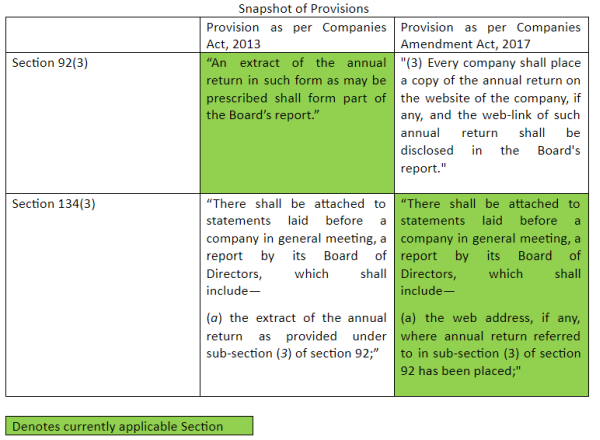

Section 92(3) of the Companies Act, 2013 provides that “An extract of the annual return in such form as may be prescribed shall form part of the Board’s report.” The form prescribed in the Rules is known MGT-9. However, Section 27 of the Companies Amendment Act, 2017, inter alia, provides that Section 92(3) of the Companies Act, 2013 shall be replaced by the following sub section

"(3) Every company shall place a copy of the annual return on the website of the company, if any, and the web-link of such annual return shall be disclosed in the Board's report."

Which means that the requirement of preparing and attaching of Annual Return is done away with.

Also, Section 134 (3) of the Companies Act, 2013, inter alia, provides that “There shall be attached to statements laid before a company in general meeting, a report by its Board of Directors, which shall include—

(a) the extract of the annual return as provided under sub-section (3) of section 92;”

Again the said sub-section is amended by Section 36 Companies Amendment Act, 2017. The said Section 36, inter alia, substituted the above clause (a) with following clause:

"(a) the web address, if any, where annual return referred to in sub-section (3) of section 92 has been placed;"

Clearly from the above two amendments, it was clear that Government is not happy with the requirement of MGT-9 and Companies Amendment Act, 2017 has done away with the requirement of MGT-9.

However, the confusion started when Section 36 of the Companies Amendment Act, 2017 (which amends Section 134 of Companies Act, 2017) was notified w.e.f. July 31, 2018 but the relevant provisions of Section 92 of Companies Act, 2013 is yet to be notified.

Which means that the requirement of preparing and attaching MGT-9 to the Board Report is still relevant and not preparing the MGT-9 shall means a non-compliance of Section 92(3). Even though amendment to Section 134 which talks about a provision which is yet to be notified can exempt company from requirement of compliance of Section 92(3) of the Companies Act, 2013?

Conclusion: Even while there are confusions about implementation of Section 134 (3) (a) of the Companies Act, 2013, it is clear that amendment to Section 92(3) is still not notified and the extant provision of Section 92(3) clearly requires Company to prepare extract of Annual Return in MGT-9 which shall form part of Annual Return. Hence, till the time amendment to Section 92(3) is not notified, the Companies will require to prepare and attach MGT-9 to Board Reports.

About Author: The author is the Founder and Partner at JMJA & Associates LLP. With over 10 years of work experience in various listed companies and conglomerates, he has a rich and varied experience in his portfolio.

Disclaimer:

This material and the information contained herein are prepared by JMJA & Associates LLP, Practising Company Secretaries (JMJA) is intended to provide general information on a particular subject or subjects and is not an exhaustive treatment of such subject(s). None of JMJA, its associate firms, or its members/employees is, by means of this material, rendering professional advice or services. The information is not intended to be relied upon as the sole basis for any decision which may affect you or your business. Before making any decision or taking any action that might affect your personal finances or business, you should consult a qualified professional adviser. JMJA shall not be responsible for any loss whatsoever sustained by any person who relies on this material.

CAclubindia

CAclubindia