AS 10 - Plant Property and Equipment

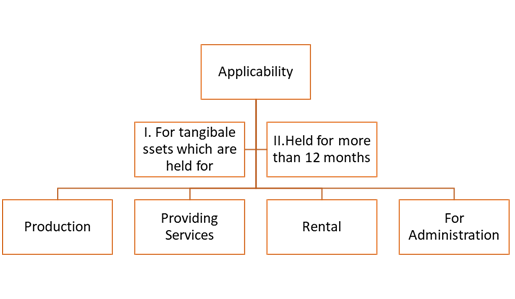

How to recognise PPE?

- Future economic benefits associated with the item will flow to the enterprise &

- Cost can be measured reliably

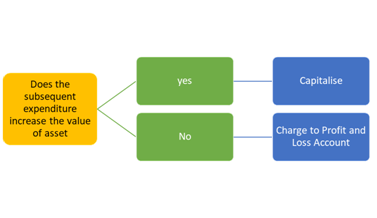

Subsequent recognition of Assets

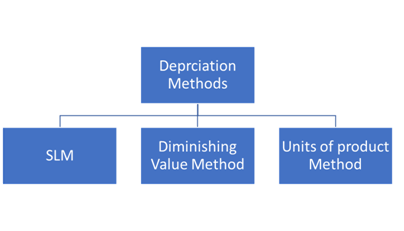

Depreciation for PPE

Retirement of PPE

- PPE is retired from active use and it is held for disposal - such PPE should be stated in balance sheet Carrying amount (Net book value); or Net realizable value(NRV) Whichever is LOWER.

- Disclose such items separately in the financial statements. Any expected loss should be recognised immediately in the profit and loss statement.

Derecognition of PPE

I. On disposal

- By sale

- By entering into Finance lease

- By Donation

OR

II. When there are no future economic benefits expected from its use or disposal.

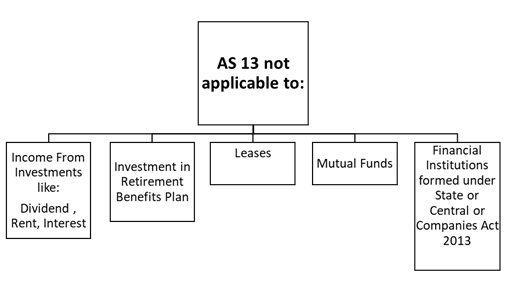

AS-13 Accounting For Investments

(Comes into effect from on or after April 1,1995)

Important Definitions:

- Investments: are assets held by an enterprise for earning income by way of dividends,interest, and rentals, for capital appreciation, or for other benefits to the investing enterprise. Assets held as stock-in-trade are not ‘investments’.

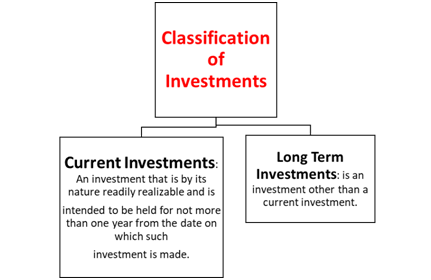

- Current investment: is an investment that is by its nature readily realizable and is intended to be held for not more than one year from the date on which such investment is made.

- Fair value: is the amount for which an asset could be exchanged between a knowledgeable, willing buyer and a knowledgeable, willing seller in an arm’s length transaction. Under appropriate circumstances, market value or net realizable value provides evidence of fair value.

- Market value: is the amount obtainable from the sale of an investment in an open market, net of expenses necessarily to be incurred on or before disposal.

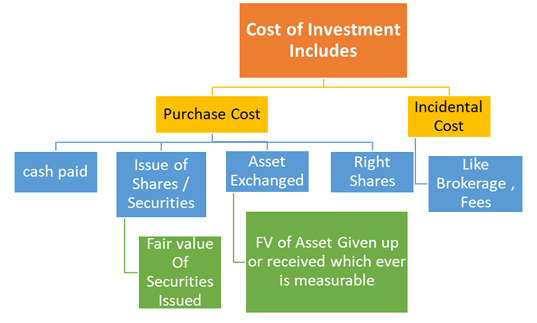

Cost of Investments

Disclosure

The following disclosures are to be made in financial statements in relation to investments:

- The accounting policies applied to determine carrying amount of investments.

- Interest, dividends

- Rentals on investments

- Amount of income tax deducted at source being included under Advance Taxes Paid.

- Profits and losses on disposal of investments (Current and Long Term) and changes in carrying amount of such investments.

- Significant restrictions on the right of ownership, realisability of investments or the remittance of income and proceeds of disposal.

- The aggregate amount of quoted and unquoted investments, giving the aggregate market value of quoted investments.

- Other disclosures as specifically required by the relevant statute governing the enterprise.

Also Read:

- Revision for Accounting Standards - CA Intermediate (Part 1)

- Revision for Accounting Standards - CA Intermediate (Part 2)

- Revision for Accounting Standards - CA Intermediate (Part 3)

- Revision for Accounting Standards - CA Intermediate (Part 4)

- Revision for Accounting Standards - CA Intermediate (Part 5)

CAclubindia

CAclubindia