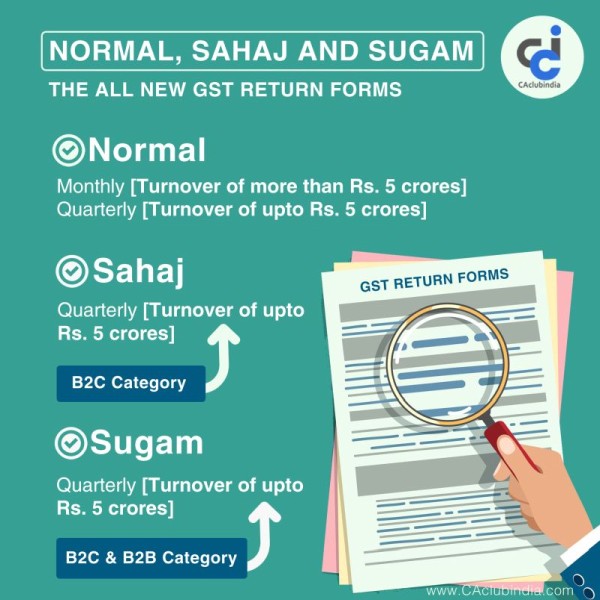

The proposed GST returns Normal, Sugam and Sahaj have been released by the CBIC. Assessees with a turnover of up to Rs. 5 crores will have an option to choose from any of the three returns to file the quarterly returns.

The returns will be available from 1st April 2019 and will become mandatory from July 2019 onwards.

Normal GST Return or GST Ret- 1

The normal return can be monthly or quarterly. Assessees opting for Normal Return or Form GST Ret-1 can declare all types of outward supplies, inward supplies and take credit on missing invoices.

Sahaj Return or the GST Ret-2

Assessees opting for Sahaj Return or Form GST Ret-2 will be able to declare outward supply under B2C category and inward supplies attracting reverse charge only. However, they will not be able to take credit on missing invoices and will not be able to make any other type of inward or outward supplies.

Sugam Return or the GST Ret-3

Sugam Return is a Quarterly Return. Assessees opting for Sugam Return or Form GST Ret-3 will be able to declare outward supply under both B2B and B2C category and inward supplies attracting reverse charge only. However, they will not be able to take credit on missing invoices or make any other type of inward or outward supplies.

CAclubindia

CAclubindia