You may have heard some news before like ABC directors of a company are charged with offense of Insider trading. What basically is insider trading? Insider trading as the name says trading the “inside”. In other words, the leaking of price sensitive information by someone who has access to the private and material information of the company. Insiders include, but not limited to, CEO, Director and Key Employees of the company. It will affect the company as leaking of companies result will fluctuate the share price. Let me explain this with an example

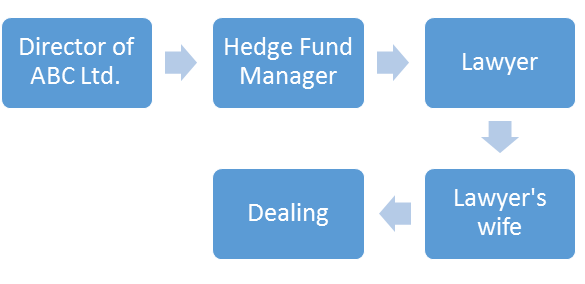

Suppose a director of ABC Ltd. has information that prices of shares will sharply fall the next day when ABC ltd. will announce its yearly financial results. Director passes the same info to Hedge fund manager over a cup of coffee. And hedge fund manager in return passes the same to his friend who is a lawyer over personal dinner. After that lawyer tells his wife that shares will sharply fall. So lawyer’s wife who is holding 10% shares of the company sold all her stake before announcement of result. So eventually company is in loss because of this transaction and lawyer’s wife is in profit. As money saved is money earned.

Who is liable for insider trading? Director obviously is responsible for insider trading but along with him tippees are also liable for one or more offenses including heavy fines and imprisonment. So all 4 of them will be liable for the same. But it is very hard to prove it. As it must be proved “beyond reasonable doubt.” Which is why too many people still get away with it.

Chiranjiv Kumar

Owner of fundspedia.com

CAclubindia

CAclubindia