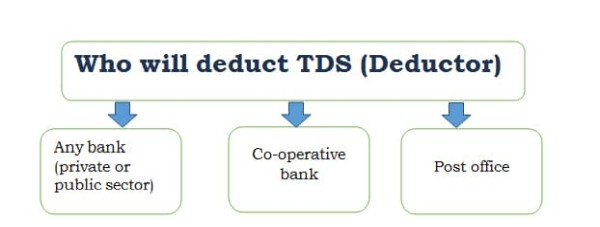

In order to discourage cash transactions and move towards cash-less economy, a new Section 194N (Introduced via Union Budget 2019) has been inserted under Income-tax Act with effect from September 1, 2019 to provide for deduction of tax on cash withdrawals made by any person from his bank or post-office account.

Meaning of Section 194N

Section 194N is applicable in case of cash withdrawals of more than Rs. 1 crore during a financial year. This section will apply to all the sum of money or an aggregate of sums withdrawn from a particular payer in a financial year.

Further, while calculating the limit of Rs 1 Crore limit all accounts maintained by a person with one bank are to be considered. Which means,

Mr.Raju has withdrawn the following amounts from different branches for HDFC Bank.

• Rs 50 lakh from Branch A

• Rs 30 lakh from Branch B

• Rs 40 lakh from Branch C

• Rs 20 lakh from Branch D of Axis Bank

In this case as per provisions of section 194N 2% TDS would be deducted by HDFC Bank on Rs 20 lakh i.e. TDS @2% by HDFC Bank Rs. 40,000

Non Applicability

The provisions under section 194N are not applicable in case payment is made to the following person:

• Government

• Banking company

• Co-operative society engaged in the business of banking

• Any business correspondent authorized by RBI

• Any white label automated teller machine (ATM) operator authorized issued by the RBI

• Any other person which central government may specify by the notification.

• As per recent notification (NN 70/2019) dated 20 September, 2019 – NoTDS under section 194N shall be deducted on cash withdrawal made by

o Commission agents or

o Trader operating under Agriculture Produce Market Committee (APMC) for the purpose of making payments to the farmers on account of purchase of agriculture produce.

Point of TDS

TDS will be deducted by the payer while making the cash payment over and above Rs 1 crore in a financial year to the payee. If the payee withdraws a sum of money on regular intervals, the payer will have to deduct TDS from the amount, once the total sum withdrawn exceeds Rs 1 crore in a financial year. Further, the TDS will be done on the amount exceeding Rs 1 crore. For example, if a person withdraws Rs 98 lakh in the aggregate in the financial year and in the next withdrawal, an amount of Rs 2,50,000 is withdrawn, the TDS liability is only on the excess amount of Rs 50,000.

Section 194N is applicable from 01st September, 2019 hence any cash withdrawal prior to 01st September, 2019 will not be subject to TDS. However, cash withdrawal before 01st September, 2019 shall be counted for threshold of Rs 1 cr. Let's understand this with a case:

Case 1:

Ram Ltd has made Withdrawn cash Rs 1.40cr on 20 July, 2019

In this case TDS will not be deducted because cash was withdrawn before September 01, 2019

Case 2:

Shyam Ltd has made the following cash withdrawals during the FY 2019-20

- Rs. 95lac on 20 Aug, 2019 and

- Rs. 10lac on 02 Sep, 2019

Now, two separate calculations would be made in this case

Calculation -1

Calculation of Rs 1cr Limit for applicability of section 194N:

The Limit of Rs 1cr will be calculated for all cash withdrawals made from 1st April 2019. Therefore, the total cash withdrawal in this case is Rs 95lac + Rs 10lac = Rs 1.05 lac

Hence, Section 194N will be applicable in this case.

Calculation -2

Calculation of TDS Under Section 194N:

Cash withdrawn on 20 Aug, 2019: 92 lac

Cash withdrawn on 2 Sep, 2019: 23 lac

Total cash withdrawn: 1.15 cr

Less: Threshold Limit of Rs 1 cr: 1cr

Amount Eligible for TDS u/s 194N: 15lac

TDS @ 2%: 30,000

Rate of TDS

The payer will have to deduct TDS at the rate of 2% on the cash payments/withdrawals of more than Rs 1 crore in a financial year under Section 194N.

Let's understand the practical aspects of this section: -

Example1: Mr. Mallya has saving and current account with a bank. The details of cash withdrawn from both the accounts are as follows:

|

Date of cash withdrawn |

Cash withdrawn from saving account |

Cash withdrawn from current account |

|

01-04-2018 |

40,00,000 |

10,00,000 |

|

31-03-2019 |

70,00,000 |

60,00,000 |

|

01-04-2019 |

20,00,000 |

20,00,000 |

|

05-07-2019 |

5,00,000 |

10,00,000 |

|

31-08-2019 |

4,00,000 |

25,00,000 |

|

01-09-2019 |

50,00,000 |

45,00,000 |

|

01-03-2020 |

55,00,000 |

20,00,000 |

|

30-04-2020 |

1,20,00,000 |

5,00,000 |

|

Total amount withdrawn |

||

|

(a) In FY 2018-19 |

1,10,00,000 |

70,00,000 |

|

(b) In FY 2019-20 |

||

|

- Up to 31-08-2019 |

29,00,000 |

55,00,000 |

|

- 01-09-2019 onwards |

1,05,00,000 |

65,00,000 |

|

(c) FY 2020-21 |

1,20,00,000 |

5,00,000 |

Answer

|

Financial Year |

Cash withdrawn from |

Total Cash withdrawn |

Tax to be deducted |

|

|

Saving Account |

Current Account |

|||

|

2018-19 |

1,10,00,000 |

70,00,000 |

1,80,00,000 |

Nil |

|

2019-20 |

1,34,00,000 |

1,20,00,000 |

2,54,00,000 |

3,08,000 |

|

2020-21 |

1,20,00,000 |

5,00,000 |

1,25,00,000 |

50,000 |

Example 2: Suppose in the above example, Mr. Mallya has also withdrawn the following amounts during the year:

|

Date of cash withdrawn |

Cash withdrawn from saving account |

Cash withdrawn from current account |

|

30-07-2019 |

1,00,00,000 |

50,00,000 |

|

Total amount withdrawn |

||

|

In FY 2019-20 |

||

|

- Up to 31-08-2019 |

1,29,00,000 |

1,05,00,000 |

|

- 01-09-2019 onwards |

1,05,00,000 |

65,00,000 |

Answer

|

Financial Year |

Cash withdrawn from |

Total Cash withdrawn |

Tax to be deducted |

|

|

Saving Account |

Current Account |

|||

|

2019-20 |

2,34,00,000 |

1,70,00,000 |

4,04,00,000 |

3,40,000 |

Although the amount of cash withdrawn from the Mr. Mallya's bank accounts before September 1, 2019 exceeds Rs. 1 crore but no TDS will be deducted on such amount. TDS will be deducted only on the amounts which are withdrawn on or after September 1, 2019, i.e. Rs. 1,70,00,000 (1,05,00,000 + 65,00,000).

Frequently Asked Questions (FAQs)

1. Can we submit lower TDS certificate for the purpose of Section 194N?

No, lower TDS certificate cannot be submitted for the purpose of the provisions under Section 194N

2. ABC has withdrawn Rs. 1cr in cash, whether TDS u/s 194N will be deducted in this case?

No, TDS will not be deducted in this case as aggregate amount withdrawn in cash does not exceed Rs. 1cr.

3. Whether the limit of Rs. 1cr is for single account or for all accounts maintained with a bank?

Cash withdrawn from Saving Account (from all branches) : 45 lac

Cash withdrawn from Current Account (from all branches) : 65 lac

Total cash withdrawn : 1.10 cr

Amount eligible for TDS deduction u/s 194N: 10 lac

4. How the tax deducted under Section 194N will be reflected under Form 26AS?

Form 26AS is a statement for such income on which tax is deducted and deposited to government by deductor.

5. Withdrawal considered as income?

Cash withdrawal cannot be considered as an income. Therefore, the government has simultaneously amended section 198 of the Income Tax Act wherein it is clarified that cash withdrawal shall not be deemed to be the income of the person

6. If A Ltd maintains an account with ICICI Bank. Now, A Ltd issue a bearer cheque/ Demand Draft of Rs. 2 crores to B Ltd and B Ltd encash the cheque from the Bank. Whether TDS is deductible in such case?

As there is no clarity provided in law. There are different opinions on the same. As per first opinion, TDS shall be deducted in this case. However, as per other possible view, TDS is not applicable as account holder is requesting the bank to issue a bearer cheque or demand draft and he is not withdrawing cash under the purview of Section 194N

7. Can we claim the credit of TDS deducted u/s 194N?

Since the implementation of Section 194N has recently been made effective hence there is no practical clarity on the matter. Different opinions are being taken up for claiming of credit of TDS deducted u/s 194N.

- As per opinion of majority you can validly claim credit/refund of TDS deducted u/s 194N while filing your Income Tax Return. The support for this opinion can be found in the fact that the TDS amount is reflected in 26AS and hence can be validly claimed.

- On the other side since the law has made the use of words Levy of TDS and no levy like surcharge or cess can be claimed as a refund. Hence, some opinion that the credit of TDS deducted u/s 194N cannot be claimed.

The authors can also be reached at ayush7agarwal@gmail.com & Agarwal.piyush093@gmail.com

CAclubindia

CAclubindia