storing and removal of goods into/ from the facility as per Annexure B.

- Keep record of each activity, operation or action taken in relation to the warehoused goods.

- Keep record of drawl of samples from the warehoused goods.

- Keep copies of the following documents:

- Bills of Entry

- Transport documents

- Forms for transfer of goods from warehouse

- Shipping Bills

- Bills of Export

- Any other documents indicating receipt/ removal of goods from the warehouse

2. Preservation of physical and digital records:

- Update records and accounts accurately and preserve for a minimum 5 years from the date of removal of goods from the facility.

- Preserve updated digital copies of records at a place other than the facility to prevent loss of records due to natural calamities.

3. Filing monthly returns:

File monthly returns within 10 days of closing of the month.

If licensees fail to comply with any of the provisions of these regulations, they shall be liable to a penalty in accordance with the provisions of the Customs Act, 1962.

Stakeholders:

Government Ministry/Department:

- Central Board of Indirect Taxes & Customs

- GST Commissionerates

- State Tax Departments

- Jurisdiction Commissionerate Office

FAQs:

1. Who is eligible for applying for manufacture and other operations in a bonded warehouse?

- The following persons are eligible to apply for manufacture and other operations in a bonded warehouse –

- A person who has been granted a licence for a warehouse under Section 58 of the Customs Act, in accordance with Private Warehouse Licensing Regulations, 2016.

- A person can also make a combined application for a license for a warehouse under Section 58, along with permission for undertaking manufacturing or other operations in the warehouse under Section 65 of the Act. The persons mentioned have to be a citizen of India or an entity incorporated or registered in India.

2. Can a factory that is solely into manufacturing goods, which are to be sold in the domestic market, eligible for applying for manufacture and other operations in a bonded warehouse?

The eligibility of a factory for manufacture and other operations in a bonded warehouse does not depend upon whether the final goods will be sold in the domestic market or exported. There is no quantitative restriction on the sale of finished goods in the domestic market. Any factory can avail a license under Section 58 of the Customs Act along with permission under Section 65 if they intend to import goods without upfront payment of Customs duty at the point of import and deposit them in the warehouse, either as capital goods or as inputs for further processing.

3. Is an existing factory which solely manufactured goods to be sold in the domestic market, eligible for application for manufacture and other operations in a bonded warehouse? How will the existing capital goods and inputs be accounted?

Yes. Any unit in the Domestic Tariff Area (DTA) is eligible for making an application for manufacture and other operations in a bonded warehouse i.e. an old factory in DTA is eligible for applying. The accounting form prescribed for the units undertaking manufacture and other operations in a bonded warehouse provides for an accounting of DTA receipts. Thus the existing capital goods and inputs must be accounted for in the accounting form prescribed. The form also provides for a remarks column in case certain remarks are to be entered.

4. Are manufacture and other operations in a bonded warehouse allowed in Public Bonded Warehouse licensed under Section 57 of the Customs Act?

No. At present, manufacture and other operations in a bonded warehouse is allowed only in a Private Bonded Warehouse licensed under Section 58 of the Customs Act.

5. Will a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, be under the physical control of Customs?

No. There is no physical control of a unit licensed under Section 65 and Section 58 of the Customs Act, 1962 , on a day to day basis. The unit will be subject to risk-based audits.

6. Can the license under Section 65 and Section 58 of the Customs Act, 1962, be obtained on bare land with identified boundaries or a built structure is imperative for obtaining the said license?

The regulations do not mandate that a fully enclosed structure is a prerequisite for the grant of license. What is important is that the site or building is suitable for secure storage of goods and discharge of compliances, such as proper boundary walls, gate(s) with access control and personnel to safeguard the premises. Moreover, depending on the nature of goods used, the operations, and the industry, some units may operate without fully closed structures. The Principal Commissioner/Commissioners of Customs will take into consideration the nature of premises, the facilities, equipment, and personnel put in place for secure storage of goods, while considering the grant of license.

7. Do we need to renew license under Section 58 or permission under Section 65?

- The license and permission granted is valid unless it is cancelled or surrendered, or the license issued under Section 58 is cancelled or surrendered. Thus no renewal of the license under Section 58 or permission under Section 65 is required.

8. Can a unit undertaking manufacture and other operations in a bonded warehouse import capital goods without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

- A unit licensed under Sections 58 and 65 can import capital goods and warehouse them without payment of duty. Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus both BCD and IGST on imports stand deferred. In the case of capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption or are exported. The capital goods can be cleared for home consumption as per Section 68 read with Section 61 of the Customs Act on payment of applicable duty without interest. The capital goods can also be exported after use, without payment of duty as per Section 69 of the Customs Act. The duty deferment is without any time limitation.

9. Would any customs duty be payable on the goods manufactured in the bonded premises using the imported capital goods (on which duty has been deferred) and sold into the domestic tariff area?

- The payment of duty on the finished goods is clarified in Paras 8 and 9 of the Circular No. 34/2019. Duty on the capital goods would be payable if the capital goods itself are cleared into the domestic market (home consumption). Thus the duty on the capital goods does not get incorporated on the finished goods. Thus no extra duty on finished goods cleared into DTA is payable on account of imported capital goods (on which duty has been deferred)..

10. Can a unit undertaking manufacture and other operations in a bonded warehouse import inputs without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus both BCD and IGST on imports stand deferred. In the case of goods other than capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption, and no interest is payable on duty. In case the finished goods are exported, the duty on the imported inputs (both BCD and IGST) stands remitted i.e. they will not be payable. The duty deferment is without any time limitation.

11. Is the import of raw material without BCD and IGST allowed? Will there be any interest obligation if IGST is paid when finished goods are sold in domestic markets?

Inputs/raw materials can be imported and deposited in the licensed warehouse without payment of BCD and IGST. No interest liability arises when the duties are paid at the time of ex-bonding the resultant goods. The duties (without any interest) are to be paid only when the resultant goods are being cleared for home consumption.

12. Would it be mandatory to appoint a warehouse keeper in the factory licensed under Section 65 of the Customs Act? Would all goods clear from the said factory be subject to inspection by the warehouse keeper/ Customs authorities?

A warehouse keeper has to be appointed, for a premise to be licensed as a private warehouse under Section 58 of the Customs Act. The warehouse keeper is expected to discharge duties and responsibilities, maintain accounts, and also sign the documents, on behalf of the licensee. The warehouse keeper is expected to supervise and satisfy himself about the veracity of the declaration/accounts that he is signing. The inspection of goods by customs at the stage of ex-bonding would be done, only if there is an indication of risks and not as a matter of routine practice. Approval of the bond officer is not required for clearance of the goods from the warehouse.

13. How frequently is an audit of a unit operating under Section 65 of Customs Act, 1962 expected?

The audit of units operating under Section 65 would also be based on risk criteria. There is no prescribed frequency for such an audit.

14. What is the customs document/ form for movement of imported goods on which duty has been deferred to/ from a unit undertaking manufacture and other operations in a bonded warehouse? Are such goods required to be under customs escort during their movement?

- Following are the customs document for movement of imported goods on which duty has been deferred to/ from a unit undertaking manufacture and other operations in a bonded warehouse:

- Customs Station to Section 65 unit : Bill of entry for warehousing. It is clarified that no separate form is prescribed for movement from Customs station to Section 65 unit as the goods are already accompanied by the Bill of entry for warehousing.

- From another warehouse (non-section 65) to a Section 65 Unit: Form for transfer of goods from a warehouse as prescribed under the Warehoused Goods (Removal) Regulations, 2016. This is because the warehouse which is not a Section 65 unit has to follow the Warehoused Goods (Removal) Regulations, 2016.

- From Section 65 Unit to another warehouse (the other warehouse can be a Section 65 unit or a non-Section 65 warehouse) : Form prescribed in Manufacture and Other Operations in Warehouse (no. 2) Regulations, 2019.

The goods will not be under customs escort during movement.

15. If the imported capital goods are cleared for home consumption after use, is depreciation available?

No. Depreciation is not available if imported capital goods (on which duty has been deferred) are cleared for home consumption after use in a Section 65 unit.

16. If the imported capital goods are cleared for export after use, is depreciation available?

The imported capital goods (on which duty has been deferred) after use in a Section 65 unit can be exported without payment of duty as per Section 69 of the Customs Act. For the purposes of the valuation of the export goods, the same will be as per Section 14 of the Customs Act read with the Customs Valuation (Determination of Value of Export Goods) Rules 2007.

17. Can all export benefits under FTP and Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 (IGCR) be taken in Bonded warehouse simultaneously?

The eligibility to export benefits under FTP or IGCR would depend upon the respective scheme. If the scheme allows, the unit operating under Section 65 has no impact on eligibility. In other words, a unit operating under Section 65 can avail of any other benefit, if the benefits scheme allows.

18. What will be the method of inventory control method in Section 65 units? Whether First in First Out (FIFO) method can be followed?

The Generally Accepted Accounting Principles will be followed for inventory control in a Section 65 unit. Thus the FIFO method can be followed.

19. What is the procedure and documentation requirements for re-entry of manufactured goods, returned by the customers for repair, in the premises?

Once the goods are cleared from the warehouse, they will no longer be treated as warehoused goods. Thus if the resultant goods cleared from the warehouse are returned by the customer for repair, they will be entered as DTA receipts (this is provided in the accounting firm). After repair, when the same is cleared from the warehouse, the same will be entered in the prescribed accounting form. If the goods were exported and subsequently rejected or sent back for repair by the customer, then the goods upon re-import have to be entered as Imports receipts in the accounting firm. The relevant customs notification for re-imports has to be followed while filing the Bill of Entry for re-import of the goods.

20. What is the procedure for the surrender of license for a Section 65 unit?

Since the unit operating under Section 65 is also licensed as a Private Bonded warehouse under Section 58 of the Customs Act, the procedure for the surrender of the licence will be as per the regulation 8 of the Private Warehouse Licensing Regulations, 2016. A licensee may, therefore, surrender the license granted to him by making a request in writing to the Principal Commissioner of Customs or Commissioner of Customs, as the case may be. On receipt of such a request, the license will be cancelled subject to payment of all dues and clearance of remaining goods in such warehouse.

Disclaimer: This article or blog or post (by whatever name) is based on the writer's personal views. The writer does not accept any liabilities for any loss or damage of any kind arising out of information and for any actions taken in reliance thereon. This article has been published for knowledge sharing purpose only.

The author is a practicing Chartered Accountant with an overall 20 years' experience in both Industry as well as an independent practice and can also be reached at cacafe4you@gmail.com

Source: Investindia.gov

CAclubindia

CAclubindia