You must have heard about PAN & TAN but got confused - What is it and are they really different?

Let's see that ahead.

WHAT IS A PERMANENT ACCOUNT NUMBER?

- PAN is a 10-digit unique identification alphanumeric number assigned, mostly to those who pay tax on their incomes

- It is governed by the Department of Income Tax

- Your PAN Card is valid for the lifetime

- No 2 person can have same PAN

- PAN card can be issued to an Individual, NRI (Non-Resident Indians), Companies, or anyone who is liable to pay tax in India

DETAILS ON PAN CARD

- Name

- Photograph

- PAN

- Date of birth

- Father’s Name

- Signature

- QR code (on new Cards issued after 1 January 2017)

USES OF PAN

- Pay Income Tax

- For registering a business in India

- Photo identification

- A lot of financial transactions require PAN, few examples are as follows :

- Sale or purchase of property

- Sale or purchase of a vehicle

- Visa & Foreign travel

- Purchase of Shares, Mutual funds and investments

- PAN Card can be used to avail utility connections such as electricity, telephone, LPG, and internet

WHAT IS TAN?

- TAN stands for Tax Deduction and Collection Account Number

- It is a unique 10 digit alpha-numeric number allotted by the Income Tax Department

- It is to be obtained by only those persons who are responsible for deducting (TDS) or collecting (TCS) the tax at source

- TAN has limited use for a specific purpose only

- It is not mandatory that every person having PAN needs to obtain TAN however, TAN cannot be issued without PAN

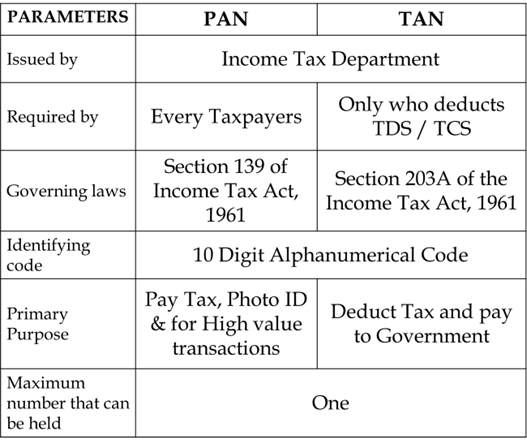

LET US SUMMARISE PAN & TAN

CAclubindia

CAclubindia