JOBWORK - DETAILED ANALYSIS OF RULES AND PROCEDURES UNDER GST

Section 2(68) of the CGST Act – 'JOB WORK' means any treatment or process undertaken by a person on goods belonging to another registered person (referred to as Principal) and the expression ‘job worker’ shall be construed accordingly

While the person sending the goods out for job work (i.e. Principal), has to be a registered person, the job worker may or may not be a registered person

Detailed analysis of meaning of JOBWORK

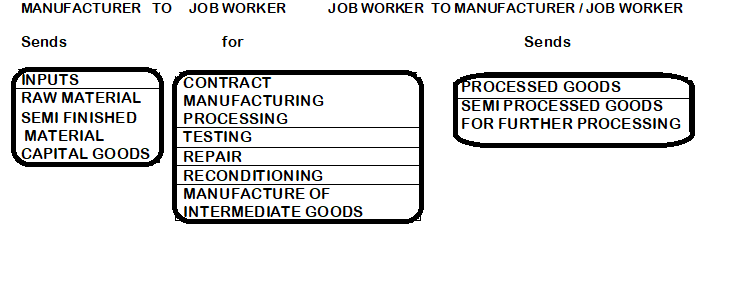

Manufacturer can send out

Inputs - either raw material or semi-finished material or

Capital goods to another party - job worker

- for further processing, testing, repair, reconditioning or for the manufacture of intermediate goods necessary for manufacture of final products or for any other purpose and receive back after processing the inputs or the products produced therefrom or the capital goods for use in further manufacture, without the manufacturer or the job worker having to pay any duty on the inputs or capital goods so sent out.

JOB WORK: Its outsourced activity of working on the goods belonging to manufacturer ,

Any treatment or process undertaken by a person on goods belonging to another registered person.

NOTE : Treatment or process is undertaken by a job worker on goods belonging to an unregistered person will not be considered as job work .

JOB WORKER: The person who treats or processes the goods sent by the principal(registered person)

Job Work Procedure

Section 143 of CGST Act 2017: Job Work Procedure (CHAPTER XXI – MISCELLANEOUS)

(1) A registered person (principal) may send any inputs or capital goods (without payment of tax) to a job worker for job work and from there subsequently send to another job worker and likewise, and shall

INPUTS OR CAPITAL GOODS( other than moulds and dies, jigs and fixtures, or tools)

(a) bring back inputs, after completion of job work or otherwise, or capital goods, within one year and three years, respectively, of their being sent out, to any of his place of business, (without payment of tax);

INPUTS - 1 YEAR

CAPITAL GOODS - 3 YEARS

(b) supply such inputs, after completion of job work or otherwise, or capital goods, within one year and three years, respectively, of their being sent out from the place of business of a job worker on payment of tax within India (with or without payment of tax for export), as the case may be.

(c) Moulds and dies, jigs and fixtures, or tools- NO Time Limit

NOTE : Principal shall not supply the goods from the place of business of a job worker in accordance with the provisions of this clause unless the said principal declares the place of business of the job worker as his additional place of business

EXCEPT in a case - (in the below cases principal can supply goods directly from place of Job worker)

- where the job worker is registered under section 25; or

- where the principal is engaged in the supply of such goods as may be notified by the Commissioner.

(2) The responsibility for keeping proper accounts for the inputs or capital goods shall lie with the principal.

(3) Where the INPUTS sent for job work are not received back by the principal after completion of job work within a period of one year of their being sent out, it shall be DEEMED that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out ( Date of transaction) [ Refer Deemed supply as per section 19(3) of the CGST Act, 2017.]

(4) Where the CAPITAL GOODS, sent for job work are not received back by the principal within a period of three years of their being sent out, it shall be DEEMED that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were sent out ( Date of transaction) [ Refer Deemed supply as per section 19(3) of the CGST Act, 2017.]

(5) Any waste and scrap generated during the job work may be supplied by the job worker directly from his place of business on payment of tax, if such job worker is registered, or by the principal, if the job worker is not registered

Waste or scrap -> from job worker place by Job worker-> if Job worker is Registered

Waste or scrap -> from job worker place by Principal-> if Job worker is not Registered

Various Practical Provisions & rules affecting Jobworks are as below

NOTE : As per Rule 45 of the CGST Rules, 2017 Principal can send goods for job work purpose without payment of GST under the cover of delivery challan and it shall contain the details specified in rule 55 of the CGST Rules, 2017

NOTE : It is compulsory where principal and job worker are situated INTER-STATE, then in case of job work transactions, e-way bill must be generated for inter-state movement of goods without any monetary limit (As per third proviso to Rule 138 of the CGST Rules, 2017)

NOTE : The principal can also send goods directly to the place of job worker without receiving the said goods in his premises first and Input Tax Credit can also be availed in such cases though the principal has not received the goods (As per Sections 19(2) and 19(5) of CGST Act, 2017),

NOTE : The principal is required to file Form GST ITC-04 by the 25th day of the month succeeding the quarter. The said form will serve as intimation as envisaged under section 143 of the CGST Act, 2017.

The author can also be reached at maheshbobbili.ca@gmail.com

CAclubindia

CAclubindia