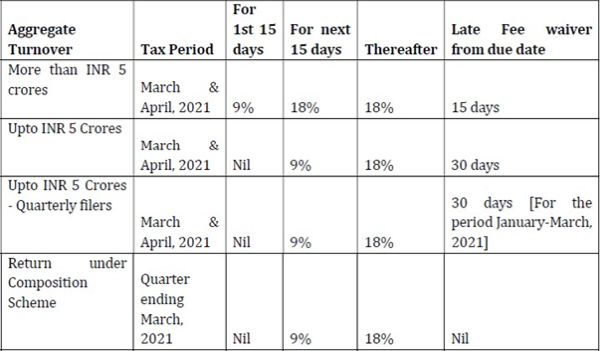

Relief in rate of interest & Waiver of Late Fee for filing GSTR-3B and statement in Form CMP-08 by the composition tax payers: (Notification No.08/2021 & 09/2021)

Due date of filing GSTR-4: (Notification No.10/2021)

The due date for furnishing return in Form GSTR-4 (Composition Tax payers) for the financial year ending 31st March, 2021 has been extended from 30th April, 2021 to 31st May, 2021.

Due date of filing ITC-04: (Notification No.11/2021)

The due date for furnishing the declaration in FORM GST ITC-04, in respect of goods dispatched to or received from a job worker, during the period from 1st January,2021 to 31st March, 2021 (For Quarter) has been extended from 25th April, 2021 to 31st May, 2021.

Due date of filing GSTR-1: (Notification No.12/2021)

The due date for furnishing details of outward supplies in Form GSTR-1 for the month of April-2021 has been extended from 11th May, 2021 to 26th May, 2021.

Applicability of Rule-36(4): (Notification No.13/2021)

Rule 36(4) shall apply cumulatively for the period April 2021 and May, 2021 and the return in FORM GSTR-3B for the tax period May, 2021 shall be furnished with the cumulative adjustment of ITC for the said months.

The details using IFF for the month of April, 2021 can be furnished from 1st May, 2021 till 28th May, 2021.

Other Compliances which falls between 01.05.2021 to 31.05.2021 has been extended to 15.06.2021: (Notification No.14/2021)

- The time limit for completion of action of verification by the proper officer of the application for GST registration and its approval (Rule-9 of CGST rules pertaining to Verification of the Application and Approval)

- Filing of any Appeal, Reply and Application

- Furnishing of any Report, Document, Return Statement or such other record

NO BENEFIT OF EXTENSION IN FOLLOWING CASES

- Chapter IV related to Time & Value of supply (Section 12 to 15)

- Compulsory opt-out of Composition Scheme on T/O exceeds Specified Limit (1.5Cr/75Lakhs) as per Section

- 68-Inspection of Movement of Goods in respect of E-Way Bill provision

NO BENEFIT OF EXTENSION IN FOLLOWING THE SECTION

- Sec 25 Procedure for Registration

- Sec 27 CTP & NRTP Provisions

- Sec 31 Tax Invoice Provisions

- Sec 37 Filing GSTR1

- Sec 47 & Sec 50- Late Fees and Interest Sec 69 Power to Arrest

- Sec 90 Liability of Partners of firm to pay tax

- Sec 122 Penalty for certain offences

- Sec 129 Detention, seizure, & release of goods & conveyance in transit

TIME LIMIT EXTENDED

Refund Orders under Section 54(5) and Section 54(7) shall be extended up to 15 days after the receipt of reply to the notice or 31st May’2021 (W.E. later)

The new GSTR 1 HSN summary table will now take effect from May'21 Return, not from April' 21 return

- Now, GSTR 1 HSN summary table shows HSN, Description & UQC but from May 2021, onwards, it will be HSN, UQC & Rate.

- Description is not applicable as it will be auto- populate which is based on HSN.

- Column Rate will be mandatory and value will be non-mandatory GSTR 1 HSN summary table.

Import of oxygen concentrators for personal use exempted till July 31, 2021

The DGFT vide Notification No. 4/2015-2020, April 30, 2021 has issued amendment in Para 2.25 of the Foreign Trade Policy, 2015-20 ("FTP"), that deals with the import of goods.

GST Returns 3B and GSTR-1 without DSC

The CBIC allowed the companies to file GST Returns without Digital Signature Certificate (DSC) with Mobile One Time Password (OTP) verified through electronic verification code (EVC)

New feature on the GST portal

Return Calendar: Registered person can allow to check the past 5 returns periods as to avoid incurring any interest or late fee.

Helpdesk

CBIC setup Dedicated Helpdesk for Handholding Trade, Industry and Individuals to expedite Customs Clearance of Imports related to COVID.

Recent AAR & Judicial Decisions

No GST on membership subscription fees and Infrastructure development fund collected from the members collected from members: (M/s. Calcutta Club Ltd.)

AAR on the Pharmaceutical Reference Standards (Prepared Laboratory Reagents) imported and supplied by the Appellant and classified under Tariff Item 3822 00 90 of the Customs Tariff Act, 1975 is covered under Entry No. 80 of Schedule-II to Notification No.1/2017- Integrated Tax (Rate) dated 28.06.2017 attracting a levy of Integrated Tax at the rate of 12%

Disclaimer: The purpose of this is to share knowledge and it is for education purpose only. It contains information for general guidance only. It is not intended to address the circumstances of any particular individual or entity. Although the best of endeavour has been made to provide the provisions in a simpler and accurate form, there is no substitute to detailed research with regard to the specific situation of a particular individual or entity.

CAclubindia

CAclubindia