Points To Remember

| Section 194C | Deals with TDS on payments made to resident contractors and sub-contractors. |

| Who Needs to Deduct | If any person makes payment to resident contractors or subcontractors for work done under a contract are required to deduct TDS. |

| Work under Section 194C | It encompasses various activities such as advertising, broadcasting etc. |

| Clarity in billing | Invoice for labor charges and material costs must be created separately as TDS is calculated based on separate billing for. If not separated, TDS applies to the total invoice. |

| TDS Rates |

|

| Timing of Deduction | TDS is deducted at the time of payment or credit, whichever earlier. |

| Threshold Limits |

|

| Form Requirement | Form No. 16A are required to be issued quarterly to contractors, with specific due dates for non-government and government deductors. |

Table of Contents

- What is TDS Section 194C?

- Who is liable to deduct TDS under Section 194C?

- Who is a sub-contractor?

- Non-applicability of section 194C

- Rate of TDS under section 194C?

- What is the time of the deduction of TDS under section 194C?

- Threshold limit under TDS section 194C?

- What is the due date to deposit TDS?

What is TDS Section 194C?

TDS Section 194C contains provisions with respect to TDS on payment made to resident contractors and sub-contractors. Section 194C is a very important section, and it has wide implications in various business scenarios. If you are working in the accounting section of any business organization, you should have deep knowledge of the provisions of this section 194 C of the Income Tax Act, 1961.

Who is liable to deduct TDS under Section 194C?

Any person who is liable to make payment to any resident contractor/sub-contractor for carrying out any work in pursuance of a contract.

Any payment made to a contractor or subcontractor is liable for deduction of tax at source in the following situations:

(i) Payment is made for carrying out any work; e.g. goods sent on job work.

(ii) Supplying labor for carrying out any work e.g. labor contractor supplies labor for working in factory premises.

(iii) Other items mentioned in the definition of work (i.e. point no. 'a' to 'd' of definition given below).

Work is defined in the explanation as reproduced below:

"work" shall include -

(a) advertising;

(b) broadcasting and telecasting including production of programmes for such broadcasting or telecasting;

(c) carriage of goods or passengers by any mode of transport other than by railways;

(d) catering;

(e) manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer,

but does not include manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from a person, other than such a customer.

Definition of work is self-explanatory. However, the discussion is needed on point no. (e).

|

Part (i) of the point no. (e) |

|

|

manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer, |

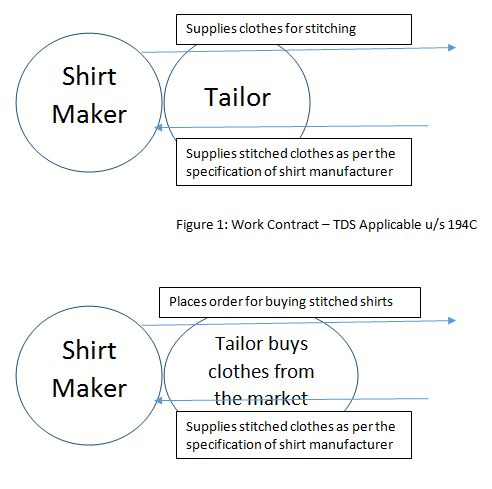

Suppose, shirt manufacturer, supplies clothes to a tailor for stitching shirts as per the specifications provided by shirt manufacturer. In this situation tailor is Job worker and shirt manufacturer is the principal manufacturer. Shirt manufacturer is liable to deduct TDS u/s 194C on payments to be made to the tailor for stitching clothes. (Figure 1) |

|

Part (ii) of the point no. (e) |

|

|

but does not include manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from a person, other than such customer. |

This is a simple contract for sale. If tailor buys clothes from open market and then stitches shirts as per the specifications of shirt manufacturer, then this is a sale contract between tailor and shirt manufacturer. Here, shirt manufacturer does not supply clothes to the tailor. Tailor is free to buy clothes from any person. In this situation TDS is not applicable. (Figure 2) |

You might be able to distinguish between sale contract and work contract by now.

Some important points:

1. In part (i) of the point no. (e) if tailor issues invoice mentioning stitching charges and material charges separately then TDS will be deducted on stitching charges only. Otherwise, TDS will be deducted on the whole invoice value.

2. Contract includes subcontract also.

Note :

TDS u/s 194C is also deducted on payments made towards job work.

Here,

Job work refers to a process of contract where a goods are supplied or manufactured as per the customer's specifications, with the customer providing the raw materials.

The TDS rate for payments made towards job work contracts is specified under Section 194C.

Who is a sub-contractor?

As per the provisions of the Income Tax Act any person, who is a contractor except individual and HUF:

Is responsible for paying any sum to the resident in pursuance of a contract with the sub-contractor for carrying out, or for the supply of labor for carrying out, the whole or any part of the work undertaken by the contractor or for supplying whether wholly or partly any labor which the contractor has undertaken to supply shall, at the time of credit of such sum to the account of the sub-contractor or, at the time of payment thereof in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier at the rate of 1%.

3. Deductor may be any of the following people:

(a) the Central Government or any State Government; or

(b) any local authority; or

(c) any corporation established by or under a Central, State or Provincial Act; or

(d) any company; or

(e) any co-operative society; or

(f) any authority, constituted in India by or under any law, engaged either for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns and villages, or for both; or

(g) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law corresponding to that Act in force in any part of India; or

(h) any trust; or

(i) any university established or incorporated by or under a Central, State or Provincial Act and an institution declared to be a university under section 3 of the University Grants Commission Act, 1956 (3 of 1956); or

(j) any Government of a foreign State or a foreign enterprise or any association or body established outside India; or

(k) any firm; or

(l) any person, being an individual or a Hindu undivided family or an association of persons or a body of individuals, if such person,-

(A) does not fall under any of the preceding sub-clauses; and

(B) is liable to audit of accounts under clause (a) or clause (b) of section 44AB during the financial year immediately preceding the financial year in which such sum is credited or paid to the account of the contractor;

4. Deductee shall be resident person only.

Non-applicability of section 194C

Section 194C is not applicable in following situations:

1. Where person liable to pay any sum to the contractor is any individual or HUF and such sum is required to be paid exclusively for personal purpose of such individual or any member of HUF.

2. If the sum to be paid does not exceed Rs. 30,000 or aggregate of the sum paid during the financial year does not exceed Rs. 1,00,000 then TDS is not required to be deducted. In other words, if single payment is for Rs. 30,001 or aggregate payment during the financial year is 1,00,001 then TDS is required to be deducted.

3. No TDS is required to be deducted if payment is made to a contractor who is engaged in the business of plying, hiring or leasing goods carriages, where such contractor owns ten or less goods carriages at any time during the previous year and furnishes a declaration to that effect along with his Permanent Account Number, to the person paying or crediting such sum.

4. TDS is not required to be deducted if it is a contract for sale and not a works contract.

Rate of TDS under section 194C?

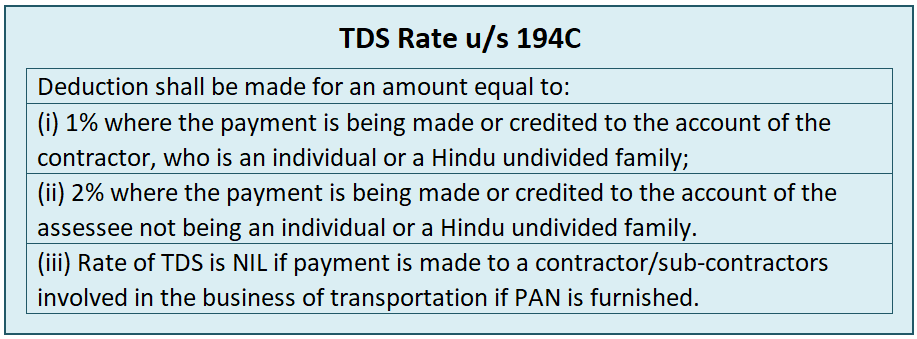

Deduction shall be made for an amount equal to:

Note: TDS shall be deducted @20% if PAN is not furnished.

TDS at a Lower Rate

According to Section 194C where the AO is satisfied that the total income of contractor or sub-contractor justifies the deduction of income-tax at any lower rate or no deduction of income-tax, as the case may be, the AO shall, on application made by the contractor or sub-contractor in this behalf give to him such certificate as may be appropriate.

What is the time of the deduction of TDS under section 194C?

TDS under section 194C shall be deducted at the time:

- Payment or

- Credit whichever is earlier.

Where such sum is credited to any account, whether called 'Suspense account' or by any other name, in the books of account of the person liable to pay such income, such crediting shall be deemed to be the credit of such income to the account of the payee and TDS shall be deducted accordingly.

Threshold limit under TDS section 194C?

The threshold limit under TDS Section 194C is as follows:

1. No TDS will be deducted if payment made to the contractors as consideration for the contract does not exceed Rs 30,000 for a single contract.

2. No TDS will be ducted if payment made to the contractor/sub-contractor as a consideration does not exceed Rs 1,00,000 for composite contracts.

What is the due date to deposit TDS?

a. Where the payment is made by or on behalf of the Government(without Challan) - On the same day.

b. Where the payment is made in any other case than the government

i. If the amount is credited in the month of March – On or before April 30th

ii. In Other months – Within 7 days from the end of the month in which the deduction is made.

Note: The payer is the person responsible for TDS.

What is the due date to file TDS Return of Section 194C?

Every Deductor deducting TDS in terms of section 194C is required to file a quarterly return in Form 26Q within following due dates:

Months | Due date

April to June | 31st July

July to September | 31st October

October to December | 31st January

January to March | 31st May

Issue of TDS certificate

In case of payments other than salary, TDS certificates are to be issued on the quarterly basis in Form No.16A. As per rule 31, every person responsible for deduction of tax from payments other than salary has to issue a quarterly TDS certificate in Form No. 16A. The certificate is to be issued by the following dates:

Quarter Due date for Non-Government Deductor | Due date for Government Deductor

April to June | 30th July 15th August

July to September | 30th October 15th November

October to December | 30th January 15th February

January to March | 30th May 30th May

As per CBDT Circular No. 1/2012, dated 9-4-2012, it is mandatory for all the deductors to issue TDS certificate in Form No. 16A by generating the certificate through TIN central system by downloading the certificate from the TIN website with a unique TDS certificate number.

CAclubindia

CAclubindia