Union Budget 2021 was presented in Parliament on Monday, February 1st, 2021.Presenting the first ever digital Union Budget, Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman stated that India's fight against COVID-19 continues into 2021 and that this moment in history, when the political, economic, and strategic relations in the post-COVID world are changing, is the dawn of a new era - one in which India is well-poised to truly be the land of promise and hope.

6 pillars of the Union Budget 2021-22

The Budget proposals for this financial year rest on following six pillars:

- Health and Wellbeing

- Physical & Financial Capital and Infrastructure

- Inclusive Development for Aspirational India

- Reinvigorating Human Capital

- Innovation and R&D

- Minimum Government and Maximum Governance

This document summarises the changes made/ proposed under the GST Law - Section wise in comparative manner for easy digest.

GST

Amendments carried out in the Finance Bill, 2021 will come into effect from the date when the same will be notified, as far as possible, concurrently with the corresponding amendments to the similar Acts passed by the States and Union territories with Legislature.

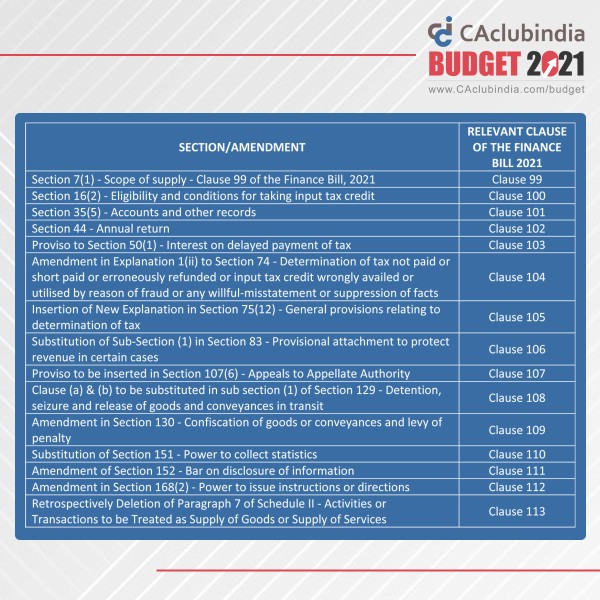

Proposed Amendments in the CGST Act, 2017

|

Current provisions |

Proposed provisions |

Effect of changes made |

Section 7(1) - Scope of supply - Clause 99 of the Finance Bill, 2021 |

||

|

------- |

After Section 7(1)(a): New clause to be inserted '(aa) the activities or transactions, by a person, other than an individual, to its members or constituents or viceversa, for cash, deferred payment or other valuable consideration. Explanation.- - For the purposes of this clause, it is hereby clarified that, notwithstanding anything contained in any other law for the time being in force or any judgment, decree or order of any Court, tribunal or authority, the person and its members or constituents shall be deemed to be two separate persons and the supply of activities or transactions inter se shall be deemed to take place from one such person to another' |

Seeks to insert a new clause (aa) to Section 7(1) of the CGST Act to expand the scope of supply to include activities or transactions of supply of goods or services or both by any person, other than an individual, to its members or constituents or vice-versa. Therefore, this inclusion wants to done away the effect of Hon'ble Supreme Court Judgment in State of West Bengal &Ors. v Calcutta Club Limited [2019 (29) G.S.T.L. 545 (S.C.)]for erstwhile Service tax regime wherein it was held that there cannot be the sale of goods or provision of services between the unincorporated private clubs/associations and its members owing to the principle of mutuality which treats such clubs/associations and its members as the same person. Hence, this amendment is unsettling the settled jurisprudence with retrospective date. This amendment shall take effect retrospectively from July 1, 2017. |

Section 16(2) - Eligibility and conditions for taking input tax credit - Clause 100 of the Finance Bill, 2021 |

||

|

------- |

After clause (a), in sub-section (2) of Section 16, the following clause shall be inserted: '(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37.' |

Seeks to insert a new sub clause (aa) after Section 16(2)(a) of the CGST Act, 2017 ('CGST Act') to provide that input tax credit ('ITC') on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies (GSTR-1) as specified in Section 37 of the CGST Act and such details have been communicated to the recipient of such invoice or debit note. Comments:Thus, one more condition is added for determining the eligibility of ITC.ITC would not be available to the recipient if the details of such invoice or debit note has been not furnished by the supplier in GSTR-1 or using IFF. In this regard it is important to note that Rule 36(4) of the CGST Rules, 2017 ('CGST Rules') was recently amended vide Notification No. 94/2020-Central Tax dated December 22, 2020 w.e.f. January 01, 2021 to restrict the ITC to 5% in respect of invoices or debit notes not furnished by supplier in GSTR-1 or using IFF. Therefore, this amendment seems to be providing statutory backing to much debated Rule 36(4) of the CGST Rules. But even pre-GST legal jurisprudence supports the view that as long as the purchasing dealer has taken all the steps required for being eligible for ITC, he could not be expected to keep track of whether the selling dealer has in fact deposited the tax collected with the government or has lawfully adjusted it against his output tax liability - Arise India Limited and Ors v. Commissioner of Trade & Taxes, Delhi and Ors [W.P.(C) 6093/2017 & connected matters dated 26.10.2017 - SLP filed by the revenue has been dismissed with no discussions on merit by the Hon'ble SC in [Special Leave to Appeal (C) No(s). 36750/2017 dated 10.01.2018]. Thus, this provision is still prone to litigation. |

Section 35(5) - Accounts and other records - Clause 101 of the Finance Bill, 2021 |

||

|

'S. 35 (5): Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.' |

Sub-section (5) of Section 35 shall be omitted S. 35 (5): Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. |

Seeks to omit Section 35(5) of the CGST Act so as to remove the mandatory requirement of getting annual accounts auditedby a chartered accountant or a cost accountant and reconciliation statement (GSTR-9C) to be submitted for registered person whose turnover during a financial year exceeds the prescribed limit, which is 2 Crore but for FY 2018-19 & 2019-20, notified as Rs. 5 Crore. |

Section 44 - Annual return - Clause 102 of the Finance Bill, 2021 |

||

|

'44. (1) Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirty-first day of December following the end of such financial year. Provided that the Commissioner may, on the recommendations of the Council and for reasons to be recorded in writing, by notification, extend the time limit for furnishing the annual return for such class of registered persons as may be specified therein: Provided further that any extension of time limit notified by the Commissioner of State tax or the Commissioner of Union territory tax shall be deemed to be notified by the Commissioner. (2) Every registered person who is required to get his accounts audited in accordance with the provisions of sub-section (5) of section 35 shall furnish, electronically, the annual return under sub-section (1) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and such other particulars as may be prescribed. Explanation.- For the purposes of this section, it is hereby declared that the annual return for the period from the 1st July, 2017 to the 31st March, 2018 shall be furnished on or before the 31st January, 2020 and the annual return for the period from the 1st April, 2018 to the 31st March, 2019 shall be furnished on or before the 31st March, 2020.' |

Substituted as under: '44. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person shall furnish an annual return which may include a selfcertified reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year, with the audited annual financial statement for every financial year electronically, within such time and in such form and in such manner as may be prescribed: Provided that the Commissioner may, on the recommendations of the Council, by notification, exempt any class of registered persons from filing annual return under this section: Provided further that nothing contained in this section shall apply to any department of the Central Government or a State Government or a local authority, whose books of account are subject to audit by the Comptroller and AuditorGeneral of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.' |

Seeks to substitute Section 44 of the CGST Act so as to remove the mandatory requirement of furnishing a reconciliation statement (GSTR-9C) duly audited by practicing chartered accountant or cost accountant and to provide for filing of the annual return (GSTR-9) on self-certification basis with reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year, with the audited annual financial statement for every financial year electronically, within such time and in such form and in such manner as may be prescribed. Further, it is also provided that the Commissioner may on recommendation of the GST Council may exempt a class of registered persons from the filing the annual return. Comments:The responsibility of reconciliation hasbeen shifted to the taxpayers now instead of GST auditors earlier. |

Proviso to Section 50(1) - Interest on delayed payment of tax- Clause 103 of the Finance Bill, 2021 |

||

|

'Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.' |

For the proviso to Section 50(1), the following proviso shall be substituted and shall be deemed to have been substituted with effect from the 1stday of July 2017: 'Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be payable on that portion of the tax which is paid by debiting the electronic cash ledger.' |

Seeks to substitute proviso to Section 50(1) of the CGST Act so as to charge interest only on net cash liability. This amendment shall take effect retrospectively from July 1, 2017. Comments:Despite the 39th GST Council's recommendation in place with regard to imposing interest liability retrospectively on net tax liability, the government still chose to appoint 01.09.2020 as the date when proviso to Section 50(1) of the CGST Act was made effective. Though, press release and instructions were issued to clarify for recovery of interest on net cash tax liability w.e.f. 01.07.2017, but still litigations were seen. With this retrospective amendment, the issue will now finally settle. |

Amendment in Explanation 1(ii) to Section 74 - Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any wilful-misstatement or suppression of facts - Clause 104 of the Finance Bill, 2021 |

||

|

'(ii) where the notice under the same proceedings is issued to the main person liable to pay tax and some other persons, and such proceedings against the main person have been concluded under section 73 or section 74, the proceedings against all the persons liable to pay penalty under sections 122, 125, 129 and 130 are deemed to be concluded.' |

'(ii) where the notice under the same proceedings is issued to the main person liable to pay tax and some other persons, and such proceedings against the main person have been concluded under section 73 or section 74, the proceedings against all the persons liable to pay penalty under sections 122 and 125 are deemed to be concluded.' |

Seeks to amend Explanation 1(ii) of Section 74 of the CGST Act so as to make seizure (Section 129) and confiscation proceedings (Section 130) of goods and conveyances in transit a separate proceeding from recovery of tax. Comments:Conclusion of proceedings u/s 73 or 74 will now mean conclusion of proceedings u/s 122 and 125 but not the proceedings u/s 129 and 130. |

Insertion of New Explanation in Section 75(12) - General provisions relating to determination of tax - Clause 105 of the Finance Bill, 2021 |

||

|

------- |

In Section 75(12), the following Explanation shall be inserted: 'Explanation.- - For the purposes of this sub-section, the expression "self-assessed tax" shall include the tax payable in respect of details of outward supplies furnished under section 37, but not included in the return furnished under section 39.' |

Seeks to insert an explanation under Section 75(12) of the CGST Act to clarify that 'self-assessed tax' shall include the tax payable in respect of outward supplies furnished in GSTR 1 but not included in the return furnished in GSTR 3B. Comments: The ambit of the term 'self-assessed tax' is proposed to be widened. Meaning thereby that now recovery can be initiated by the officer even for the outward supply liability shown in the GSTR-1 filled under Section 37. |

Substitution of Sub-Section (1) in Section 83 - Provisional attachment to protect revenue in certain cases - Clause 106 of the Finance Bill, 2021 |

||

|

'(1) Where during the pendency of any proceedings under section 62 or section 63 or section 64 or section 67 or section 73 or section 74, the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue, it is necessary so to do, he may, by order in writing attach provisionally any property, including bank account, belonging to the taxable person in such manner as may be prescribed.' |

'(1) Where, after the initiation of any proceeding under Chapter XII, Chapter XIV or Chapter XV, the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue it is necessary so to do, he may, by order in writing, attach provisionally, any property, including bank account, belonging to the taxable person or any person specified in sub-section (1A) of section 122, in such manner as may be prescribed.' |

Seeks to substitute sub section (1) of Section 83 of the CGST Act so as to provide that provisional attachment made toany property, including bank account, belonging to a taxable person or any person specified in Section 122(1A) of the CGST Act (i.e., person who causes to commit specified offences and retains the benefit arising out of such offences) shall remain valid for the entire periodstarting from the initiation of any proceeding under Chapter XII- Assessment, Chapter XIV- Inspection, Search, Seizure & Arrest, Chapter XV- Demand and Recovery, till the expiry of a period of one year from the date of provisional order made under Section 83(1) of the CGST Act. |

Proviso to be inserted in Section 107(6) - Appeals to Appellate Authority - Clause 107 of the Finance Bill, 2021 |

||

|

------- |

In Section 107(6), inserted following proviso: 'Provided that no appeal shall be filed against an order under sub-section (3) of section 129, unless a sum equal to twenty-five per cent. of the penalty has been paid by the appellant' |

Seeks to insert proviso under Section 107(6) of the CGST Act to provide that anappeal against order passed in Section 129(3) of the CGST Act i.e. in Form MOV-09 cannot be filed unless 25% of the penalty has been paid by the appellant. Comments:Pre-deposit requirement prior to this amendment was only to the extent of 10% of the disputed tax liability which is now proposed to be 25% of the penalty amount in case of detention and seizure of conveyance and goods during transit. |

Clause (a) & (b) to be substituted in sub section (1) of Section 129 - Detention, seizure and release of goods and conveyances in transit - Clause 108 of the Finance Bill, 2021 |

||

|

Sub-section (1)(a) of Section 129: '(a) on payment of the applicable tax and penalty equal to one hundred per cent. of the tax payable on such goods and, in case of exempted goods, on payment of an amount equal to two per cent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods comes forward for payment of such tax and penalty;' |

Sub-section (1)(a) of Section 129: '(a) on payment of penalty equal to two hundred per cent. of the tax payable on such goods and, in case of exempted goods, on payment of an amount equal to two per cent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods comes forward for payment of such penalty.' |

Seeks to increase the payment of penalty (previously penalty and tax) from 100% to 200% for releasing of detained or seized goods and conveyance. Previously, tax and penalty equal to 100% were to be paid for release of detained or seized goods and conveyance. |

|

Sub-section (1)(b) of Section 129: (b) on payment of the applicable tax and penalty equal to the fifty per cent. of the value of the goods reduced by the tax amount paid thereon and, in case of exempted goods, on payment of an amount equal to five per cent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods does not come forward for payment of such tax and penalty; |

Sub-section (1)(b) of Section 129: (b) on payment of penalty equal to fifty per cent. of the value of the goods or two hundred per cent. of the tax payable on such goods, whichever is higher, and in case of exempted goods, on payment of an amount equal to five per cent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods does not come forward for payment of such penalty; |

Seeks to change options for release of detained or seized goods and conveyance for taxable goods where owner does not come forward: • Penalty equal to 50% of value of goods;or • 200% of tax payable on such goods Whichever is higher. |

|

Section 129(2): 'The provisions of sub-section (6) of section 67 shall, mutatis mutandis, apply for detention and seizure of goods and conveyances.' |

Section 129(2) shall be omitted 'The provisions of sub-section (6) of section 67 shall, mutatis mutandis, apply for detention and seizure of goods and conveyances.' |

Seeks to provide that goods seized shall not be released on provisional basis upon execution of a bond and furnishing of a security, in such manner and of such quantum. Comments:This means that the penalty imposed by the officer will have to be paid in cash by the taxpayer. |

|

Section 129(3): '(3) The proper officer detaining or seizing goods or conveyances shall issue a notice specifying the tax and penalty payable and thereafter, pass an order for payment of tax and penalty under clause (a) or clause (b) or clause (c).' |

Sub-section (3) of Section 129: '(3) The proper officer detaining or seizing goods or conveyance shall issue a notice within seven days of such detention or seizure, specifying the penalty payable, and thereafter, pass an order within a period of seven days from the date of service of such notice, for payment of penalty under clause (a) or clause (b) of sub-section (1)' |

Seeks to amend Section 129(3) of the CGST Act to provide time limit of 7 days' notice of such detention or seizure, specifying the penalty payable for issuance of MOV 07 and for passing an order in MOV 09 within a period of 7 days from the date of service of such MOV 07 under 129 (a) and (b) of the CGST Act. |

|

Section 129(4): 'No tax, interest or penalty shall be determined under sub-section (3) without giving the person concerned an opportunity of being heard.' |

Section 129(4): 'No penalty shall be determined under sub-section (3) without giving the person concerned an opportunity of being heard.' |

Seeks to amend Section 129(4) of the CGST Act to provide that no penalty shall be determined without opportunity of hearing where penalty is payable on detention or seizure of goods and conveyance. Comments:It is to be noted that tax and interest shall not be demanded after the amendment in law for release of goods and conveyance. |

|

Sub-section (6) of Section 129: '(6) Where the person transporting any goods or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within fourteen days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130: Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of seven days may be reduced by the proper officer.' |

Sub-section (6) of Section 129: '(6) Where the person transporting any goods or the owner of such goods fails to pay the amount of penalty under sub-section (1) within fifteen days from the date of receipt of the copy of the order passed under sub-section (3), the goods or conveyance so detained or seized shall be liable to be sold or disposed of otherwise, in such manner and within such time as may be prescribed, to recover the penalty payable under sub-section (3): Provided that the conveyance shall be released on payment by the transporter of penalty under sub-section (3) or one lakh rupees, whichever is less: Provided further that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of fifteen ays may be reduced by the proper officer.' |

Seeks to amend Section 129(6) of the CGST Act to delink the proceedings under thesection relating to detention, seizure and release of goods and conveyances in transit, from the proceedings under Section 130 of the CGST Act for confiscation of goods or conveyances and levy of penalty. Comments:Earlier the provision was if person does not pay tax and penalty within 14 days of seizure, the conveyance and goods detained were liable for confiscation as per Section 130. But, after this amendment, the goods or conveyance detained or seized shall become liable to be sold or disposed off in the manner prescribed in case the payment of imposed penalty is not made within 15 days from the date of receipt of copy of the order imposing such penalty. |

Amendment in Section 130 - Confiscation of goods or conveyances and levy of penalty- Clause 109 of the Finance Bill, 2021 |

||

|

Sub-section (1) of Section 130: '(1) Notwithstanding anything contained in this Act, if any person- …………..' |

Sub-section (1) of Section 130: '(1) Where, if any person- …………..' |

Seeks to amend Section 130 of the CGST Act to delink the proceedings under that section relating to confiscation of goods or conveyances and levy of penalty from the proceedings under Section 129 of the CGST Act relating to detention, seizure and release of goods and conveyances in transit. |

|

Second Proviso to Section 130(2): 'Provided further that the aggregate of such fine and penalty leviable shall not be less than the amount of penalty leviable under sub-section (1) of section 129' |

Second Proviso to Section 130(2): 'Provided further that the aggregate of such fine and penalty leviable shall not be less than the penalty equal to hundred per cent. of the tax payable on such goods' |

|

|

Sub-section (3) of Section 130: 'Where any fine in lieu of confiscation of goods or conveyance is imposed under sub-section (2), the owner of such goods or conveyance or the person referred to in sub-section (1), shall, in addition, be liable to any tax, penalty and charges payable in respect of such goods or conveyance.' |

Sub-section (3) of Section 130 shall be omitted. 'Where any fine in lieu of confiscation of goods or conveyance is imposed under sub-section (2), the owner of such goods or conveyance or the person referred to in sub-section (1), shall, in addition, be liable to any tax, penalty and charges payable in respect of such goods or conveyance.' |

|

Substitution of Section 151 - Power to collect statistics- Clause 110 of the Finance Bill, 2021 |

||

|

'(1) The Commissioner may, if he considers that it is necessary so to do, by notification, direct that statistics may be collected relating to any matter dealt with by or in connection with this Act. (2) Upon such notification being issued, the Commissioner, or any person authorised by him in this behalf, may call upon the concerned persons to furnish such information or returns, in such form and manner as may be prescribed, relating to any matter in respect of which statistics is to be collected.' |

'The Commissioner or an officer authorised by him may, by an order, direct any person to furnish information relating to any matter dealt with in connection with this Act, within such time, in such form, and in such manner, as may be specified therein.' |

Seeks to substitute Section 151 of the CGST Act to empower thejurisdictional commissioner to call for information from any person relating to any matter dealt with in connection with the CGST Act. |

Amendment of Section 152 - Bar on disclosure of information- Clause 111 of the Finance Bill, 2021 |

||

|

Section 152: '(1) No information of any individual return or part thereof with respect to any matter given for the purposes of section 150 or section 151 shall, without the previous consent in writing of the concerned person or his authorised representative, be published in such manner so as to enable such particulars to be identified as referring to a particular person and no such information shall be used for the purpose of any proceedings under this Act. (2) Except for the purposes of prosecution under this Act or any other Act for the time being in force, no person who is not engaged in the collection of statistics under this Act or compilation or computerisation thereof for the purposes of this Act, shall be permitted to see or have access to any information or any individual return referred to in section 151.' |

Section 152: '(1) No information of any individual return or part thereof with respect to any matter given for the purposes of section 150 or section 151 shall, without the previous consent in writing of the concerned person or his authorised representative, be published in such manner so as to enable such particulars to be identified as referring to a particular person and no such information shall be used for the purpose of any proceedings under this Act without giving an opportunity of being heard to the person concerned.' |

Seeks to amend Section 152 of the CGST Act to provide that no information obtained under Sections 150 (i.e., obligation to furnish information return) and 151 (i.e., power to collect statistics) of the CGST Act shall be used for the purposes of any proceedings under the Act without giving an opportunity of being heard to the person concerned. |

Amendment in Section 168(2) - Power to issue instructions or directions- Clause 112 of the Finance Bill, 2021 |

||

|

'The Commissioner specified in clause (91) of section 2, sub-section (3) of section 5, clause (b) of sub-section (9) of section 25, sub-sections (3) and (4) of section 35, sub-section (1) of section 37, sub-section (2) of section 38, sub-section (6) of section 39, sub-section (1) of section 44, sub-sections (4) and (5) of section 52, sub-section (1) of section 143, except the second proviso thereof, sub-section (1) of section 151, clause (l) of sub-section (3) of section 158 and section 167 shall mean a Commissioner or Joint Secretary posted in the Board and such Commissioner or Joint Secretary shall exercise the powers specified in the said sections with the approval of the Board.' |

'The Commissioner specified in clause (91) of section 2, sub-section (3) of section 5, clause (b) of sub-section (9) of section 25, sub-sections (3) and (4) of section 35, sub-section (1) of section 37, sub-section (2) of section 38, sub-section (6) of section 39, section 44, sub-sections (4) and (5) of section 52, sub-section (1) of section 143, except the second proviso thereof, sub-section (1) of section 151, clause (l) of sub-section (3) of section 158 and section 167 shall mean a Commissioner or Joint Secretary posted in the Board and such Commissioner or Joint Secretary shall exercise the powers specified in the said sections with the approval of the Board.' |

Seeks to amend Section 168 of the CGST Act to enable the jurisdictional commissioner to exercise powers under Section 44 (i.e., annual return) and omitted Section 151 of the CGST Act (i.e., power to collect statistics) to call for information. |

Retrospectively Deletion of Paragraph 7 of Schedule II - Activities or Transactions to be Treated as Supply of Goods or Supply of Services- Clause 113 of the Finance Bill, 2021 |

||

|

Paragraph 7: 'Supply of Goods: The following shall be treated as supply of goods, namely:- Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration.' |

Paragraph 7 shall be omitted and shall be deemed to have been omitted with effect from the 1stday of July, 2017. 'Supply of Goods: The following shall be treated as supply of goods, namely:- Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration.' |

Consequent to the insertion of sub-clause (aa) in Section 7(1) of the CGST Act (supra), paragraph 7 of Schedule II to the CGST Act is being omitted. Therefore, supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration will be treated as supply of goods. This deletion was made to clarify that there is levy of taxes on activities or transactions of supply of goods or services or both by any person, other than an individual, to its members or constituents or vice-versa for cash, deferred payment or other valuable consideration. This amendment shall take effect retrospectively from July 1, 2017. |

Proposed Amendments in the IGST Act, 2017

Section 16 - Zero rated supply- Clause 114 of the Finance Bill, 2021 |

||

|

Current provisions |

Proposed provisions |

Effect of changes made |

|

Section 16(1)(b): 'Supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.' |

Section 16(1)(b): 'Supply of goods or services or both for authorised operations to a Special Economic Zone developer or a Special Economic Zone unit.' |

Seeks to amend Section 16 of the IGST Act, 2017 ('IGST Act') to provide: • zero rated supply of goods or services to a Special Economic Zone developer or a Special Economic Zone unit only when the said supply is for authorised operations; • restrict the zero-rated supply on payment of integrated tax only to a notified class of taxpayers or notified supplies of goods or services; and • link non realization of sales proceeds of goods exported liable for refund so received along with interest within 30 days after expiry of specified time limit prescribed under FEMA for receipt of sales proceeds. Comments: Seemingly, now only notified class of taxpayer or notified class of goods/services will be eligible for claiming refund of IGST paid on zero-rated supplies, unlike present provision which allows both the options to all persons subject to Rule 96(10) of the CGST Rules. Other option left will be to claim refund of unutilized ITC. |

- Online Advanced GST Training and Certification Course by CA Bimal Jain - Click here for details

- GST Practitioner Course Certified by MSME Govt of India - Click here for details

- 20 hours Live GST Practical Training class on GST portal - Click here for details

CAclubindia

CAclubindia