The government changed the Rules & Conditions for claiming the Input Tax Credit (ITC) in GSTR-3B

CBIC has inserted the new Sub-rule (4) to Rule 36 with effect from 09.10.2019

Extract of sub-rule (4) of 36 areas

"Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 20 percent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37."

Summary of the new sub-rule / in common Language*

Our claimed ITC IN GSTR-3B should not exceed by 20 % of ITC reflecting in GSTR 2A for the month, subject to section rule 36

(हिन्दी मे)

(GSTR-3B मे क्लेम की जाने वाली ITC और GSTR 2A मे दिखाई दे रही ITC के बीच का अंतर 20% से ज़्यादा नही होना चाहिए उदाहरण के लिए यदि GSTR-3B मे लेने योग्य ITC Rs. 100 है और GSTR-2A Rs. 50 ही ITC दिख रही हो तो, हम GSTR-3B मे Rs.60 (50 + 20% of 50) से ज़्यादा ITC नही ले सकते है.)

To clarify the provision and its applicability, the Government has issued Circular No.123/42/2019 GST dated 11th November 2019 and the important clarifications are

- Self-Assessment Basis,This being a new provision, the restriction is not imposed through the common portal and it is the responsibility of the taxpayer that credit is availed in terms of the said rule and therefore, the availment of restricted credit in terms of sub-rule (4) of rule 36 of CGST Rules shall be done on self-assessment basis by the taxpayers.

- Full ITC which are Out of subsection (1) of section 37,Taxpayers may avail full ITC in respect of IGST paid on import, documents issued under RCM, credit received from ISD etc. which are outside the ambit of sub-section (1) of section 37, provided that eligibility conditions for availing of ITC are met in respect of the same

- Effective from 9thOCT 2019,The restriction of 36(4) will be applicable only on the invoices/debit notes on which credit is availed after 09.10.2019

- No supplier wise restriction,the restriction imposed is not supplier wise. The credit available under sub-rule (4) of rule 36 is linked to total eligible credit from all suppliers against all supplies whose details have been uploaded by the suppliers.

- The calculation will be based on Eligible ITC only;the calculation would be based on only those invoices which are otherwise eligible for ITC. Accordingly, those invoices on which ITC is not available under any of the provision (say under sub-section (5) of section 17) would not be considered for calculating 20 % of the eligible credit available.

The restriction of 20% applies with respect to eligible input tax credit available to the recipient in respect of invoices or debit notes the details of which have been uploaded by the suppliers under subsection (1) of section 37as on the due date of filing of the returns in FORM GSTR 1 of the suppliers for the said tax period.

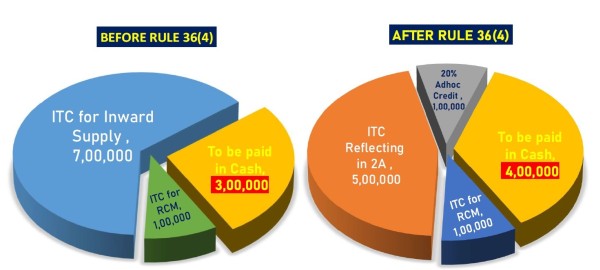

For more clarity on this sub-rule, the following example will be helpful.

|

Particulars |

Amount |

Particulars |

Amount |

|

GST Liability on Outward Supply |

10,00,000/- |

ITC for the Month (Tax Invoice available) |

7,00,000/- |

|

GST Liability on RCM |

1,00,000/- |

Date of filing GSTR3B for Oct |

18 Nov 2019 |

|

Total Liability for the Month |

11,00,000/- |

ITC showing in 2A for Oct Month |

5,00,000/- |

Some interesting points

- Before this sub-rule / 9th Oct, GSTR-2A did not return, it was just a reflective return for the betterment of taxpayers to track their vendors, suddenly on 9th Oct 2019, the government brought new sub-rule & in which GSTR-2A are going to play a very big role.

- Circular states that the eligible ITC as reflected in GSTR - 2A on the due date for filing GSTR - 1 needs to be considered. Hence such a date would be the 11th day of a given month.BUT our GSTIN will take around Two days to reflective respective GSTR-2A. No clarity on what will be the position when GSTR-1 filed after the due date.

- CBIC Clarification is total silent on Quarterly return filers. In the case of Quarterly Taxpayer, they could not upload monthly invoices too, due to our GSTIN portal so what to do?

- It will not be any surprise; you suppose to take the ITC, yet you have to make the payment by cash, later on, the same ITC will unutilized till next outward liability.

Conclusion

This new rule 36(4) is restricting the ITC which is not showing in GSTR-2A. It is very clear that due to this circular a new type of hassle will be increased for taxpayers as well as professionals also. It is very clear showing in the above Pictures that due to sub-rule 4 of rule 36, an additional 1 Lakh liability increased.

The logic behind this new sub-rule 36(4) can't understand by anyone. I thought it may a step to prevent fake billing or ITC. If this will be the reason, it will be very unfortunate for honest taxpayers.

In my opinion, it will impact very badly on MSME sectors & businesses for MSME / quarterly filers will be drastically reduced because All one Would do their business with monthly filers only. Compliance cost also increase for taxpayers.

We hope for the good from Government very soon on this new sub-rule.

- Before this sub-rule / 9th Oct, GSTR-2A did not return, it was just a reflective return for the betterment of taxpayers to track their vendors, suddenly on 9th Oct 2019, the government brought new sub-rule & in which GSTR-2A are going to play a very big role.

- Circular states that the eligible ITC as reflected in GSTR - 2A on the due date for filing GSTR - 1 needs to be considered. Hence such a date would be the 11th day of a given month. BUT our GSTIN will take around Two days to reflective respective GSTR-2A. No clarity on what will be the position when GSTR-1 filed after the due date.

- CBIC Clarification is total silent on Quarterly return filers. In the case of Quarterly Taxpayer, they could not upload monthly invoices too, due to our GSTIN portal so what to do?

- It will not be any surprise; you suppose to take the ITC, yet you have to make the payment by cash, later on, the same ITC will unutilized till

The author can also be reached at pankajkannaujiya@yahoo.com

Disclaimer and Confirmation: The above data is based on the Goods & Services Tax Act & Rules. Some changes/modification and interpretation have been done for easy to understand, so please ignore if any discrepancy with original rules. This illustration is for easy understanding of the new ITC restriction with assumption & Views are strictly personal. Kindly consult your advisor before any decision. All rights reserved by Kannaujiya& Co.-Cost Accountants.

CAclubindia

CAclubindia