Pursuant to the provisions of section 185(1) of the Companies Act, 2013 no company shall, directly or indirectly, advance any loan, including any loan represented by a book debt to, or give any guarantee or provide any security in connection with any loan taken by:

- Any director of the company, or of a company which is its holding company or any partner or relative of any such director; or

- Any firm in which any such director or relative is a partner.

Thus, the company cannot provide any loan to:

- Any director of the company;

- Any director of its holding company;

- Any partner or relative of such director;

- Any firm in which such director or relative is a partner

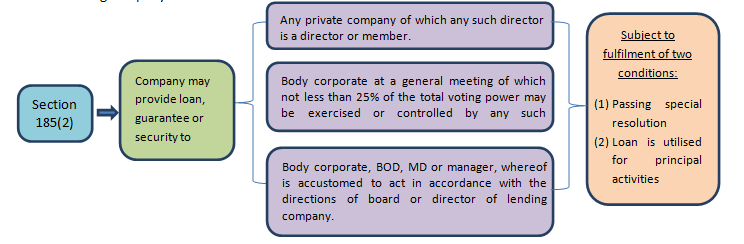

Section 185(2) states that a company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the directors of the company is interested, subject to following conditions.

(1) Passing special resolution in general meeting

(Provided that the explanatory statement to the notice of general meeting shall disclose the full particulars of the loan given, or guarantee given or security provided and the purpose of such and other relevant fact)

(2) The loan is utilized by the borrowing company for its principal business activities

Here the person in whom any of the director of the company is interested means:

- any private company of which any such director is a director or a member;

- any body corporate at a general meeting of which not less than 25% of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together; or

- any body corporate, the board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the board, or of any director or directors, of the lending company.

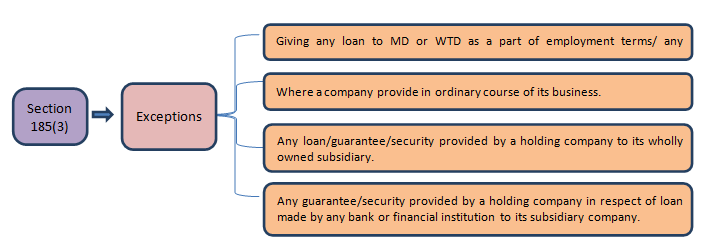

Further section 185(3) provides that, nothing contained in sub-section (1) and (2) shall apply to:

- Giving any loan to managing or whole-time director as a part of the conditions of service extended by the company to all its employee or pursuant to any scheme approved by the members by a special resolution.

- A company which in the ordinary course of its business provides loans or gives guarantees or securities for the due repayment of any loan and in respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of 1 year, 3 years or 10 years Government security closest to the tenor of the loan.

- Any loan made by a holding company to its wholly owned subsidiary company or any guarantee given or security provided by a holding company in respect of any loan made to its wholly owned subsidiary company.

- Any guarantee given or security provided by a holding company in respect of loan made by any bank or financial institution to its subsidiary company.

Thus, sub-section (3) provides for an exception to sub-section (1) and (2)

Lastly section 185(4) provides that, if any loan is advanced or a guarantee or security is provided or utilized in contravention of the provisions of this section, then the same shall be penalized in following manner:

|

Company |

Shall be punishable with fine which shall not be less than Rs. 5,00,000/- but which may extend to Rs. 25,00,000/- |

|

Every officer of the company who is in default |

Shall be punishable with imprisonment for a term which may extend to 6 months or with fine which shall not be less than Rs. 5,00,000/- but which may extend to Rs. 25,00,000/- |

|

Director or the other person to whom any loan is advanced or guarantee or security is given or provided in connection with any loan taken by him or the other person. |

Shall be punishable with imprisonment which may extend to 6 months or with fine which shall not be less than Rs. 5,00,000/- but which may extend to Rss. 25,00,000/- or with both. |

The author can also be reached at csneharedekar@gmail.com

Disclaimer: Please note that the above article is based on the interpretation of related laws, which may differ from person to person and is not a legal advice.

CAclubindia

CAclubindia